Gold Spot Price Hits Record Highs at $4,000/oz: What Should You Do Next?

The Gold Spot Price has surged to an unprecedented $4,000 per ounce, a milestone that has galvanized investors, central banks, and market strategists alike. The rally, driven by a weaker dollar, growing Fed easing bets, and broad safe-haven flows amid geopolitical and economic uncertainty, has pushed bullion into territory not seen in modern markets.

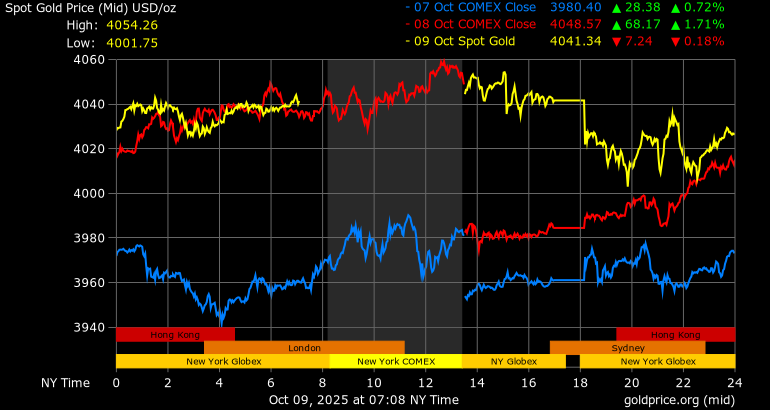

Early October’s move above $4,000 was confirmed by multiple market trackers and major outlets, and analysts say central bank demand and ETF inflows are key pillars of the rally.

Why the Gold Spot Price Hit $4,000

The jump in the Gold Spot Price reflects several forces coming together: expectations of U.S. rate cuts, dollar weakness, heightened geopolitical risk, and strong institutional buying.

Market participants note that the prospect of lower real rates makes non-yielding assets like gold more attractive, while a softer dollar raises buying power for overseas purchasers.

Central bank accumulation and ETF inflows have amplified momentum, creating a feedback loop of rising prices and fresh demand.

Is the rally driven purely by fear? Partly, safe-haven demand is a major factor, but structural buyers like central banks and long-term investors are adding a durable layer of demand beyond short-term panic buying.

Central Banks Continue to Accumulate Gold

Central bank purchases stand out as a structural underpinning. Recent data from the World Gold Council and central bank reports show stronger net buying after a temporary pause, with major buyers in Asia and emerging markets increasing reserves.

This institutional demand is a major reason analysts cite for the Gold Spot Price breach of $4,000.

The Role of the Federal Reserve and Interest Rates

The Federal Reserve’s forward guidance is pivotal. When markets price in rate cuts, real yields fall and gold becomes more appealing relative to bonds and cash. Current market pricing suggests investors expect easier U.S. policy sooner than previously thought, a dynamic that has supported bullion’s sprint to record highs.

Investor Reaction to the Record High

Investor sentiment is split. Some traders view the $4,000 mark as a breakout and momentum trade, while others warn of sharp profit-taking after the rapid run. ETF flows, retail interest, and central bank reports will determine whether the move is sustained or followed by a correction. Recent coverage shows both heavy inflows into gold ETFs and rising retail engagement.

Global Economic Pressures Behind the Rally

This rally is global, not just U.S.-centric. Europe’s sluggish growth, political strains in several economies, and currency instability in emerging markets have pushed sovereigns and investors toward bullion as a hedge.

Commodity price volatility and supply concerns for energy and industrial metals have also reinforced inflation worries, further bolstering the Gold Spot Price.

Oil and Commodities Also Play a Role

Rising oil and commodity prices can heat inflation expectations, which in turn lift demand for gold. Parts of the recent move are explained by broad commodity strength and the inflation-hedging role gold has historically served.

If energy and commodity pressures cool, some speculative demand for gold could ease, but central bank buying complicates that outlook.

What Should Investors Do Next?

