How AI-Based Chatbot Services are Transforming Financial Operations

The financial industry is undergoing a significant transformation, driven by the integration of AI-powered chatbots. In 2025, over 98 million U.S. banking customers engaged with chatbots, a number projected to rise to 110.9 million by 2026. These AI banking chatbots are revolutionizing customer service by providing instant, 24/7 assistance, handling tasks ranging from account inquiries to complex financial transactions.

A notable example is Bank of New York Mellon, which has integrated over 100 “digital employees” into its operations, handling tasks such as payment remediation and code repair. Similarly, fintech challenger banks have achieved 100% adoption of chatbot support, often as the sole customer service channel.

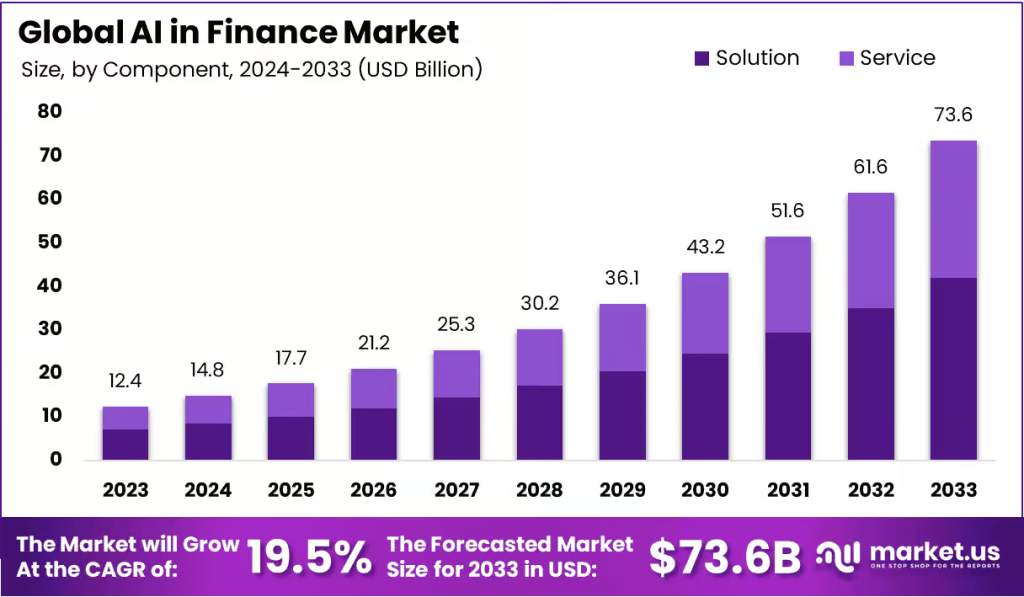

The global AI in finance market is projected to reach $73.9 billion by 2033, growing at a CAGR of 19.5%. This surge is fueled by the increasing demand for personalized financial services and the need for operational efficiency.

Let’s explore how AI-based chatbot services transform financial operations, enhance customer experiences, and drive innovation in the industry.

The Challenge in Modern Financial Operations

The financial industry faces increasing pressure to manage vast amounts of data, ensure compliance, and meet customer expectations for instant service. In 2025, the global AI in finance market is projected to reach $73.9 billion, growing at a compound annual growth rate (CAGR) of 19.5%. This increase underscores the industry’s need for innovative solutions.

Traditional methods of handling customer inquiries, processing transactions, and analyzing financial data are often slow and prone to errors. Customers demand 24/7 access to services, personalized interactions, and quick resolutions to their concerns.

Financial institutions also grapple with compliance challenges. Regulatory requirements are becoming more stringent, and manual processes can lead to costly mistakes. AI-powered chatbots can assist in ensuring compliance by automating tasks and providing real-time updates.

