How AI-Powered Tools are Reshaping Stock Research and Analysis

More than 90% of today’s market data is created in real time, and investors struggle to keep up. There is too much news. Too many numbers. Too many fast moves. Traditional stock research can’t handle this level of noise. It is slow. It is manual. And it often misses key signals that matter in the moment. This is why investors are moving towards an AI-powered tool.

These systems read data much faster than humans. They scan markets, compare companies, track trends, and even study sentiment in seconds. They remove guesswork and help investors focus on facts.

Platforms like Meyka make this shift even clearer. They bring together live data, smart analytics, and simple dashboards so users can get clean insights without doing hours of work. Whether you’re a new investor or a research team inside a firm, an AI-powered stock research tool makes the whole process easier and more accurate. Stock analysis is changing fast. And AI is now at the center of that change.

How AI Is Changing Stock Research in 2025?

Stock research looks very different today than it did five years ago. Markets move faster. Data flows instantly. News can shift prices in seconds. This pace makes old research methods feel slow and incomplete. Many analysts still jump between spreadsheets, reports, and charts. Many investors still try to process earnings news, price moves, and industry updates on their own. It is easy to miss key changes when everything updates at once.

AI tools solve this problem. They read the market in real time, organize data, spot patterns, and highlight early signs of change. They help investors work smarter, not harder. In 2025, this shift is not a prediction. It is already happening. More trading platforms and research teams now rely on AI for screening, alerts, and insights.

Why AI Stock Research Works Better?

AI works well in finance because markets create huge amounts of data every minute. A human analyst cannot read 10,000 headlines a day. AI can. A human cannot compare 500 companies across 30 metrics in seconds. AI can. This makes research faster and more complete.

Machine learning also spots connections that people might ignore. It compares past behavior, price moves, and financial signals. It also checks sentiment from news and social media. This gives investors a bigger picture of a company’s health. Instead of guessing, they get clear signals backed by data.

This shift does not replace human thinking. It supports it. Investors use the AI output to make stronger decisions. They save time and reduce errors.

