HDFC AMC Share Price: Asset Manager Stocks in Focus After SEBI’s Expense Ratio Move

On October 28, 2025, the Securities and Exchange Board of India (SEBI) rocked the mutual-fund world by releasing a consultation paper that could change how fund fees are charged. Shares of HDFC Asset Management Company (HDFC AMC) fell sharply as investors rushed to digest the impact. The key change: fees called the Total Expense Ratio (TER) may get simpler, smaller, or more transparent. At the same time, so-called hidden costs like brokerage and statutory levies are being exposed.

For HDFC AMC and its peers, this means possible pressure on profit. Yet for ordinary investors, it could mean clearer, fairer costs when you invest. The coming weeks will reveal how much earning power AMCs lose and whether the shake-up becomes an opportunity, not just a risk.

HDFC AMC Share Price: What SEBI Proposed?

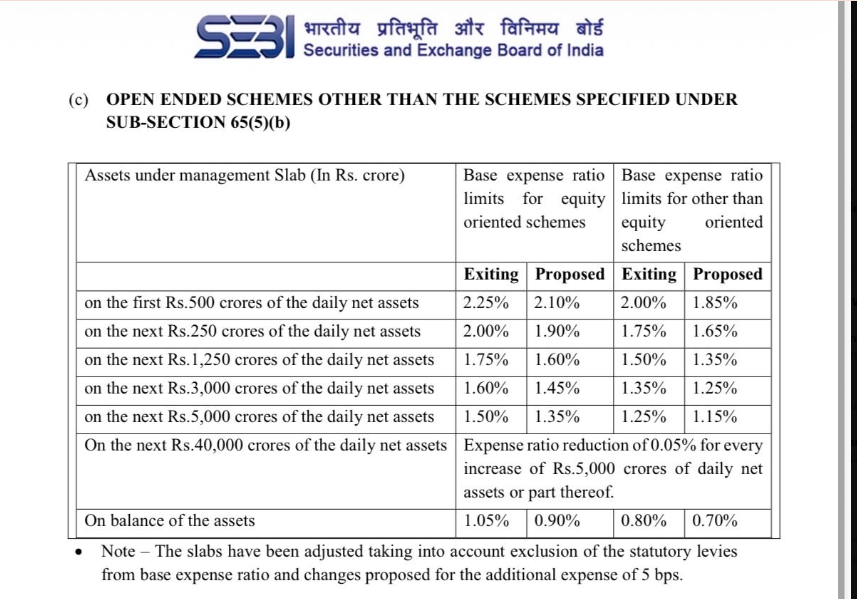

SEBI’s consultation paper calls for a clearer view of the Total Expense Ratio (TER). It says brokerage, transaction levies, and statutory charges should not sit inside the headline TER. SEBI also proposed sharp caps on brokerage paid by funds, cutting cash market brokerage caps from 12 basis points to 2 bps and derivatives costs from 5 bps to 1 bps.

The draft recommends removing a transitory 5 bps charge that fund houses could levy and asks that non-mutual fund activities operate through separate units and teams. The regulator framed these steps as a push for transparency and lower costs for unitholders in India’s large mutual-fund industry.

Immediate Market Impact

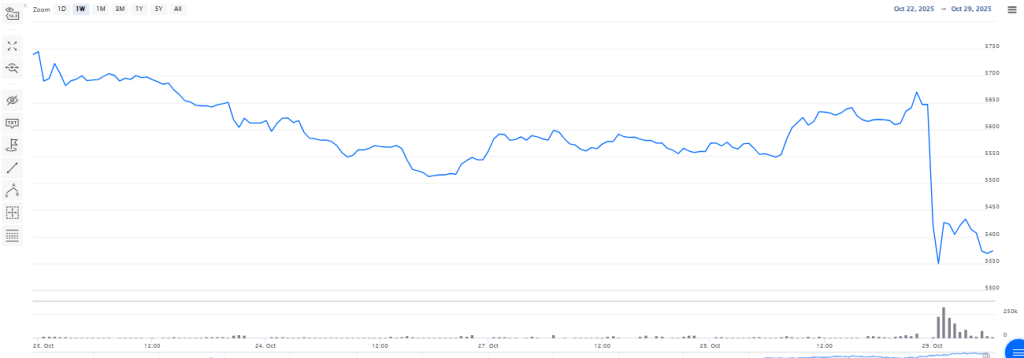

Markets moved quickly. On October 29, 2025, HDFC AMC led sector declines after the paper’s release. The stock fell more than 5% in a session described by Reuters as the steepest one-day drop since June 2024. Other AMCs and related capital-market stocks fell too, with some names down nearly 9-10% in early trade according to the domestic press. Traders said the proposals could hit near-term earnings for large fund houses and raise uncertainty about future margins.