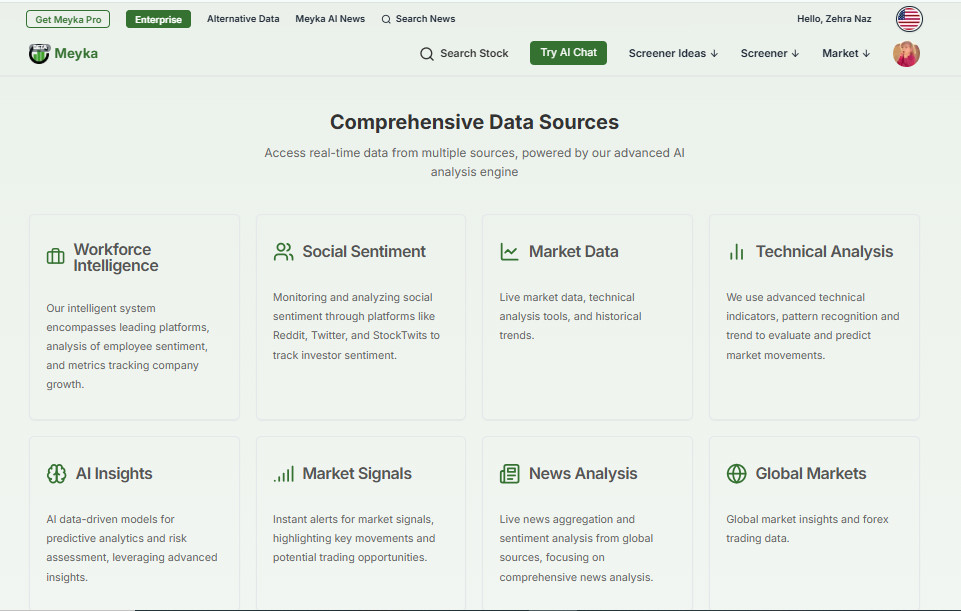

Moreover, the integration of AI into financial operations can streamline processes, reduce costs, and enhance decision-making. Companies like Meyka are at the forefront of this transformation, offering AI-driven solutions that empower businesses to navigate these challenges effectively.

Defining Key Concepts

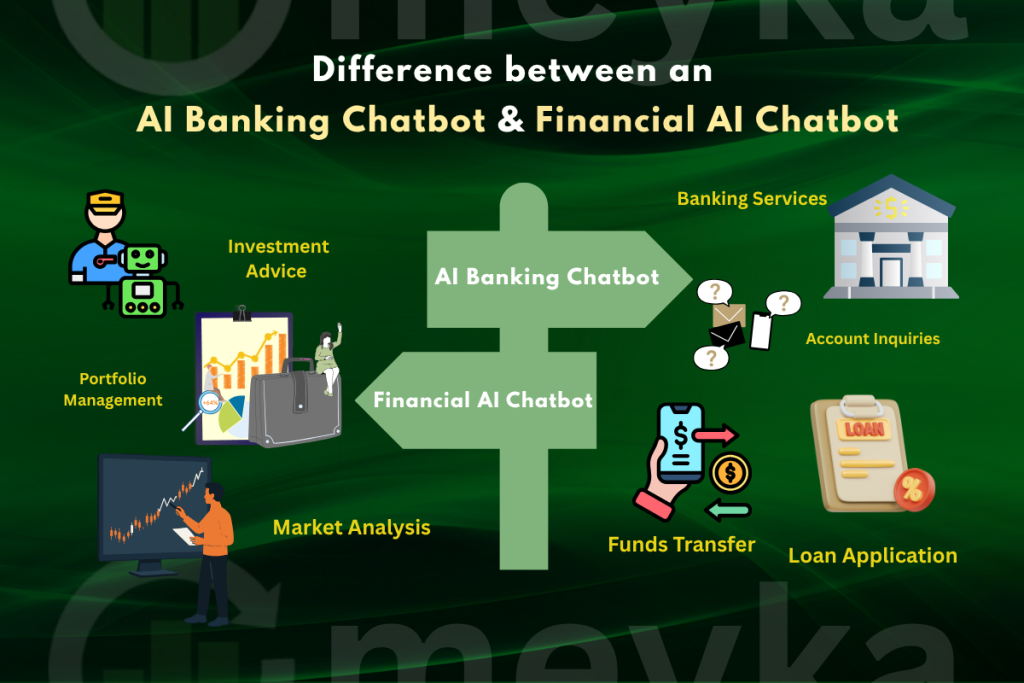

An AI chatbot in finance is a software application that uses artificial intelligence to simulate human conversation and perform tasks related to financial services. These chatbots use natural language processing (NLP) and machine learning to understand and respond to customer inquiries, process transactions, and provide financial advice.

A chatbot for financial services can significantly enhance customer experience by providing instant responses, personalized recommendations, and consistent service across various platforms. This not only improves customer satisfaction but also increases operational efficiency and reduces costs.

How AI Chatbots are Transforming Specific Financial Operations?