Meyka AI: A Platform Built for Modern Stock Research

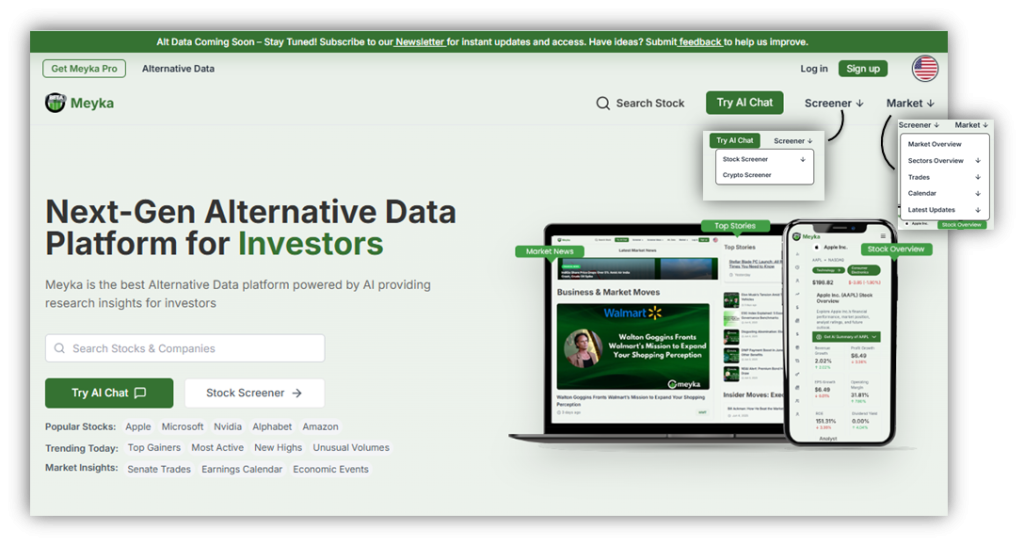

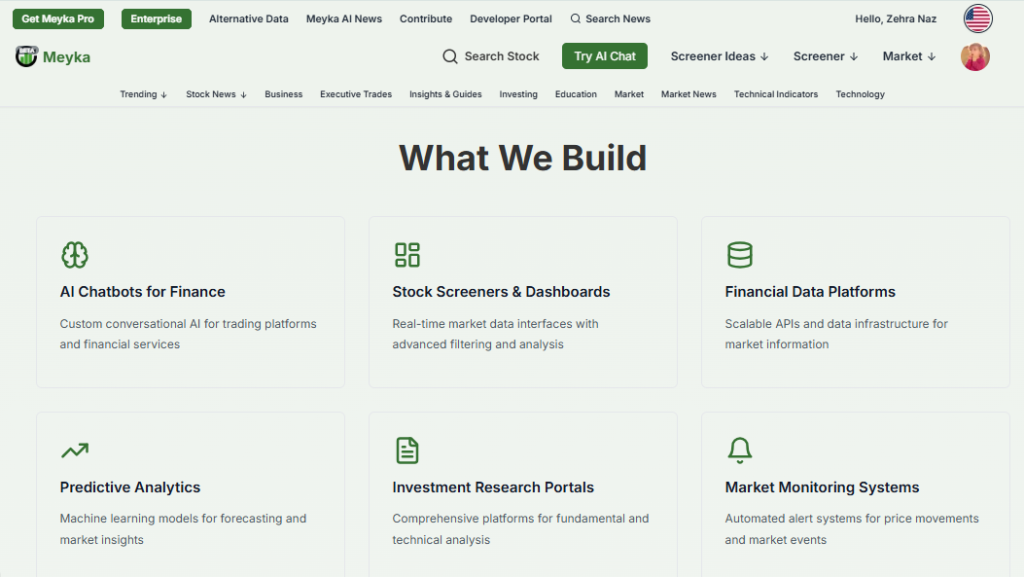

Meyka stands out because it does not offer “generic AI.” It builds finance-first AI systems designed for real market work. Its platform brings together data, analytics, automation, and research tools in one place. You can explore these offerings on the official site:

Meyka gives users access to a full market engine. It blends live-stock data, financial metrics, technical signals, and sentiment checks. It also supports end-to-end development for firms. This includes data pipelines, dashboards, reports, and custom AI features. The system is built for both single users and large enterprise teams.

Meyka’s biggest strength is its ability to make research simple. You don’t need advanced knowledge to explore a company. The system turns complex data into clean insights. It helps users understand what is moving a stock right now, not yesterday.

How Meyka Improves Day-to-Day Stock Analysis?

