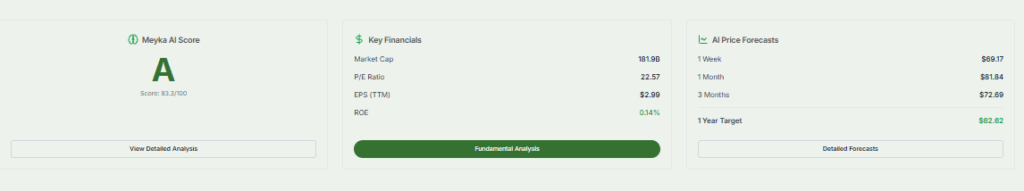

HDFC Bonus Share Adjustment Triggers 2% Drop in Stock Price

HDFC Bank, one of India’s leading financial institutions, recently announced a bonus share issue. This news immediately caught the attention of investors and market watchers. Following the announcement, HDFC’s stock saw a drop of around 2%. At first glance, this may seem worrying. But if we look closer, the story is not as simple as it appears.

Bonus shares are free shares given to existing shareholders in proportion to what they already hold. While it may sound like “extra money,” the stock price often adjusts after the bonus issue. This adjustment can make the share value look lower even though the total investment remains the same.

Let’s break down why HDFC’s stock reacted this way. We will explain how bonus shares work, what investors can expect, and why short-term price drops are common.

What are Bonus Shares?

A bonus share is an extra share a company gives to its current investors without charging them. The shares are issued based on how many are already owned. For example, in a 1:1 bonus, each existing share brings one more share. Even though the number of shares goes up, the overall investment value does not change. This happens because the company’s total market worth remains the same, but the price per share adjusts to match the larger share count.

Companies typically issue bonus shares to capitalize on their retained earnings or reserves. This move is often seen as a way to reward shareholders, improve liquidity, and make the stock more accessible to a broader base of investors. It’s essential to note that receiving bonus shares doesn’t result in immediate financial gain; rather, it reflects the company’s confidence in its future and aims to enhance shareholder value over time.

Market Reaction to HDFC Bonus

On August 26, 2025, HDFC Bank’s stock price experienced a significant adjustment following its 1:1 bonus share issue. The shares began trading ex-bonus on both the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE), leading to a sharp decline in the stock price. While the apparent drop was substantial, it’s crucial to understand that this was a technical adjustment rather than an actual loss in value. The market capitalization of HDFC Bank remained unchanged; only the share price adjusted to reflect the increased number of shares in circulation.

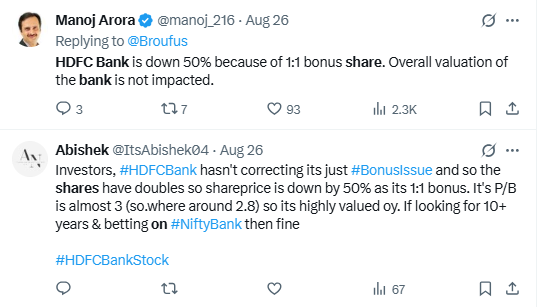

This adjustment often leads to confusion among investors, especially those unfamiliar with bonus issues. The immediate drop in stock price can be alarming, but it’s essential to recognize that the overall value of an investor’s holdings remains the same. Once the bonus shares are added to shareholders’ accounts, the value evens out, and the market usually steadies as investors adjust to the new share count.

Why Stock Price Fall After a Bonus Issue?

