HDFC Bank Shares Surge as 1:1 Bonus Record Date Nears

HDFC Bank is India’s largest private sector bank and one of the most trusted names in the financial world. Recently, it has been in the spotlight because of its decision to issue bonus shares in a 1:1 ratio. Every shareholder receives one bonus share for each share already owned. The holding doubles, but the overall investment value stays unchanged since the price adjusts. The announcement has created excitement in the stock market. We have seen HDFC Bank’s share price rise as the record date gets closer.

But why does a bank issue bonus shares? And what does it mean for investors? A bonus issue does not bring extra cash to shareholders, but it can make the stock more affordable and boost investor confidence. It signals strong internal reserves of the firm. In HDFC Bank’s case, this step signals stability and growth potential.

Let’s explore what the 1:1 bonus issue means, how it affects shareholders, and why the market is reacting so strongly.

About Bonus Shares

Bonus shares are free shares given to existing shareholders. They do not change the total value of the company. The company simply splits existing reserves into more shares. A 1:1 bonus gives one new share for each existing share. This makes the holding count double. After the ex-date, the share price normally drops since the company’s value is divided among more shares. Bonus issues can improve liquidity. They also make the stock feel more affordable to small investors. However, bonus shares do not create cash or change profits unless the firm uses the occasion to signal strong reserves or good earnings.

HDFC Bank’s 1:1 Bonus Announcement and Dates

HDFC Bank announced a 1:1 bonus issue. This is the bank’s first-ever bonus. The board fixed the record date for late August 2025. The ex-date came one day earlier. Shareholders listed on the record date qualified for the bonus. Strong quarterly earnings were also announced, adding to excitement. Together, these updates brought intense focus to the stock.

Impact on Shareholders

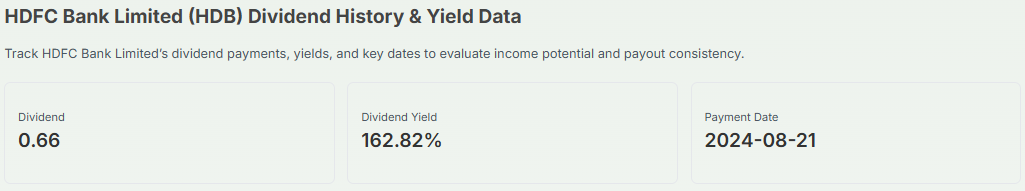

Existing shareholders will own twice as many shares after the bonus is allotted. The overall investment value does not change immediately. The share price is expected to adjust roughly in half on the ex-date. For retail holders, the move can make trading easier. More shares can mean tighter bid-ask spreads. Fractional and brokerage effects may also change how small investors buy and sell. Dividend math may shift. Future dividends will be paid on a larger number of shares, though the company’s total dividend pool could remain the same. Tax treatment can vary by jurisdiction and investor type.

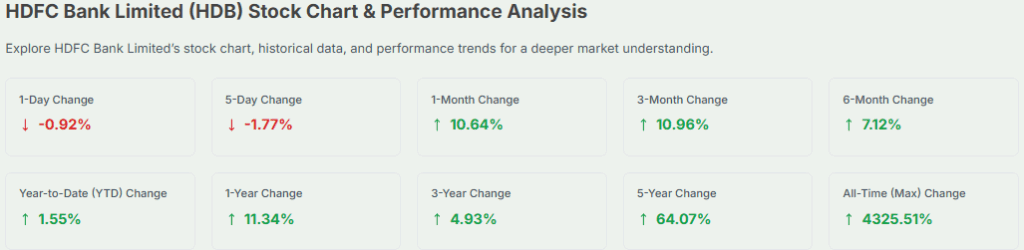

Market Performance and Investor Sentiment

HDFC Bank shares rose as the record date approached. Rising volumes and larger trade interest were visible in trading sessions. Some investors bought shares to qualify for the bonus. Others sold into strength, expecting the price to normalize after the ex-date. Broker reports and news columns noted a blend of excitement and caution. Analysts pointed out that short-term gains often follow such corporate actions. Long-term value still depends on loan growth, margins, and asset quality.

Comparison with Other Banks and Past Actions

Indian private banks have used stock actions before. HDFC Bank had done stock splits in the past years to improve retail access. Some peers have issued bonuses or splits to reward long-term holders. The 1:1 ratio for HDFC Bank stands out because of the bank’s size. A bonus at this scale can increase free float and invite more retail buying. Global banks sometimes use similar tools, but the frequency varies by market and regulatory norms.

Strategic Significance for HDFC Bank

A large bonus can improve share liquidity. More tradable stock often draws new investors. The bonus also signals strong retained earnings and capital buffers. For HDFC Bank, the move comes after steady profit growth in the latest quarter. Management may also be aiming to broaden the shareholder base. A bigger base can help in future capital moves or in marketing the bank to small investors. Still, such moves are part of a bigger strategy and not a substitute for top-line growth.

Risks and Considerations

Bonus shares do not change core business health. Price jumps before the ex-date can unwind quickly afterwards. Traders who buy only for the bonus risk short-term losses when the market corrects. The dividend per share could fall if the payout pool is not raised. Some investors may misread the bonus as a direct value boost. That can cause mispricing. Tax rules for bonus shares and subsequent sales may differ for retail and institutional investors. Caution and clarity on tax treatment are advised.

Expert Views and Analyst Projections

Market analysts gave mixed views. Some said the bonus shows strong capital and can aid liquidity. Others said fundamentals matter more than corporate actions. Brokerages adjusted target prices while noting the expected share dilution in per-share metrics.

A few firms highlighted the bank’s recent quarterly growth as a stronger driver of long-term value than the bonus itself. Readers should follow broker reports for concrete price forecasts and rationales.

Bottom Line

HDFC Bank’s 1:1 bonus is a major corporate event. It doubles share counts for eligible holders. It may help liquidity and invite new retail buyers. However, it does not generate cash or alter core profits on its own. Price moves around the ex-date will reflect supply and demand, not new earnings. Smart investors will look past the buzz. Focus on loan growth, margin trends, and asset quality to judge long-term value.

Frequently Asked Questions (FAQs)

HDFC Bank announced a 1:1 bonus issue. For every one share owned, shareholders get one extra share free. It increases share count without changing investment value.

HDFC Bank set August 27, 2025, as the record date for its 1:1 bonus shares. Shareholders owning stock on that day will be entitled to the extra shares.

The record date for bonus shares is the deadline fixed by a company. Only shareholders listed in the company records on that date qualify to receive bonus shares.

A 1:1 bonus issue means that each shareholder receives one new equity share for every share they already own. It doubles shareholding but does not increase overall investment value.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.