With the Gold Spot Price at record highs, investors face three basic choices: buy, hold, or sell. The right move depends on time horizon, portfolio goals, and risk tolerance.

- Short-term traders may consider locking in partial profits or using options to hedge — volatility remains elevated.

- Long-term investors who seek a hedge against inflation, currency risk, or systemic shocks can view dips as buying opportunities.

- Diversified portfolios typically maintain a small allocation to gold (commonly 5–10%) to smooth returns during downturns.

A measured approach, trimming some exposure on strength while keeping a core allocation, is prudent for many investors.

Short-Term vs Long-Term Strategy

If you trade actively, consider technical resistance levels and liquidity conditions. If you invest for the long haul, focus on the metal’s role as insurance rather than a pure return engine.

Some institutional models, including AI Stock Analysis tools used by asset managers, suggest that gold’s long-term role as portfolio ballast remains intact even after strong rallies.

Use diversified instruments (ETFs, sovereign gold bonds, or allocated bullion) to tailor exposure to cost and custody preferences.

How Retail Investors Can Approach Gold Now

Retail investors have several practical routes into gold beyond physical bullion: gold ETFs for liquidity, digital gold platforms for small incremental buys, and sovereign gold bonds in select countries for coupon-bearing exposure.

Financial planners stress avoiding emotional buying at peaks and recommend dollar-cost averaging to smooth entries. Consider liquidity, fees, and tax treatment when choosing a vehicle.

Comparing Gold with Other Asset Classes

Gold outperformed many assets this year, including equities and cryptocurrencies, amid heightened risk aversion. Unlike stocks or bitcoin, gold’s appeal lies in stability and centuries-old trust as a store of value.

For investors worried about macro shocks, a small allocation to bullion can materially reduce portfolio drawdowns. AI Stock research and commodity models increasingly include gold as a key scenario hedge in multi-asset strategies.

Expert Opinions on Gold’s Future

Analysts are divided on the ceiling. Some strategists see room to $4,200–$4,500 or higher if geopolitical tensions escalate and rate cuts materialize; others warn of pullbacks if risk sentiment revives.

Major investment banks have updated forecasts to reflect higher structural demand from central banks and weaker policy expectations. Goldman Sachs notably updated its medium-term view on gold in recent research.

Investors should monitor macro indicators (inflation, real yields, and Fed communication) and central bank reports for signs of continuation.

Risk Checklist Before You Act

- Monitor U.S. inflation and real yields.

- Watch the central bank balance sheet moves and official gold purchases.

- Track ETF flows and physical market liquidity.

- Stay aware of geopolitical flashpoints that could trigger safe-haven surges.

Conclusion: Gold Spot Price and Your Next Move

The Gold Spot Price breaching $4,000 per ounce is both historic and instructive. It reflects a mix of short-term fear and long-term structural demand, especially from central banks.

For most investors, the sensible path is neither blind buying nor panicked selling but thoughtful rebalancing: lock in some gains if needed, preserve a core hedge allocation, and use disciplined entry methods for new exposure.

Whether you’re a trader or a long-term allocator, staying diversified, watching macro signals, and avoiding emotional timing will serve you best as gold writes this new chapter in markets.

FAQ’S

Yes, gold can hit $4,000 an ounce if inflation stays high, the U.S. dollar weakens, and central banks continue buying gold. Experts say growing global uncertainty supports this price level.

Analysts estimate gold could range between $2,600 and $3,200 per ounce by 2025, depending on interest rates, inflation trends, and investor demand.

Gold hit all-time highs today due to a weaker dollar, lower bond yields, and rising geopolitical risks, which drove investors toward safe-haven assets like gold.

Gold reached $4,000 per ounce in early October 2025, setting a new record amid global market uncertainty and expectations of U.S. rate cuts.

Many economists believe gold could reach $3,000 an ounce within a few years as central banks increase reserves and inflation pressures persist.

By 2030, forecasts suggest gold may trade between $3,500 and $4,500 per ounce if current macroeconomic and policy trends continue.

Disclaimer

This is for information only, not financial advice. Always do your research.