GRSE Share Price Jumps 6% After Signing Five MOUs in Maritime Expansion

Garden Reach Shipbuilders & Engineers (GRSE) made waves today. Its share price jumped 6% after it signed five important MOUs in maritime expansion. We see this move as bold. It shows that GRSE is not just keeping pace but aiming higher.

The MOUs involve partners in shipbuilding, ports, and infrastructure. These are areas where we are seeing strong demand in India. Under national plans like “Maritime Amrit Kaal,” the government wants India to be among the top shipbuilding nations by 2047.

Investors reacted fast. The stock climbed because they believe GRSE’s new agreements will bring more contracts, more work, and more profit. We believe these partnerships could also help GRSE reach greener ship designs, better port links, and stronger export potential.

Let’s explore what the MOUs are. We will examine how they affect GRSE’s growth and what risks lie ahead. Then, we will consider what this move might mean for investors and the wider maritime industry.

Background on GRSE

Garden Reach Shipbuilders & Engineers Ltd (GRSE) is one of India’s leading shipyards. It operates under the Ministry of Defence, and builds warships, coast guard boats, scientific vessels, and more. The company has shipyards in Kolkata and elsewhere. It also does export work. In recent years, GRSE has pushed to modernize. It tries to add green tech, better port systems, and better global links. The government of India supports it under “Make in India” and “Maritime Amrit Kaal Vision 2047.”

GRSE has delivered many platforms. It has earned a reputation for quality. It also keeps seeking new partnerships. This helps reduce risks from only relying on naval orders. It also helps tap into commercial vessel work, aiming to grow its order book to compete globally.

The Five MOUs: Key Highlights

GRSE signed five MOUs with major partners. The MOUs cover shipbuilding, ports, infrastructure, repair, and green vessels. The partners are:

- Deendayal Port Authority (Kandla)

- Syama Prasad Mookerjee Port Authority (Kolkata)

- Indian Port Rail & Ropeway Corporation Ltd (IPRCL)

- Shipping Corporation of India (SCI)

- Modest Infrastructure Private Ltd (MIPL)

The focus areas include low-emission vessels, green tugs, ship repair, port infrastructure, and rail and road links for ports. These agreements link GRSE with key nodes of India’s maritime system. They aim to build an integrated ecosystem. Green and sustainable technologies are a major part.

Market Reaction and GRSE Share Price Surge

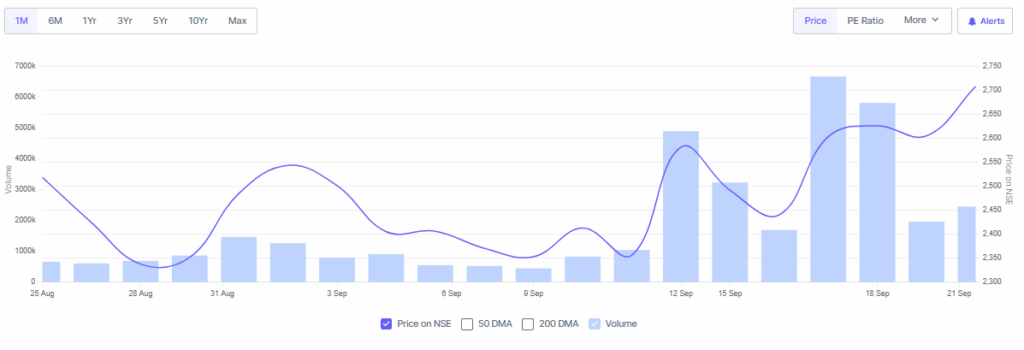

After the MOUs were announced, the GRSE share price rose sharply. It jumped around 6%, reaching about ₹ 2,760 on 22 September 2025. Investors saw the MOUs as adding promise for revenue growth..

Earlier, in June 2025, share price gains of 5-5.2% followed international MOUs in marine systems and cruise vessels. The stock has nearly doubled year-to-date, driven by these new deals and optimism over India’s shipbuilding push.

Maritime Expansion Strategy

India wants to become a top shipbuilding nation by 2047 under “Maritime Amrit Kaal.” GRSE fits into this plan. It aims to build more ships domestically, to export more, and to use greener propulsion and sustainable materials. It also aims to make port and transport infrastructure better. The MOUs support these aims.

GRSE also works on hybrid vessels. For example, a recent contract with Germany’s Carsten Rehder is for four hybrid multi-purpose vessels. These use battery-assisted hybrid propulsion. They align with global trends for lower emissions.

Industry and Competitor Landscape

Indian shipbuilding faces competition. Other players include Cochin Shipyard, Mazagon Dock, etc. These firms also aim for naval, coast guard, and export orders. Global trends push for greener ships, digital tools, automation, and efficient propulsion systems. GRSE has an advantage due to its existing capacity to build many platforms. It also has four separate yards.

In global markets, buyers demand eco-friendly vessels. They demand compliance with emission rules (e.g., IMO goals). GRSE’s MOUs and contracts show that it aims to meet those demands. That raises its chances in international tenders.

Risks and Challenges

Execution risk is real. Big shipbuilding projects often cost more or take longer. Green propulsion systems like hybrids need tech and supply chains. Costs of steel, fuel, and batteries vary. Delays are possible. Dependence on government policy and funding remains. If port infrastructure development slows, linked MOUs lag. Export orders are subject to foreign regulations, exchange rates, and delivery risks.

GRSE Share Future Outlook

GRSE could see revenue rise in the coming years. Its new MOUs could turn into contracts. The hybrid vessel deal with Germany is one example of earning from exports. If GRSE delivers quality and on time, it could attract more global clients. The green vessel trend is likely to grow. That can help margins.

Share prices may remain volatile. But investor sentiment looks positive now. If GRSE wins more orders, and if India’s maritime policies remain friendly, it may sustain growth. For investors, monitoring order book, execution performance, and global demand will be key.

Final Words

GRSE’s 6% share price jump after signing five MOUs shows strong market confidence in its growth plans. The deals focus on green vessels, port infrastructure, and global outreach, aligning with India’s maritime vision for 2047.

Recent AI stock analysis highlights GRSE’s shift into sustainable and export-driven shipbuilding as a key advantage against competitors. If the company delivers on these projects, AI stock research suggests it can strengthen its order book, expand its global presence, and play a central role in shaping India’s future in the maritime sector.

Frequently Asked Questions (FAQs)

On September 22, 2025, GRSE shares rose 6% after the company signed five MOUs for green vessels, port growth, and global outreach projects.

AI stock analysis on September 22, 2025, shows GRSE has growth chances with new projects. Still, risks remain, so investors should study carefully before buying.

GRSE helps India’s vision by building green ships, boosting port links, and joining exports. These steps aim to make India a top shipbuilder by 2047.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.