GOLD Price Today: Downtrend Persists With Prices 8% Below Monthly Highs

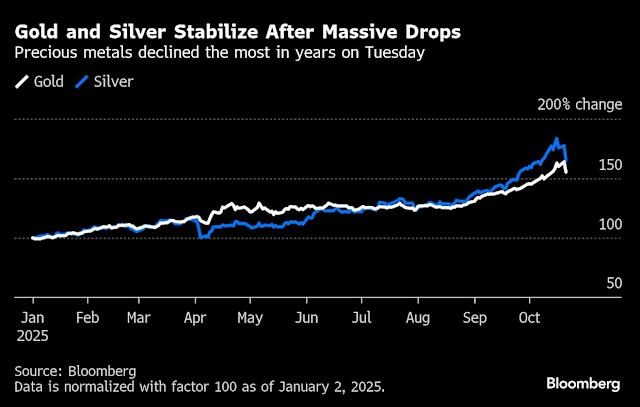

The price of gold is under clear pressure today, trading approximately 8% below its monthly highs. After a surge earlier, the yellow metal is now in a downtrend, reflecting a shift in investor sentiment

According to real-time data, gold futures are trading lower, and the broader momentum suggests weakness. Analysts point to a mix of stronger confidence in equities, a recovering U.S. dollar, and reduced safe-haven demand as key drivers of the slide.

Why Is Gold Falling From Its Highs?

1. Attractive Risk Appetite & Rising Equities

When global stock markets and sectors such as AI stocks rally, risk appetite increases and safe-haven assets like gold tend to take a back seat. The shift away from fear into chasing growth has pressured gold’s appeal.

2. A Stronger U.S. Dollar & Higher Yields

Because gold is priced in U.S. dollars, a stronger dollar makes it relatively more expensive for foreign buyers, reducing demand. Moreover, rising U.S. treasury yields increase the opportunity cost of holding gold (which pays no yield). These dynamics are highlighted in recent technical analysis.

3. Profit Taking After Recent Highs

Having reached record highs in recent months, the metal is now facing a natural pull-back. Analysts note that a correction of 5-10% is not uncommon after rapid gains.

4. Less Urgency for Safe-Haven Cover

When geopolitical tensions ease and economic data show resilience, investors may feel less urgency to flock into gold. That reduced “flight to safety” movement is being seen now.

Technical Outlook: What the Charts Show

On the technical front, gold is now trading below short-term support levels, and the Relative Strength Index (RSI) is showing signs of exhaustion. Key levels to watch:

- Resistance around $3,700‐$4,000 per ounce as previous highs.

- Support zones near $3,200-$3,300 may act as a near-term floor if selling continues.

- If gold breaks below these supports, further decline toward $3,000 may be in play.

In summary, gold remains in an overall uptrend in the long term, but the immediate trend is decisively weaker.

Linking Gold to Broader Market & Stock Research

While gold isn’t a stock or an AI stock, its movements reflect broader market moods and deserve attention if you are doing thorough stock research or monitoring the stock market. Here’s how:

- When equity markets, including AI stocks, are soaring, gold may decline as funds rotate into growth.

- For commodity-linked stocks or mining stocks, gold price downturns create headwinds.

- Investors looking to diversify portfolios often include gold as a hedge, so shifts in gold influence thinking about risk allocation.

- Understanding gold’s trend can inform decisions about exposure to inflation, interest rates, and central bank policy, all of which feed into stock market outlooks.

What Should Investors Do?

Review Your Time Horizon

If you are looking at gold as a short-term trade, this downtrend could present either a buying opportunity if you believe in a bounce or a signal to stay away if the trend continues downward. If you hold gold for long-term diversification, consider the correction as part of a broader cycle.

Monitor Key Drivers

Stay alert to:

- U.S. dollar strength and Treasury yields

- Central bank purchases of gold

- Geopolitical or economic shock scenarios

- Rotations in stock markets (e.g., AI stocks) that affect risk sentiment

Set Risk Controls

If you hold gold or gold-linked investments, consider setting stop-loss levels or reducing position size until the trend clarifies.

Be Ready for Both Scenarios

- Scenario A (Bounce): If inflation fears reignite or the dollar weakens, gold could rally again, and this dip could be a buying opportunity.

- Scenario B (Correction): If global growth accelerates, yields keep rising, and the dollar remains firm, gold may move lower toward the support zones.

The Bottom Line

The gold price today is reflecting a weakening in momentum, trading about 8% below its recent highs and clearly in a short-term downtrend. While the metal remains an important diversification tool in many portfolios, it is currently under pressure from a stronger dollar, rising yields, increased risk appetite, and profit-taking.

For investors, this means reassessing expectations: whether you treat gold as a hedge, a short-term tactical play, or simply part of your overall stock-market and commodity research framework, the current pull-back is meaningful. As always, combining commodity trends with broader market and stock research will provide a more comprehensive view.

FAQs

The metal is being weighed down by other forces: a firm U.S. dollar, higher real yields, and renewed appetite for growth assets (such as stocks). Gold’s status as a safe-haven has less sway when risk sentiment improves.

It depends on your goal. If you believe inflation will rise, yields will fall, or the dollar will weaken, this may be a strategic entry. If you expect stronger economic growth and higher yields, it might be prudent to wait. Monitoring support around $3,200-$3,300 may give clues.

Gold serves as a hedge when stock markets or sectors (including AI stocks) turn volatile. When you track stock research, including alternative asset classes such as commodities, helps gauge broader risk. A falling price may signal increased risk appetite, which can also affect stocks and other assets.

Disclaimer:

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.