How AI Analytics Platforms are Powering Financial Decision-Making

Financial markets today move faster than ever. Every second, huge amounts of data are created from prices, news, reports, and global events. In 2025, this flow of information is even harder to track without smart tools. Many teams now struggle to make decisions because markets are volatile and data is messy. This is where an AI financial analytics platform makes a powerful difference.

AI can read data at lightning speed. It can find patterns that humans often miss. It can also give alerts, forecast trends, and explain what might happen next. This helps investors, advisors, and businesses act with more confidence.

More companies are turning to AI not just for speed, but for clarity. They want sharper insights, fewer errors, and better risk control. They also want tools that fit into daily work without feeling complex.

Meyka Enterprise is one of the platforms helping teams bridge this gap. It brings real-time analytics, advanced models, and easy-to-use features into one space. With AI, financial decision-making is no longer slow or confusing. It is becoming smarter, faster, and far more strategic.

Data, Speed, and Complexity: The New Rules of Finance

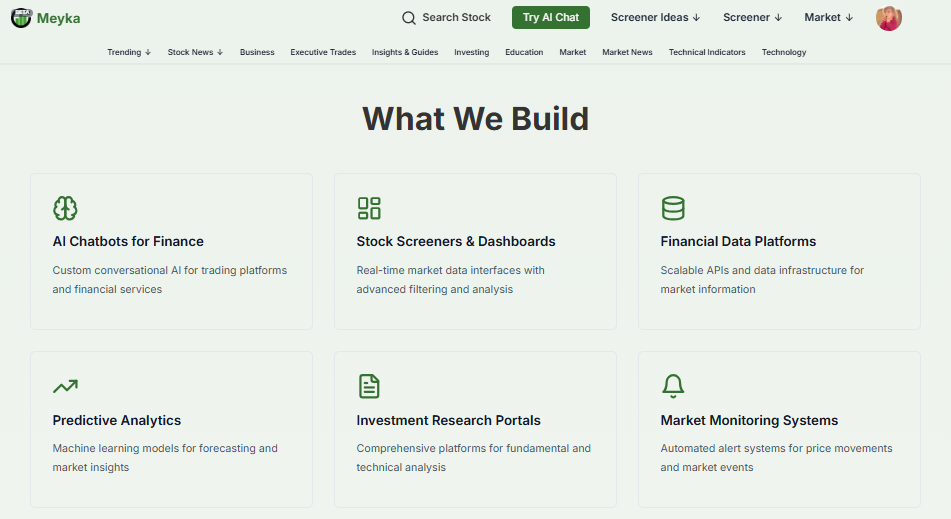

Markets now move on streams of data. Prices tick every second. News, filings, and social posts add context. Firms need to act fast. Manual analysis cannot keep up. Large firms and nimble startups both face the same problem: too much data, too little time. Platforms that fuse AI with finance solve this gap. Meyka builds such systems for enterprises and traders. Meyka’s platform centralizes market feeds, research, and dashboards into one place. This helps teams see a single truth for decisions.

Unified Data and Reliable Inputs

Good decisions start with good data. Modern analytics platforms pull price feeds, financial filings, news, alternative data, and internal records. They clean and map these sources so outputs are consistent. A platform that treats data pipelines as code reduces errors. It also lets firms add new sources fast. Meyka documents show how custom data platforms and APIs support real-time analytics and forecasts for enterprise clients. Clean pipelines mean models run on trustworthy inputs.

Real-time Signals and Timely Alerts

Speed matters in trading and risk control. Real-time dashboards show positions, exposures, and market moves as they happen. Automated alerts trigger on thresholds and anomalies. This shortens the time from signal to action. Large banks report big gains from this approach. Bank of America recently noted that AI tools sped up client work and helped staff manage more accounts. That same drive toward automation appears across investment firms in 2025.

Predictive Models that Explain Themselves

AI models can forecast trends and stress scenarios. Good platforms pair machine learning with explainability. That means models show why they recommend an outcome. Explainable outputs build trust with analysts and regulators. Recent industry guidance emphasizes model governance and human validation as key to scaling AI from pilots to production. Firms that adopt these practices capture more value.

Automating Research and Reporting

Analysts spend hours gathering numbers and writing reports. AI can automate those tasks. Platforms can generate first drafts of earnings summaries, trend notes, and sector scans. This saves time and cuts repetitive work. Meyka’s AI financial report agent automates the collection and synthesis of data to produce timely reports for teams. That kind of automation reduces errors and speeds client delivery.