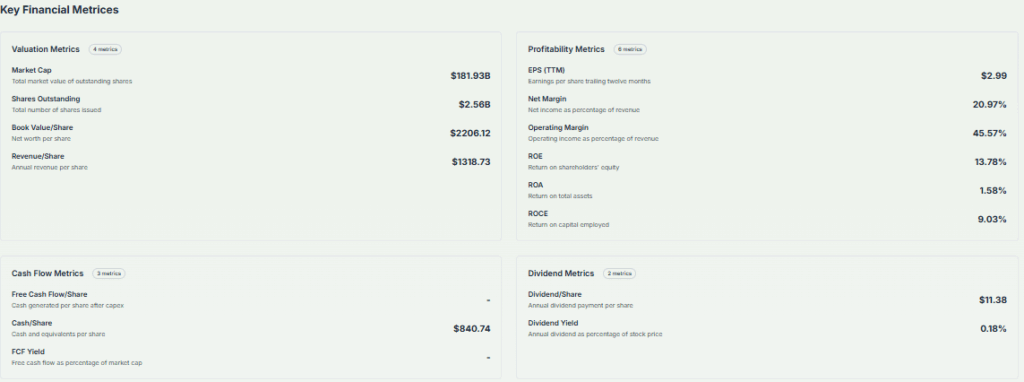

The decline in stock price following a bonus issue is primarily due to the increase in the number of shares outstanding. When a 1:1 bonus is declared, the share count doubles, and the price per share is cut in half, so the company’s total market value stays the same. This adjustment ensures that the total value of an investor’s holdings remains consistent before and after the bonus issue.

Investor psychology also plays a role in the post-bonus price movement. The influx of new shares can lead to increased selling pressure, as some investors may choose to capitalize on the immediate liquidity. Additionally, the perception of a lower share price can attract retail investors, further influencing the stock’s movement.

It’s important to note that while the stock price may decline temporarily, the company’s fundamentals, such as earnings, revenue, and growth prospects, remain unaffected by the bonus issue. Therefore, the long-term value proposition of the stock is not diminished.

Impact on Shareholders

For current shareholders, bonus shares can be a positive benefit. These extra shares increase holdings without any extra cost. The market price may drop initially, but total investment value stays the same.

Liquidity often improves with more shares in circulation. Higher trading volumes can follow, making the stock easier to buy or sell. This can support the share price over time and help long-term investors.

Still, shareholders must keep track of company performance and market trends. Bonus shares add value but do not promise price gains.

Expert Opinions & Analyst Views

Financial analysts generally view bonus issues as a positive signal from a company, indicating confidence in its prospects. However, they also caution investors to be aware of the potential short-term volatility that can accompany such corporate actions.

Analysts suggest that investors should not make hasty decisions based solely on the immediate post-bonus price movement. Instead, they recommend evaluating the company’s fundamentals, industry position, and long-term growth potential. If the company’s outlook remains strong, the bonus issue can be seen as an opportunity to accumulate shares at a more accessible price.

It’s also advisable for investors to consult with financial advisors to understand the implications of bonus issues on their portfolios and to make informed investment decisions.

Historical Context & Trends

HDFC Bank’s recent bonus issue marks a significant milestone, being the first such issuance by the bank. In the past, companies have issued bonus shares to reward investors and make their stocks easier to trade. The trend of issuing bonus shares is common among companies with strong financial positions and a commitment to enhancing shareholder value.

In the broader context, the Indian banking sector has seen several instances of bonus issues, reflecting the industry’s growth and profitability. Such corporate moves usually attract more investors and may help improve the stock’s performance in the long run.

Wrap Up

HDFC Bank’s 1:1 bonus share issue is a strategic move aimed at rewarding shareholders and enhancing stock liquidity. While the immediate adjustment in stock price may cause concern, it’s essential to understand that this is a standard procedure following a bonus issue and does not reflect any underlying financial issues.

For investors, it’s crucial to focus on the company’s long-term prospects rather than short-term price fluctuations.

Frequently Asked Questions (FAQs)

After a bonus issue, the number of shares increases. The price adjusts lower to keep the total investment value the same. This is normal and not a loss.

On August 26, 2025, HDFC’s shares dropped due to its 1:1 bonus issue. The stock price adjusted ex-bonus, which is normal and does not reduce the company’s value.

Buying post-bonus shares can be good if the company is strong. Price is lower, but investors should check performance and market conditions before investing.

Shareholders holding HDFC shares on August 27, 2025, will get bonus shares. Each share gives one extra share. Shares will be credited to demat accounts shortly.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.