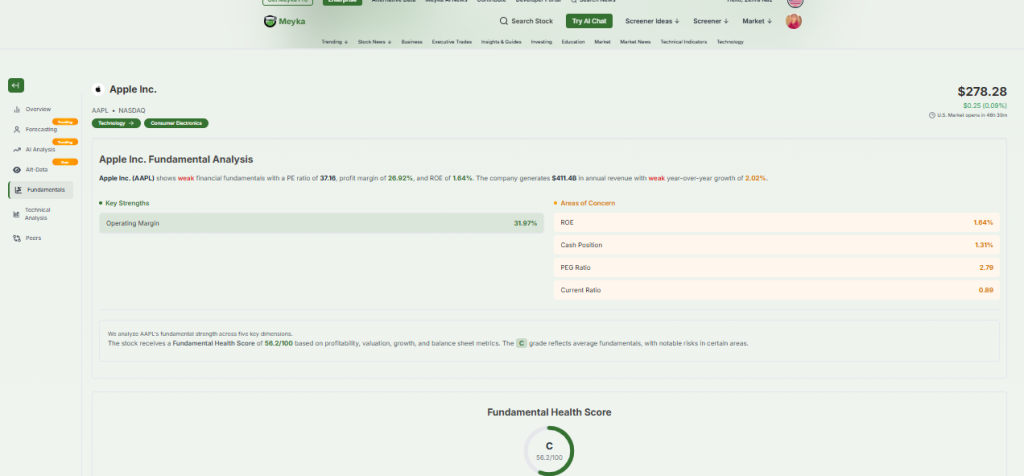

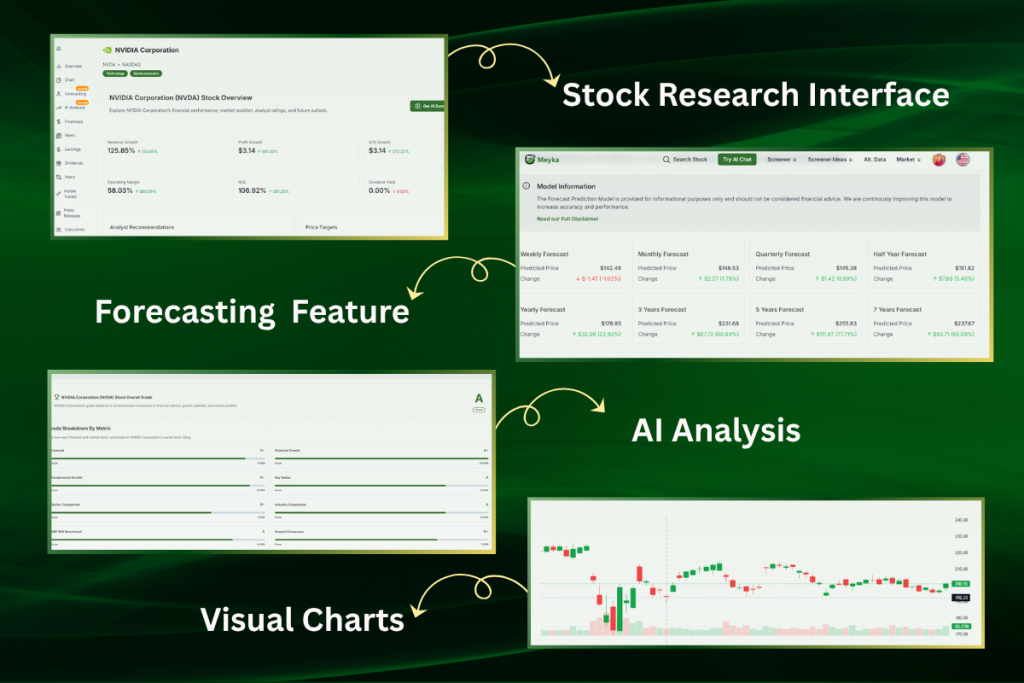

One major feature is Meyka’s real-time analysis engine. It reads market data as it updates, checks fundamentals like revenue, profit growth, and balance sheet strength. It also follows price action, chart patterns, sector shifts, and news sentiment. This gives a complete view of a company at any moment.

Meyka, an AI-powered stock research tool, also offers a smart stock screener. Users can filter companies using metrics such as ROE, P/E ratio, EPS growth, or momentum signals. Instead of scanning hundreds of charts, the system shows the strongest candidates in seconds. This saves hours of manual work.

Another helpful tool is automated alerts. If a company shows an unusual move, Meyka sends a notice. Moreover, if earnings numbers change expectations, the AI flags it. If a stock breaks a trend, you know right away. This makes the research process smoother and faster.