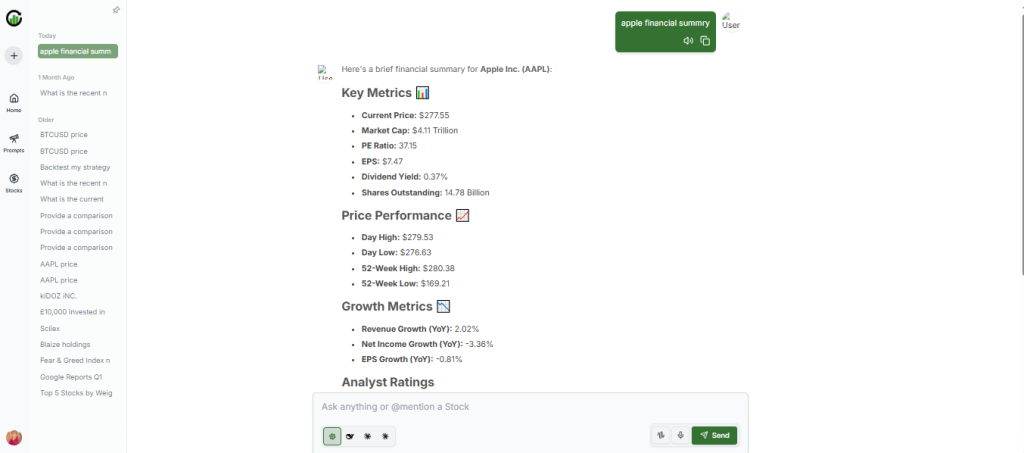

Conversational Access to Complex Data

Not everyone reads dashboards. Natural language interfaces let users ask questions in plain speech. These interfaces return summaries, charts, and model outputs. They lower the friction and broaden who can use the analytics. Including such tools helps advisors and corporate teams get answers quickly. On enterprise pages, Meyka highlights chatbots and conversational AI built for finance use cases. The presence of conversational tools has grown sharply across fintech in 2025.

Use Cases that change Workflows

Portfolio managers use these platforms to screen stocks, rebalance exposures, and simulate scenarios. Corporate treasurers use them for cash forecasts and stress tests. Wealth teams use them to personalize advice at scale. Client service teams use chatbots to speed responses. Even small firms can access institutional-grade analytics without building large in-house stacks. This democratization is a major trend in 2025.

Security, Compliance, and Governance

Finance is tightly regulated. Any analytics platform must protect data and log model decisions. Role-based access, audit trails, and encryption are non-negotiable. Platforms must also document data lineage and model validation for audits. Enterprise providers emphasize these features to win institutional trust. Meyka’s enterprise materials highlight secure infrastructure and compliance-ready design for production deployments.

Practical Risks and How to Manage Them?

Models can fail with biased or stale data. Overreliance on automation can erode human judgment. Firms must monitor model drift and require human sign-off for high-impact actions. Pilot projects with clear success metrics help. Focused governance, ongoing validation, and retraining plans reduce operational risk. Industry reports urge firms to balance speed with controls as they scale AI.

Why 2025 is a Turning Point?

In 2025, investment in AI and data systems accelerated across finance. Major banks and fintechs increased AI budgets and pushed production deployments. This shift moves AI from experimental to core infrastructure. Firms that modernize analytics can react faster and manage risk better. The move is not about replacing experts. It is about giving them better tools.

AI Financial Analytics Platform: What Matters Now?

Look for a vendor with deep finance experience, production-grade engineering, and clear governance. The tool should integrate with existing stacks and support custom workflows. Also, verify recent case studies and published roadmaps. Meyka’s site lists product features, chatbots, stock screeners, and case studies that show how the platform supports enterprise needs.

Conclusion: Make AI a Rigorous Partner

AI platforms are changing how financial decisions are made. They speed work, reduce errors, and surface patterns that were hard to see before. Adoption in 2025 shows clear gains when firms pair models with governance. The outcome is smarter decisions and better risk control. Choose a platform that treats data, security, and explainability as core features. That choice will shape outcomes for years to come.

Frequently Asked Questions (FAQs)

AI studies large data fast and finds patterns humans miss. It gives clearer signals for risks and trends. In 2025, tools like Meyka will help users act with more confidence.

AI tools read prices, news, and reports in real time. They show simple trend charts and alerts. AI stock market analysis platforms like Meyka offer these features for teams that need quick insights.

AI gives helpful forecasts when the data is clean and updated. It is not perfect, but it supports smarter planning. By 2025, platforms like Meyka will make predictions more stable.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.