How Canada Traders Can Choose the Best Perpetual Futures Platform?

Canadian traders can learn how to choose the best perpetual futures platform with simple steps, key features, and smart tools using the focus keyword.

A Simple and Complete Guide for Canadian Traders

Choosing the best perpetual futures platform in Canada can feel confusing, especially when so many exchanges offer similar tools. Traders want a place that is safe, fast, smooth, and fair. They also want clear fees, strong support, and easy access to trading pairs. In this guide, we look closely at what Canadian traders should check and how they can pick a platform that fits their needs.

The crypto market is growing fast in Canada. More young users, retail traders, and even small businesses want to explore perpetual futures because they like the idea of trading with high liquidity and simple long and short positions. This article explores the key features traders must check, what mistakes to avoid, and why platforms like BYDFi are getting strong attention in Canada.

Why Are Perpetual Futures Gaining Popularity in Canada

Perpetual futures allow traders to buy or sell a coin without owning it. These contracts do not expire, so traders can stay in a position as long as they want. This is one of the reasons why the demand for such platforms has grown in cities like Toronto, Vancouver, and Calgary.

But why do traders like these contracts so much? Perpetual futures offer flexible trading, fast tools, and the ability to trade with leverage. For many Canadian traders, this is a simple way to join the global crypto market without owning the actual asset.

BYDFi provides 200x leverage for perpetual contracts. This sets BYDFi apart from other exchanges where the maximum leverage for perpetual contracts is typically 100x or 125x. BYDFi offers up to 200x leverage.

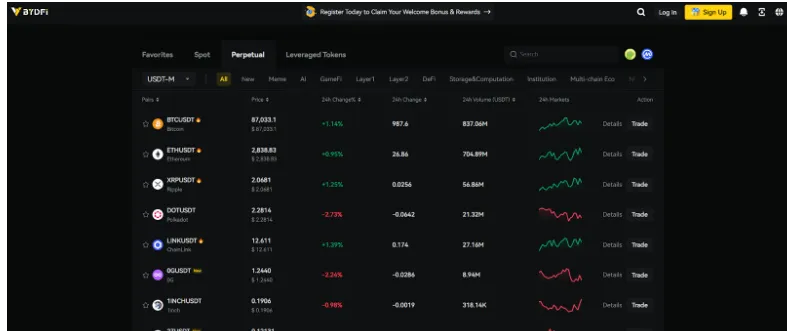

- Up to 600+ crypto trading pairs.

- Includes USDT-M and Coin-M perpetual futures.

- Up to 200x leverage for perpetual contracts

- Higher potential returns, greater flexibility, and convenience

- This sets BYDFi apart from other exchanges, where the maximum leverage for perpetual contracts is typically 100x or 125x

How Canadian Traders Can Choose the Best Perpetual Futures Platform

Choosing the right platform requires looking at many small but important details. Here are the points every trader in Canada should check.

Check the Trading Fees and Hidden Charges

One of the biggest mistakes traders make is not checking the fees. Some platforms show low trading fees but add extra costs later.

A common trader question:

How can I avoid high fees while trading perpetual futures

The best way is to choose a platform that clearly shows its trading fees and does not hide charges. You need a platform that supports low-fee futures trading, especially for long-term traders who open and close many positions.

The Security and Safety Measures of the Platform

Security is one of the most important things to check. Canadian traders should look for platforms that use multi-layer security. These include cold storage, strong encryption, and a secure trading engine.

But what matters the most

The platform should share clear and simple information about how it keeps user funds safe. It should not claim unrealistic results or guaranteed protection. Only real steps matter, and traders should always verify them.

The Quality of the Trading Interface

A smooth and simple interface is a huge benefit for traders in Canada. The platform must offer fast charts, easy order placements, and simple navigation.

When a chart takes too long to load, traders may lose good chances. When the buttons are complicated, new users feel lost. A good platform should offer both simple tools for new traders and advanced tools for skilled users.

Funding Rates and Liquidity

While picking the best perpetual futures exchange, traders should check the funding rate model. Some platforms adjust the funding rate too fast and increase the cost of long-term positions.