Customer Service & Support

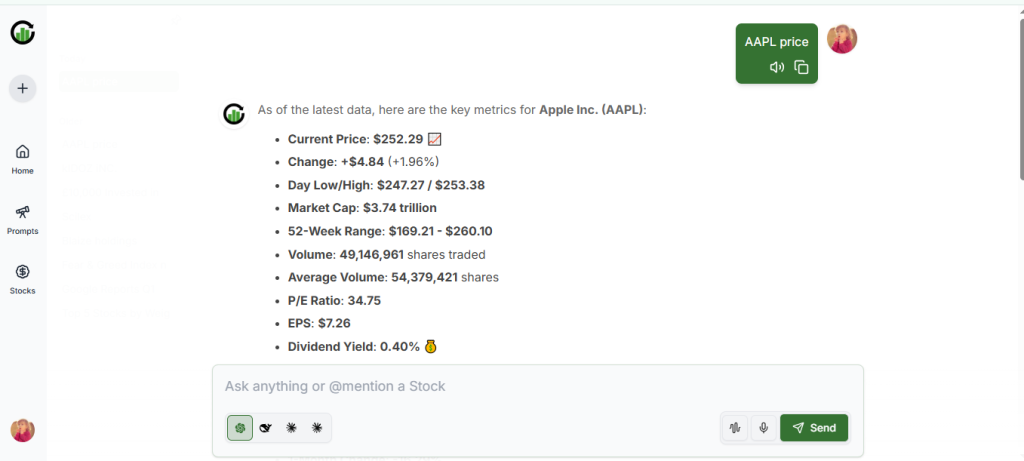

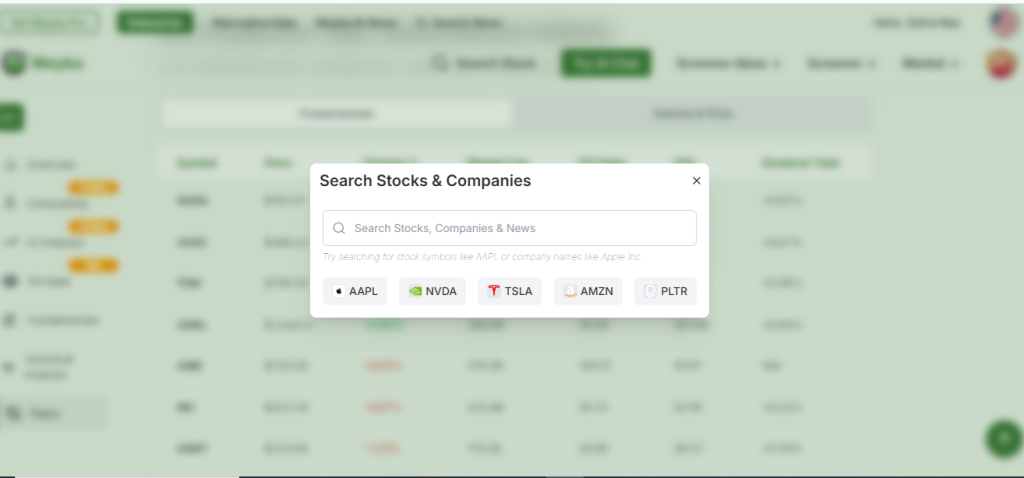

AI chatbots have changed how financial firms serve customers. They provide instant answers, 24/7 support, and personalized advice. In 2025, JPMorgan Chase uses a virtual assistant, COiN, to review legal documents, saving 360,000 work hours yearly. Meyka’s AI chatbot helps investors by answering stock questions, summarizing earnings reports, and analyzing trends instantly. Users no longer wait for emails or call centers. This speeds decisions and improves satisfaction.