Why does this matter for HDFC AMC’s Business Model?

HDFC AMC earns fees mainly from assets under management (AUM) multiplied by the TER. Any cut in allowable visible fees or a firm cap on pass-through costs slices directly into gross revenue. Brokerage and transaction levies have, in recent years, been billed outside headline TER.

SEBI’s draft aims to move many of those costs into the open. That reduces the levers AMCs used to preserve net yield. Analysts at Jefferies warned the reforms could knock profit before tax by roughly 30-33% in the first, then corrected it to 8-10% in stressed scenarios by 2027. This is driven by lower fee take and the loss of the extra 5 bps funding line listed in past rule changes. Scale helps HDFC AMC, but scale alone may not fully offset a structural drop in fee income if the rules are finalized as drafted.

How AMCs might Respond?

HDFC AMC and other firms can try several options to protect margins. One route is to push more flows into higher-margin products such as actively managed strategies with premium TERs or niche alternatives. Another is to bundle services off the mutual-fund platform into legally separate units, as SEBI itself suggested, to preserve revenue streams without hiding them inside TER. Cost control and scale efficiencies will become increasingly important.

Distribution models may shift, with AMCs seeking direct channels and digital engagement to cut reliance on broker payouts. Some brokerages and research houses are already running scenario work using an AI stock research analysis tool to model different fee and flow outcomes for each AMC. That modeling reveals a wide range of outcomes depending on how quickly AUM growth offsets margin compression.

Broader Industry and Investor Implications

For retail investors, the draft promises clearer bills. Fees will be easier to compare across funds. That could boost trust and long-term participation in mutual funds. For the industry, the pain will be uneven. Large, diversified AMCs with strong brand and distribution may survive the margin squeeze better than niche or small players.

Firms that rely heavily on third-party distributors and broker incentives will feel the strain most. Banks and brokerages that earn from distribution could also see revenue pressure. The stock market reaction reflects both the immediate re-pricing of expected profits and a reassessment of long-term business models.

HDFC AMC Share Price: What to Watch Next?

The consultation period matters. SEBI published the paper on October 28, 2025, and will accept feedback before finalizing rules. Watch stakeholder responses from AMCs, distributor bodies, and large institutional investors. Pay attention to HDFC AMC’s management commentary and any interim steps it announces on October-November 2025 earnings calls or investor presentations.

Track AUM trends and the mix between passive and active funds, since higher active AUM could lessen the blow. Finally, monitor regulator clarifications on timeframes and transitional arrangements. Those details will determine the magnitude of the earnings hit and the speed at which firms must adapt.

Practical Investor Takeaways

Do not react to headlines alone. The market sells off prices in worst-case scenarios. HDFC AMC remains a leading manager with scale and a track record. Yet this is a structural jolt to fee transparency that could lower margins industry-wide. Investors should review valuation, listen to management guidance, and check how much revenue is derived from TER versus other fee lines.

Also watch for any regulatory transition rules that might cushion short-term shocks. For longer-term investors, clearer fees are a net positive for the market, even if the transition is painful for some firms.

Closing Thought

SEBI’s consultation marks an important step toward simpler charges for retail savers. The exact impact on HDFC AMC share price or business will depend on the final rule text, implementation timelines, and how quickly the company adapts its products and distribution. Investors should follow developments closely through November 2025 and beyond, and weigh both the near-term profit risk and the long-term potential of a more transparent fund market.

Frequently Asked Questions (FAQs)

HDFC AMC shares fell on October 28, 2025, after SEBI proposed new rules to limit fund fees, which may lower company profits and investor returns.

SEBI’s new rules make mutual fund costs clearer and fairer. Investors will know exactly what they pay and may save more money on their investments.

Analysts predict AMC profits could drop by around 25-30% if SEBI’s October 2025 expense ratio rules become final without major changes or adjustments.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.