How AI Is Powering Next-Gen Investment Advisory Solutions

The AI Revolution in Investment Advisory

Artificial intelligence is redefining how the financial world operates. From predictive analytics to intelligent automation, AI has become the driving force behind digital transformation in finance.

The rise of the AI-driven investment advisory platform has replaced intuition-based advisory methods with data-driven intelligence, enabling financial enterprises to make faster, smarter, and more precise investment decisions.

Meyka, a global innovator in AI-powered investment and financial analytics, is at the forefront of this transformation, helping institutions rethink how financial planning, forecasting, and portfolio management are done.

What makes AI the next big leap for investment advisors and enterprises? Let’s explore.

Understanding the Rise of the AI-Driven Investment Advisory Platform

What Is an AI-Driven Investment Advisory Platform?

An AI-driven investment advisory platform combines machine learning, predictive analytics, and big data to offer personalized investment insights. These platforms enable digital wealth management, smart portfolio management, and automated investment recommendations, helping advisors make intelligent, data-backed decisions.

Why It Matters for Today’s Financial Enterprises

AI is transforming investment advisory by making decision-making faster, more accurate, and scalable. It eliminates emotional bias, streamlines data interpretation, and delivers actionable insights that drive consistent portfolio performance.

Why are enterprises investing in AI-driven advisory platforms? Because they deliver real-time, data-backed insights that minimize risk and enhance portfolio performance for clients.

How Meyka Is Transforming Investment Advisory for Enterprises

Meyka’s AI Enterprise Advantage

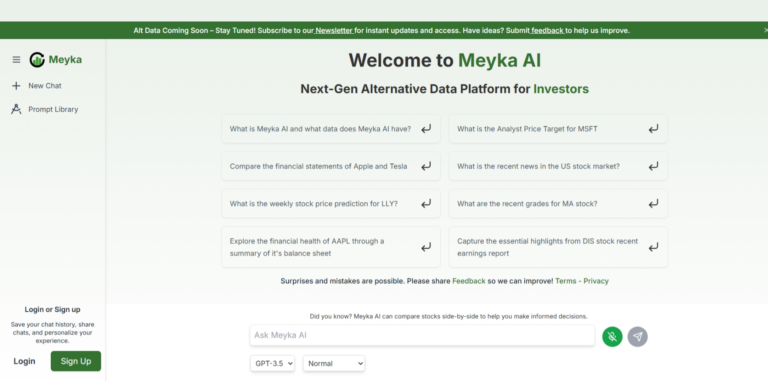

Meyka is an AI enterprise service provider specializing in investment forecasting, predictive analytics, and automated advisory systems. Its cutting-edge platform integrates AI, big data, and deep learning to help institutions analyze market dynamics and investor sentiment efficiently.

Meyka’s AI Stock research tools help enterprises identify emerging trends across global markets using real-time financial modeling.

Enterprise-Grade Features and Integration

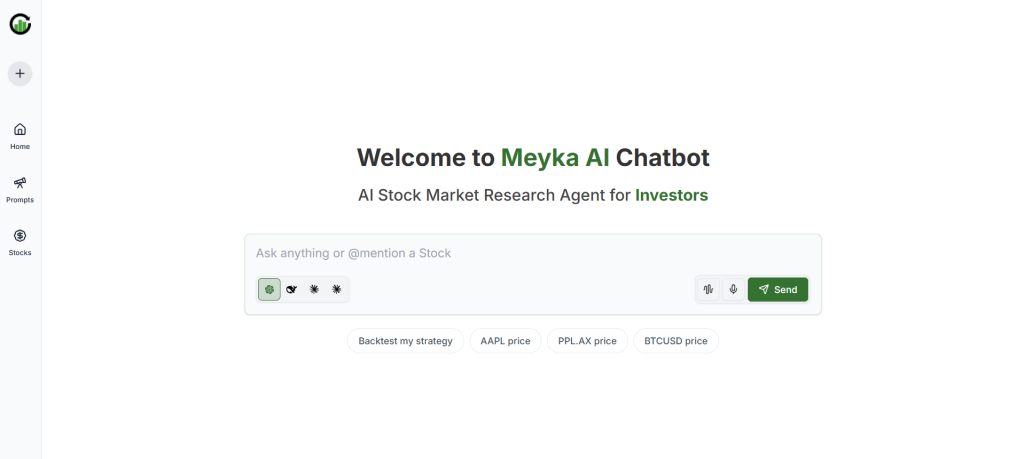

Meyka offers data transparency, custom enterprise integrations, and an advanced AI chatbot interface, Meyka Chat, which helps financial analysts make smarter, faster decisions through conversational intelligence and natural language queries.