Sales, Cross-Selling & Advisory

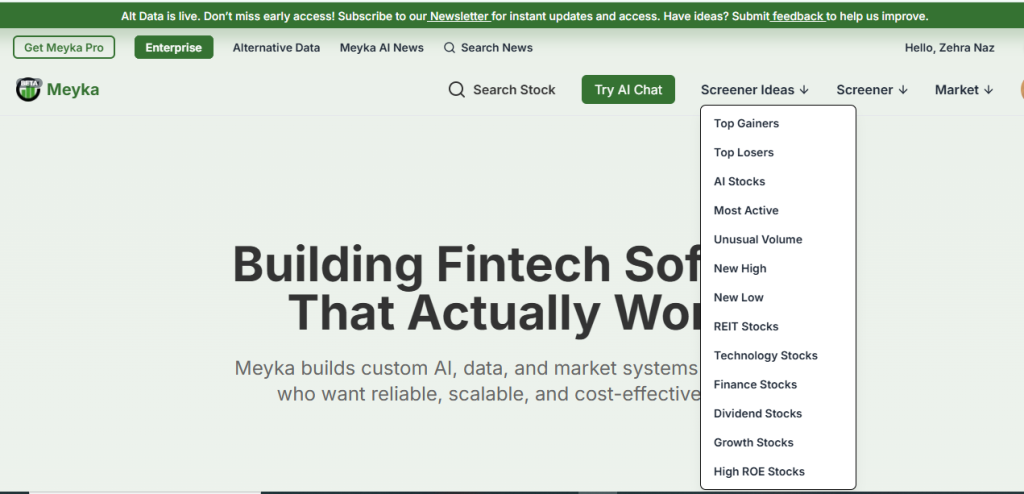

AI chatbots can boost revenue by offering tailored recommendations. Fintech firm Cleo increased engagement by 20% using AI to suggest saving or investment options based on user behavior. Meyka applies similar technology to suggest stocks, ETFs, and portfolio adjustments. Chatbots notice patterns humans may miss and prompt users with timely, relevant financial advice, improving conversions and loyalty.

Data Analysis, Insights & Reporting

Chatbots can analyze thousands of data points instantly. They identify market trends, portfolio risks, and investment opportunities. Meyka’s chatbot, for instance, compares company fundamentals and peer performance to provide quick insights. Banks like Bank of America use AI-driven virtual assistants to generate reports and detect anomalies in transactions, enabling faster decisions. Humans cannot process this volume in minutes.

Internal Finance & Back-Office Automation

AI chatbots reduce repetitive work. They handle data entry, reconcile accounts, and check compliance. For example, Deutsche Bank uses AI bots for trade confirmations, reducing errors by 50%. Meyka automates stock data collection and calculations for investors. This frees staff for strategic tasks, lowers costs, and increases efficiency.

Risk, Compliance & Fraud Monitoring

AI chatbots strengthen security. They monitor transactions in real-time, flag fraud, and ensure regulatory compliance. PayPal applies AI to detect fraudulent payments, saving millions annually. Meyka alerts users if stock trends indicate unusual activity or risk. AI patterns spot anomalies humans might overlook, protecting both institutions and clients.

Key Technical Enablers & Architecture

The effectiveness of AI chatbots in finance is underpinned by several key technologies:

- Natural Language Processing (NLP): Enables chatbots to understand and interpret human language, facilitating meaningful interactions.

- Machine Learning (ML): Allows chatbots to learn from data and improve their responses over time.

- Integration with Financial Systems: Ensures that chatbots can access and process data from various financial platforms.

- Security Protocols: Protects sensitive financial information and ensures compliance with data protection regulations.

Meyka’s AI chatbot exemplifies these capabilities and offers secure, real-time financial insights and analysis to users.

