Hindustan Unilever Sees Marginal Gains as Over 13.5 Lakh Shares Trade

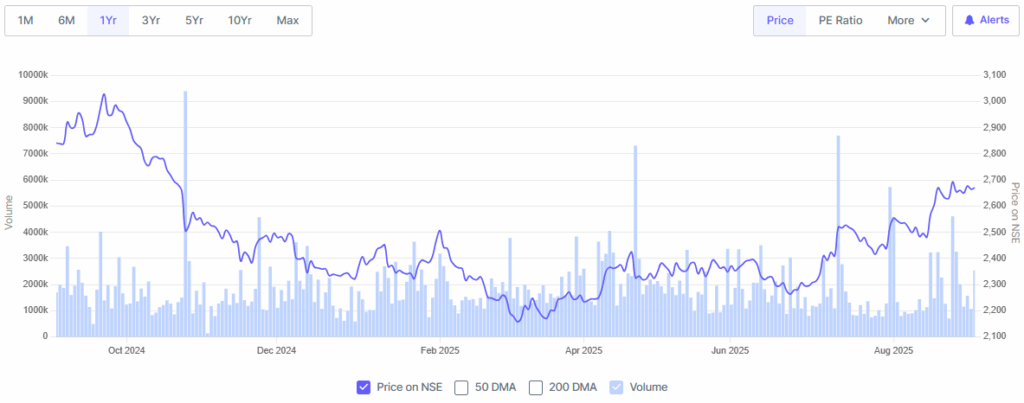

Hindustan Unilever Limited (HUL), one of India’s most trusted consumer goods companies, witnessed marginal gains in its stock movement as over 13.5 lakh shares traded in the market recently. This activity reflects growing investor interest even amid a volatile stock market environment.

Hindustan Unilever’s Market Presence

Hindustan Unilever is a subsidiary of the global giant Unilever, and it dominates several consumer categories in India, including skincare, haircare, cleaning solutions, food, and beverages. With brands like Dove, Surf Excel, Lifebuoy, Lux, Vim, and Brooke Bond, the company has established a massive distribution network that touches millions of households across urban and rural areas.

The stock’s performance often mirrors broader consumer demand trends in India. Despite rising inflationary pressures and challenges in rural demand recovery, Hindustan Unilever has shown resilience. Its long-term growth strategy, driven by innovation and sustainable practices, has helped it retain investor confidence.

Stock Activity: 13.5 Lakh Shares Exchange Hands

The trading session that saw over 13.5 lakh shares of Hindustan Unilever change hands highlights the market’s continued focus on this blue-chip stock. Such volumes are significant as they indicate both institutional and retail participation. Even though the gains were marginal, the steady demand suggests that investors are betting on the company’s stability in the face of economic uncertainties.

Stock researchers point out that Hindustan Unilever’s performance is often cushioned by its diverse product range, ensuring consistent revenues across categories. While some fast-moving consumer goods (FMCG) companies struggle to maintain growth momentum, HUL’s vast portfolio provides it with a natural hedge.

Earnings Outlook and Growth Drivers

Hindustan Unilever has consistently posted stable earnings, supported by strong margins in premium product categories. The company’s strategy of introducing value-for-money packs for rural markets while pushing premium products in urban areas continues to pay off.

Recent initiatives in digital transformation and supply chain efficiency have also positioned the company to adapt to evolving consumer behavior. For instance, the integration of AI-driven stock research tools into operations helps the company forecast demand more accurately and manage inventory with precision.

Additionally, Hindustan Unilever is investing in sustainability, reducing plastic waste, and enhancing renewable energy usage, aligning with global ESG (Environmental, Social, Governance) goals. Such steps not only support brand reputation but also strengthen its long-term market outlook.

Challenges Facing Hindustan Unilever

Despite the gains, Hindustan Unilever faces several challenges that could weigh on its stock performance in the near term. These include:

- Rising Input Costs: Inflation in raw materials like palm oil and packaging has squeezed margins.

- Rural Slowdown: Demand recovery in rural India remains uneven, and since rural markets account for a major share of HUL’s sales, this is a concern.

- Competitive Pressures: Both multinational and domestic FMCG players are vying for market share, leading to aggressive pricing strategies.

Nevertheless, Hindustan Unilever’s brand loyalty and diversified portfolio help it mitigate many of these challenges.

Analyst Opinions on Hindustan Unilever Stock

Stock market analysts maintain a largely positive outlook on Hindustan Unilever, citing its robust fundamentals and strong balance sheet. According to experts, the company’s defensive nature makes it a safe bet during economic uncertainties.

While short-term volatility in share prices is expected, many investors see Hindustan Unilever as a long-term compounder in their portfolios. In stock research reports, analysts emphasize its ability to generate consistent cash flows, pay dividends, and deliver steady capital appreciation.

For those comparing AI stocks or technology-driven companies with FMCG giants like HUL, the key difference lies in stability. Unlike volatile AI or tech stocks, Hindustan Unilever offers a steady growth trajectory with lower risk, making it attractive for conservative investors.

Stock Market Performance in Context

The recent trading activity of over 13.5 lakh shares must be seen in the context of the broader Indian stock market, which has experienced fluctuations due to global economic factors, crude oil price movements, and interest rate changes.

Consumer-focused stocks like Hindustan Unilever are often considered defensive plays, attracting investors when market volatility rises. This explains why institutional investors often increase exposure to HUL during uncertain times.

Future Outlook: What Investors Can Expect

Looking ahead, Hindustan Unilever’s focus will remain on expanding penetration in rural markets, strengthening its premium product segment, and adopting digital-first strategies. The company’s commitment to sustainability and responsible business practices will also enhance investor trust.

Market experts believe that while near-term growth may be moderate due to economic headwinds, Hindustan Unilever’s long-term story remains intact. For investors looking for stability, consistent dividends, and reliable returns, HUL continues to be a compelling choice.

FAQs

Yes, HUL is considered a strong long-term investment due to its stable earnings, wide product portfolio, and strong market position. However, short-term investors should be prepared for limited gains amid inflationary pressures.

AI stocks often carry higher volatility and greater risk, but can deliver rapid growth. Hindustan Unilever, on the other hand, offers steady returns and lower risk, making it suitable for conservative investors seeking stability.

The key risks include rising raw material costs, uneven rural demand recovery, and intense competition in the FMCG sector. However, its diversified portfolio and strong brand equity help reduce these risks.

Disclaimer:

This content is made for learning only. It is not meant to give financial advice. Always check the facts yourself. Financial decisions need detailed research.