Key Benefits of AI-Driven Investment Advisory Platforms for Enterprises

Personalized and Predictive Intelligence

AI enables personalized portfolio recommendations that adapt to each client’s goals, preferences, and risk tolerance.

Real-Time Market Insights

Using deep neural networks, AI forecasts market cycles and asset performance while offering real-time analytics to improve decision-making and reduce uncertainty.

Scalability and Compliance

With AI, enterprises can scale advisory services to thousands of clients without increasing operational costs. Moreover, AI systems improve audit trails and reduce regulatory risks by ensuring transparency.

With AI, enterprises gain an advisor that never sleeps, delivering insights, forecasts, and alerts in real time.

Inside Meyka’s Enterprise AI Infrastructure

The Power Behind Meyka’s AI Systems

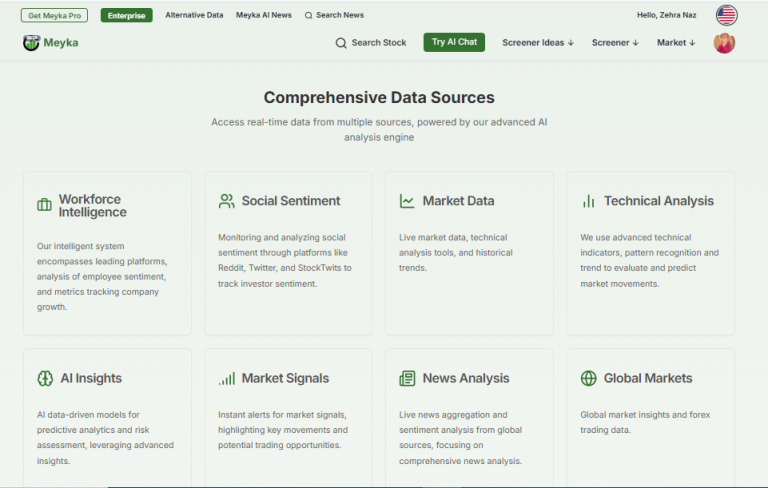

Meyka’s enterprise-grade AI architecture integrates data aggregation, neural forecasting, sentiment modeling, and LLM-based market interpretation to transform raw data into actionable financial insights.

Data Intelligence and Predictive Modeling

Through AI Stock Analysis, Meyka’s system decodes massive volumes of market data, providing investment signals that are both actionable and explainable. This approach blends structured and unstructured data, from financial reports to market sentiment, into a unified decision-support framework.

Security, Scalability, and Integration

Meyka ensures enterprise-grade security, scalability, and API connectivity, making it ideal for financial data infrastructure and AI portfolio analytics within complex institutional ecosystems.

The Global Market Size and Growth Potential of AI Advisory Solutions

AI’s Growing Influence in Finance

According to insights from FPA Trends, AI adoption in Financial Planning and Analysis (FP&A) is accelerating rapidly. The global AI in finance market is projected to reach hundreds of billions of dollars within the next decade as institutions embrace automation and data intelligence.

Enterprise Opportunity and Market Expansion

As the AI investment market size continues to expand, enterprises leveraging AI-driven investment advisory platforms like Meyka will capture significant competitive advantages through faster insights and smarter financial planning.

Is now the right time for financial enterprises to invest in AI transformation? Yes, early adopters are building stronger predictive models, achieving higher ROI, and leading in fintech innovation.

How Enterprises Use Meyka’s AI Platform to Gain Market Advantage

Practical Use Cases Across the Financial Sector

Banks, asset managers, and investment firms use Meyka’s AI platform for forecasting, risk analysis, and portfolio optimization. The platform integrates seamlessly with enterprise CRMs, data warehouses, and client dashboards for smooth workflows.