Real-World Example: Meyka as an AI Chatbot Finance

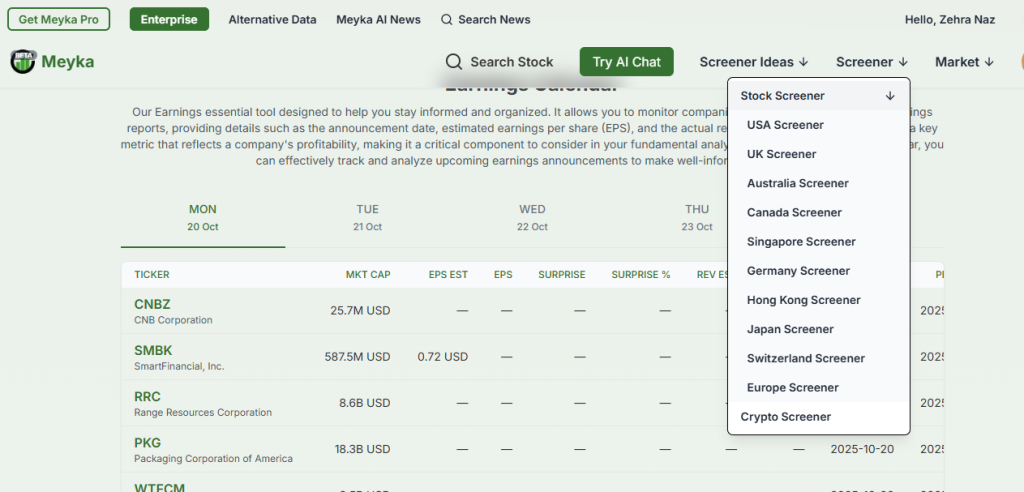

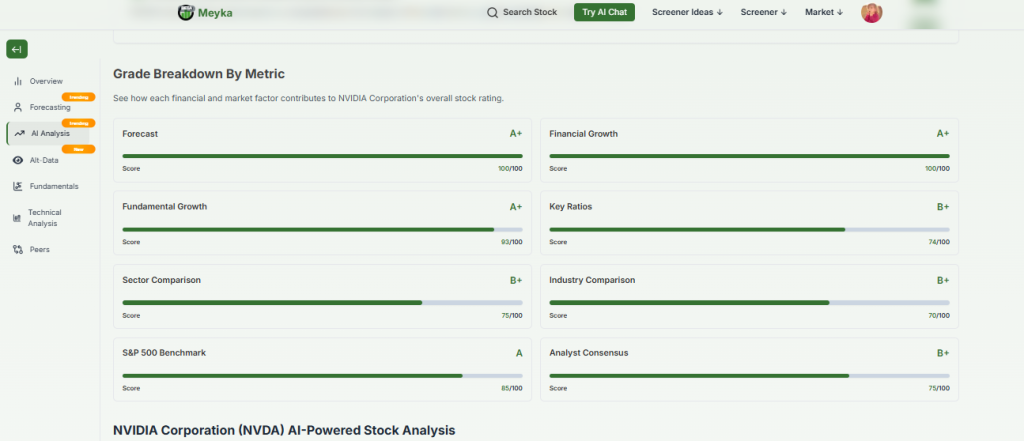

Meyka is an AI-powered financial assistant designed to assist investors in making informed decisions. Launched in March 2024, Meyka offers features such as stock analysis, market trend forecasting, and personalized investment advice.

Meyka, with an AI feature, provides users with instant access to financial information, eliminating the need for time-consuming research. This accessibility empowers individuals to make timely investment decisions and stay informed about market developments.

Meyka’s chatbot continuously learns from user interactions, improves its responses and recommendations over time. This adaptability ensures that users receive relevant and up-to-date information tailored to their financial goals.

Broader Landscape & Use Cases in Banking, Fintech & Financial Services

The adoption of AI chatbots extends beyond individual investors to encompass various sectors within the financial industry:

- Banking: Banks utilize AI chatbots to handle customer inquiries, process transactions, and provide financial advice, enhancing customer experience and operational efficiency.

- Fintech: Fintech companies leverage AI chatbots to offer innovative financial services, such as peer-to-peer lending and robo-advisory, democratizing access to financial products.

- Insurance: Insurance providers employ AI chatbots to assist with policy management, claims processing, and customer support, streamlining operations and improving service delivery.

- Investment Firms: Investment firms use AI chatbots to analyze market trends, assess risks, and provide clients or users with personalized investment strategies.

These applications demonstrate the versatility and impact of AI chatbots across the financial sector.

Challenges, Risks & Best Practices

While AI chatbots offer numerous benefits, their implementation comes with challenges:

- Data Privacy: Ensure the protection of sensitive financial information is paramount.

- Integration Complexity: Integrating AI chatbots with existing financial systems can be complex and resource-intensive.

- User Trust: Building trust with users is essential for the adoption of AI chatbots.

To address these challenges, financial institutions should implement real-time fraud detection, use end-to-end encryption for customer data, and integrate chatbots with existing banking systems like CRM and core banking platforms. They should provide clear explanations of AI recommendations, log all interactions for audit and compliance, and continuously update chatbots with regulatory and market data.

The Future: What’s Next for AI Chatbot Finance?

The future of AI chatbot finance is promising, with advancements in technology paving the way for more sophisticated applications:

- AI chatbots will offer more personalized financial advice by analyzing individual user data and preferences.

- The integration of voice recognition will enable users to interact with chatbots through voice commands, enhancing accessibility.

- AI chatbots will utilize predictive analytics to forecast market trends and assist users in making proactive financial decisions.

These developments will further solidify the role of AI chatbots in transforming financial operations.

Bottom Line

AI chatbots are transforming finance by delivering faster customer support, reducing errors, and enabling smarter decisions through data-driven insights. Platforms like Meyka show how AI research tools provide real-time market analysis, trend forecasts, and investment insights. As AI advances, chatbots will not only support daily operations but also predict risks, optimize portfolios, and guide strategic financial planning, making them essential for the future of financial services.

Frequently Asked Questions (FAQs)

AI chatbots enhance banking by offering 24/7 customer support, automating routine tasks, and providing instant responses, leading to improved efficiency and customer satisfaction.

Financial AI chatbots, such as Meyka, analyze market data and provide insights, helping users make informed stock and investment decisions quickly and accurately.

Chatbots in financial services offer benefits like cost savings, improved efficiency, and enhanced customer engagement by automating tasks and providing personalized support.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.