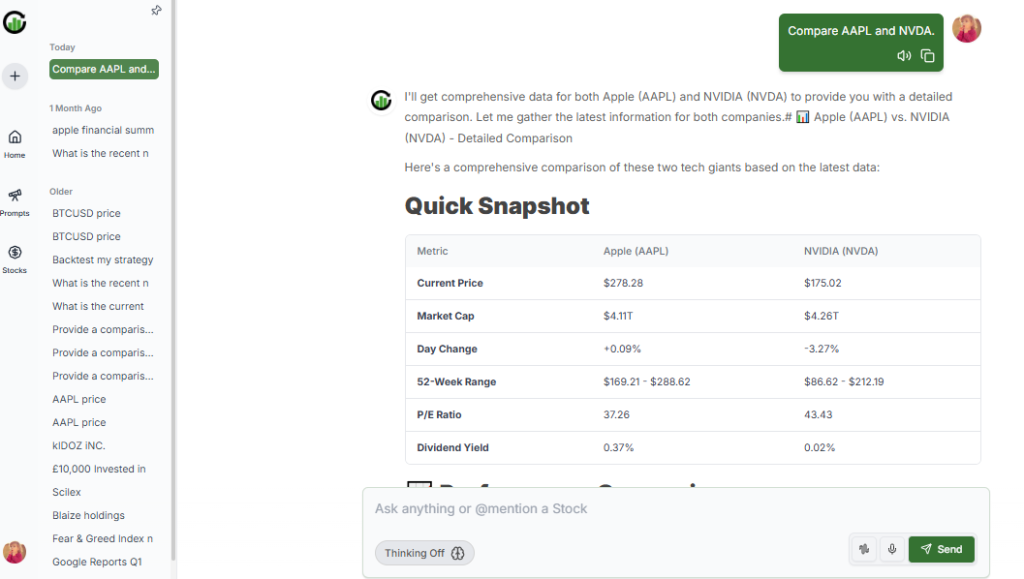

The platform also includes an AI chatbot. Users can ask simple questions such as “Show undervalued tech stocks” or “Compare AAPL and NVDA.” The AI replies with clear, structured insights. It removes the need to dig through multiple reports.

Why These Tools Matter for Investors and Firms?

Investors no longer have to sort through hundreds of pages or jump across platforms. AI brings everything into one clean flow. It reduces human error and helps users rely on facts instead of assumptions.

For firms, the benefits go even further. Research teams can scale their work without hiring a large staff. They can automate reporting and compliance tasks. They can standardize how analysts collect and review information. This improves quality and lowers cost.

Meyka’s enterprise features support private hosting, secure data controls, and audit tracking. This matters because financial firms are subject to strict regulations.

Common Challenges and How Meyka Solves Them

AI is powerful, but it is not perfect. Models still need good data. Markets still move in unexpected ways. No system can “predict everything.” Investors need to use AI results with their own judgment.

Meyka makes this easier by keeping the process transparent. It shows how data moves and why signals change. It also supports human oversight. Users check insights, adjust settings, and confirm findings. This adds safety and reduces blind trust.

Security is another concern. Financial data is sensitive. Meyka handles this through secure connectors, encryption, and private deployment options. Firms can keep their data inside their own environment.

Who Gets the Most Value From Meyka?

Meyka helps many types of users. Individual investors get simple, clear insights without learning advanced methods. Analysts use it to handle bigger workloads. Portfolio managers track trends across sectors without losing time. Brokerage firms use it to offer clients better research tools.

The platform also supports content creators. They can generate faster summaries, charts, and market updates using the AI engine. This helps them deliver better content in less time.

The Future of Stock Research Is Already Here

Markets will keep growing in speed and complexity. More data will appear each year. An AI-powered stock research tool like Meyka helps people stay ahead. They make research faster, clearer, and more reliable. They also make advanced analysis easier for everyday investors.

This shift is not hype. It is real, and it is already improving how people study the market. As AI grows stronger, platforms like Meyka will play a bigger role in how investors check companies, follow trends, and make decisions.

Frequently Asked Questions (FAQs)

Many tools help with stock research, but the best ones give fast data and clear insights. Meyka is a strong choice because it blends real-time data with smart AI analysis.

AI reads large amounts of data quickly. It spots patterns people may miss. Platforms like Meyka use real-time updates and simple visuals to help users see clearer and more accurate signals.

AI tools guide investors by showing trends, risks, and key changes early. They do not remove market risk, but systems like Meyka make research easier and decisions more informed.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.