Meyka’s AI Stock insights empower institutions to evaluate equities, ETFs, and indices in real time for better trading and allocation decisions.

ROI and Business Transformation

These integrations deliver measurable results, allowing enterprises to automate manual advisory work, improve accuracy, and strengthen profitability through AI financial management tools, enterprise investment automation, and predictive asset modeling.

The Future of AI in Investment Advisory: Beyond Automation

Agentic AI and Dynamic Decision-Making

As discussed in the FPA Trends article, agentic AI models and LLMs are now enabling dynamic decision-making, where AI advisors learn continuously from real-time data to evolve strategies automatically.

Emerging Trends in AI Advisory

The future of AI in finance lies in self-learning advisors, predictive analytics, and AI advisory innovation that merges automation with human judgment.

Meyka’s Vision for the Future

Meyka envisions an era where AI advisory systems not only automate tasks but also provide interpretable insights that empower advisors. Enterprises partnering with Meyka gain early access to cutting-edge AI technologies shaping the global investment ecosystem.

Why Meyka Stands Out Among AI Investment Platforms

Unique Differentiators

- Enterprise Customization: Tailored AI models aligned with corporate data strategies.

- End-to-End Automation: From market research to performance tracking.

- Explainable AI: Transparent insights that build investor trust.

- Cloud and On-Premise Integration: Ensuring compliance and flexibility.

- Dedicated Support: Enterprise onboarding, training, and 24/7 assistance.

Why choose Meyka over other AI platforms? Because Meyka doesn’t just automate investments; it transforms enterprises into data-driven decision-makers ready for the AI future.

Real-World Impact and Enterprise Success Stories

Transformative Business Results

A leading financial advisory firm improved its portfolio ROI by 35% within six months using Meyka’s predictive forecasting tools.

Another wealth management company automated over 60% of manual advisory work, reducing costs and boosting client satisfaction through Meyka’s AI-driven workflows.

Performance and Client Retention

These outcomes represent more than statistics; they show how AI is enhancing portfolio performance, client retention, and risk management across the financial ecosystem.

For more details, visit the Meyka Enterprise page.

These are not just numbers; they represent how technology is empowering financial advisors to serve smarter, faster, and better.

Partnering with Meyka: The Enterprise Growth Opportunity

Building the Future of Financial Intelligence

Financial leaders, fintech founders, and institutional investors are invited to explore Meyka’s enterprise solutions and discover how AI can revolutionize their operations.

Through meyka.com/contact-us, organizations can connect directly with Meyka’s team to explore collaboration opportunities.

Empowering Enterprise Innovation

By partnering with Meyka, enterprises gain a competitive edge, scalability, and insight-driven decision-making, all powered by the most advanced AI infrastructure in the financial industry.

The future of investment advisory is here, and Meyka is leading the way.

Conclusion: AI and Meyka’s Role in Next-Gen Investment Advisory

Empowering Advisors, Enhancing Insights

AI is not replacing advisors; it’s empowering them with intelligence. Meyka’s AI-driven investment advisory platform bridges technology and trust, helping enterprises achieve more with less effort and more confidence.

Early adopters of Meyka’s AI-powered innovation are positioning themselves as future-ready leaders in digital investment transformation.

With Meyka’s AI at the core, enterprises can unlock smarter insights, confident decisions, and sustainable growth in the financial era ahead.

FAQ’S

An AI-driven investment advisory platform uses artificial intelligence, machine learning, and predictive analytics to deliver personalized investment recommendations, automate portfolio management, and optimize financial decision-making for enterprises.

AI improves financial planning by analyzing massive datasets in real time, identifying market trends, forecasting risks, and helping advisors create more accurate and tailored investment strategies for clients.

Enterprises should adopt platforms like Meyka because they enable faster data analysis, enhance transparency, automate compliance, and provide predictive insights that improve ROI and client satisfaction.

Key benefits include real-time market insights, scalable advisory services, predictive asset modeling, enhanced compliance, and data-driven portfolio optimization that reduces human error and improves profitability.

Meyka is leading the transformation through its enterprise-grade AI infrastructure, real-time analytics, and intelligent automation tools that empower institutions to make smarter, faster, and more transparent investment decisions.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.”