How Financial AI Software Providers are Transforming Fintech Infrastructure

The financial world is changing fast. Every week, banks and fintech firms face new rules, new risks, and new customer needs. By 2025, most financial services will be moving toward real-time systems and smarter digital tools. This shift is not just a trend. It is now a basic requirement for any company that wants to stay competitive.

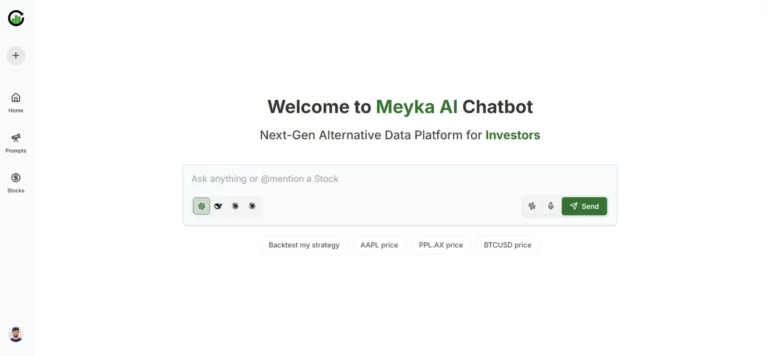

Continue Reading on Meyka

This article is available in full on our main platform. Get access to complete analysis, stock insights, and more.

Read Full Article →