Liquidity also matters. When liquidity is low, orders take longer to fill, and the price may slip. Good liquidity keeps the market smooth and fair.

Market Reputation and Community Support

Before choosing any platform, traders should see how active the company is in the crypto community. For example, BYDFi recently announced its partnership with Newcastle United Football Club, which added strong visibility to the brand and showed its commitment to global projects.

This type of global partnership shows users that the company invests in strong branding and long-term growth.

Why Many Canadian Traders Are Showing Interest in BYDFi

BYDFi has gained attention in the Canadian community because of its easy interface, simple fee structure, and friendly design. Canadian traders often say that they enjoy the clean layout and smooth order execution.

Overview of BYDFi’s Core Trading Features

- Spot trading: 1000+ assets

- Derivatives: Perpetual contracts (600+ pairs; 1x–200x leverage) with flexible margin modes.

- Trading bots: Auto-invest, martingale, spot/futures grid.

- Smart Copy Trading: Dedicated sub-accounts per trader; proportional auto-follow orders with isolated positions for better risk control.

- Onchain Memecoin Trading: MoonX for Onchain trading (Solana & BNB Chain) with real-time insights and a smooth Web3 flow.

User-Friendly Charting and Analytical Tools

The charting tools are smooth and easy to understand, and they include basic indicators that help beginners and intermediate traders read the market.

The platform also offers a transparent view of the funding rates and the trading fees, which makes it easier for Canadian traders to plan long-term strategies.

Supported Crypto Pairs and Trading Performance

BYDFi also supports a wide range of crypto pairs, simple leverage options, and an updated engine that helps reduce delays during busy trading hours.

These features make the platform easy for new users who want a calm trading experience without complicated tools.

Recent Global Events and Brand Expansion

In recent months, BYDFi has gained more attention through its global events and brand growth. One of the biggest highlights is its official partnership with Newcastle United Football Club. This event helped the platform reach more users around the world and showed its focus on brand expansion.

Community Updates and Feature Rollouts

BYDFi has also shared updates through its press releases, AMAs, and community activities that focus on bringing more features and giving traders helpful information.

These events and updates show that BYDFi aims to stay active in the global market and provide a platform that feels simple, friendly, and helpful for traders in Canada.

User-Friendly Interface

The platform offers easy navigation and fast load times. New users can learn the tools without stress. It is simple enough for beginners while still helpful for skilled traders.

Low Fees

The platform keeps fees simple and clear. Canadian traders appreciate this because many other exchanges add hidden charges.

Global Recognition Through the Newcastle United Partnership

The official sponsorship with Newcastle United helped BYDFi build more trust globally. It also positioned the platform as a strong and growing brand in the trading industry.

BYDFi Platform Preview for Canada Traders

According to the press materials, Canadian traders often look to understand the interface layout, the futures positions panel, and the clean chart view.

Other Factors Canada Traders Should Consider

Customer Support Availability

A strong support team builds trust. Canadian traders prefer platforms that answer questions fast. Support teams should offer email help, live chat, and clear guides.

Mobile App Quality

Since many users trade on the go, the mobile app must be stable and smooth. A good app offers fast charts, real-time data, and simple order management.

Crypto Pairs and Tools

Canadian traders want more choices and strong analytics tools. A good platform offers many trading pairs, easy leverage control, real-time indicators, and smooth execution.

Common Questions from Canadian Traders

Why is choosing the right perpetual futures platform so important

Because a wrong platform can cause losses through hidden fees, slow charts, or liquidity issues.

Is BYDFi safe for new traders?

Yes, as it offers simple guides, clear fees, and user-friendly tools. Its security practices are moderate and transparent.

Should beginners trade with leverage?

Beginners should start small because leverage increases both risk and reward.

Final Thoughts for Canada Traders

Finding the best perpetual futures platform in Canada is about staying informed and choosing a service that is simple, fair, and aligned with your needs. A good platform offers clarity and trust, not confusion. Check the fees, check the tools, and choose the platform that gives you confidence. Platforms like BYDFi are gaining attention because of their clean design, ease of use, and global partnerships, like their Newcastle United sponsorship. Canadian traders want a smooth and fair trading experience, and the right platform can make all the difference.

Disclaimer:

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.