Gold Price Today: Near $4,000 as Markets React to US-China Trade Truce

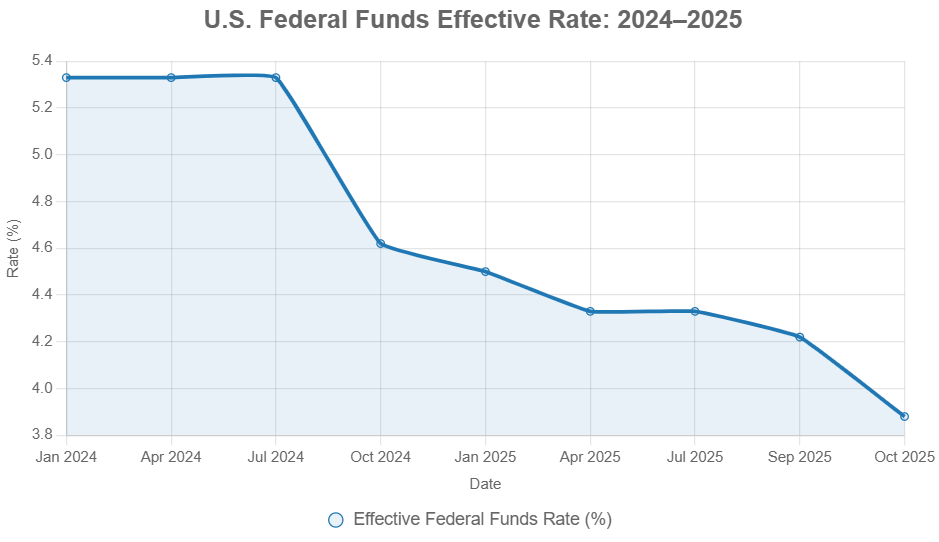

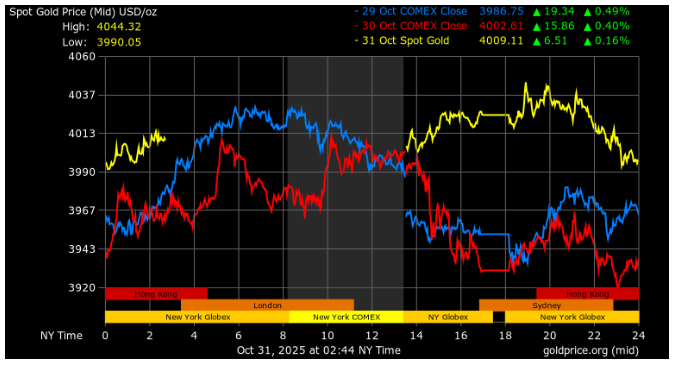

Gold price is holding near $4,000 per ounce as of October 31, 2025, marking one of the strongest runs in recent history. The rally comes just days after the US-China trade truce eased months of tension between the world’s two largest economies. Investors who once rushed to gold for safety are now watching how global markets react to this calm. The Federal Reserve’s rate cut on October 30 also played a role, keeping borrowing costs low and supporting demand for real assets.

Yet, the excitement is mixed with caution. A stronger dollar and better stock performance have slowed gold’s climb. Still, central banks continue to buy at record levels, showing trust in the metal’s long-term value. As traders debate whether gold will break past $4,000 again, the question remains clear: Is this the start of a new gold era or just a pause before the next big move?

Background: The US-China Trade Truce

On 30 October 2025, the Federal Reserve cut interest rates by 25 basis points but offered a cautious outlook on future cuts. At the same time, the U.S. and China moved toward a one-year trade truce that paused further tariff escalation. Markets interpreted these actions as reducing immediate trade risk. Still, analysts noted that the truce is temporary and many structural tensions remain, which keep markets on alert.

Gold’s Rally: What’s Driving Prices Near $4,000?

As of 31 October 2025, spot gold was trading around ~$3,996.53 per ounce, down marginally on the day but still near the psychological $4,000 mark. The rally this year has been driven by high inflation expectations, robust central-bank buying, and safe-haven demand amid global uncertainties. The recent trade truce reduced one source of risk, dampening some of the upward pressure on gold. Additionally, the stronger U.S. dollar and less aggressive Fed easing have constrained further upside.

Market Reactions Across the Globe

Markets responded to the trade and monetary signals by showing less “fear” premium in gold. Asian and European equities rose modestly as trade worries eased, which can pull money out of safe havens like gold. The dollar gained ground, reducing the local appeal of gold for non-U.S. investors. On the commodities front, industrial metals gained slightly, showing that some growth expectations remain intact. But because gold is non-yielding, the stronger dollar and rising yields limit its appeal.

Expert Opinions & Analyst Forecasts

Analysts remain mixed. Some see the recent level around $4,000 as a pivot: if inflation stays sticky and central banks keep buying, gold could rise further. Others argue that the truce and stronger monetary policy could trim upside. The use of an AI-driven research tool shows that ETF inflows may slow if rates stay higher longer, which could weigh on gold.

Impact on Investors and Consumers

For investors, the near $4,000 price means careful decision-making. Some may take profits or hedge, while others hold for the long term. Jewelry demand is muted at high bullion prices, and consumers see higher local rates in many countries. The key message: even if the price consolidates, gold remains an inflation hedge and safe asset, but it may not deliver strong gains every month.

Outlook: Can Gold Price Stay Above $4,000?

If the truce holds, inflation remains high, and central banks buy more gold, the metal may hover at or above the $4,000 level. But if the dollar strengthens further, yields rise, or the truce leads to higher trade flows (reducing risk premium), gold could fall toward support near ~$3,900. On 30 October 2025, technical analysis showed resistance near $4,020 and support around $3,900.

Wrap Up

As of October 31, 2025, gold’s position near ~$4,000 per ounce reflects both confidence and caution in global markets. The US-China trade truce brought short-term relief, but investors still face inflation, currency shifts, and changing interest rates. Central banks continue to buy gold, showing that trust in the metal remains strong despite better stock performance.

Looking ahead, gold may hover around current levels as markets weigh new data and policy signals. Whether it climbs higher or corrects slightly, one thing is clear: gold remains a key safe-haven asset in uncertain times, balancing hope for growth with the reality of risk.

Frequently Asked Questions (FAQs)

Gold stays near $4,000 because of strong central-bank buying, high inflation, and the recent US-China trade truce that reduced but didn’t erase global uncertainty.

Gold could hold near $4,000 if inflation remains high and the dollar stays steady, but it may dip if trade and growth improve further.

The trade truce on October 30, 2025, eased safe-haven buying, yet strong investment and central-bank demand continue to keep gold prices supported worldwide.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.