ICICI Prudential AMC IPO Live: Subscription Opens for Rs 10,603-Cr Mega Public Offer

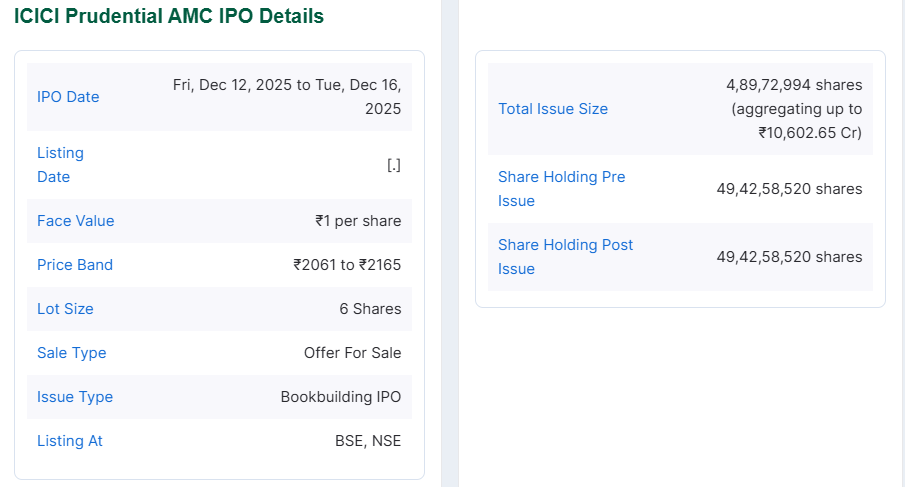

The ICICI Prudential AMC IPO has opened for public bids on December 12, 2025. This public offer aims to raise around Rs 10,603 crore. It is one of the biggest listings in India’s financial markets this year. The issue will run until December 16, 2025, and will be listed on the stock exchanges around December 19.

Investors are watching closely. This is not just another finance IPO. ICICI Prudential AMC manages large amounts of money for millions of mutual fund holders. Its size and reach make this listing stand out. Early market signals and grey market premiums show strong interest.

For new and seasoned investors, this IPO could be a key chance to join a major player in India’s growing asset management space. The next few days will show how strong the appetite is.

What Makes ICICI Prudential AMC’s IPO a Big Deal Today?

The ICICI Prudential AMC IPO opened for subscription on December 12, 2025. The offer is sized at about ₹10,603 crore. The company set a price band of ₹2,061-₹2,165 per share. This is one of the largest asset-management listings in India this year. Anchor investors committed about ₹3,022 crore before the public offer. These facts frame why many market watchers are paying close attention.

Business Strengths That Support the Valuation

ICICI Prudential AMC runs a large, diversified mutual fund business. It is a market leader in active equity and equity-oriented funds. The firm benefits from strong retail flows. It also uses a wide distribution network that includes ICICI Bank branches and digital partners.

Revenue and profit grew sharply in recent years, with operating metrics among the best in the industry. These strengths explain the premium valuation investors are being asked to accept.

The Offer Structure: No Fresh Capital, Big OFS

This IPO is mainly an offer for sale by Prudential Corp. Holdings. That means the company will not receive fresh capital from this listing. Existing shareholders are selling down part of their stake. Post-IPO, promoter holding will change, but the AMC will remain tied to its parent brand. The OFS structure matters because valuation now reflects market appetite for shares rather than new funds for growth.

Numbers That Investors Care About

The issue opens on December 12 and closes on December 16, 2025. The lot size is small, six shares per minimum application. The IPO implies a market value near ₹1.07 lakh crore at the upper band. Allocation splits include quotas for institutional, non-institutional, and retail investors, plus an anchor portion that was allocated in the pre-IPO placement. These details shape subscription tactics and allotment odds.

What Investors are Paying For (Beyond AUM)?

Investors are not simply buying assets under management. The price factors in fee margins, high return ratios, and scale benefits. The AMC generates fee income that grows with AUM, but costs rise slowly. The premium also reflects strong retail SIP flows and a high wallet share through bancassurance. Add the firm’s push into passive and alternative strategies, and the long-term margin story looks attractive on paper.

Real Risks That Deserve Attention

Regulatory change is a real threat. Fee compression and SEBI’s evolving rules can hurt margins. Market downturns will slow flows and pressure revenue. The company also leans on ICICI Bank’s distribution. High concentration in one partner could become a vulnerability if that channel weakens. Competition from fintechs and passive fund providers adds pressure on market share and fees. These risks are not hypothetical. They influence fair value today.

Broker Views and Anchor Backing

Top brokerage notes generally call the IPO a long-term buy but warn about near-term valuation risk. Analysts highlight the AMC’s strong ROE and healthy margins. Anchor commitments from institutional names signal confidence. Yet many brokers caution that listing gains may be modest because much of the valuation already appears baked in. Investors should weigh long-term earnings potential against current pricing.

How Digital and Product Mix Matter?

Digital adoption is accelerating. The AMC’s online platforms and API partners are increasing retail reach. This should lower customer acquisition costs over time. Product mix is evolving, too. A shift toward passive funds and smart-beta strategies could compress fees, but scale in passive can offset margin loss via higher AUM.

One practical way to analyze this tradeoff is to run scenarios with an AI stock research analysis tool to model fee-compression effects on future earnings. The result will vary by growth and cost assumptions.

Who This IPO Suits, and Who Should Steer Clear?

Long-term investors who believe in India’s financialization story may find value here. The AMC’s scale and distribution make it a structural play on mutual fund growth. Conservative buy-and-hold investors can consider applying with a long horizon.

Short-term traders seeking quick listing profits should be cautious. High valuation and limited fresh capital reduce the likelihood of large listing pops. Retail applicants should also factor in the ICICI Bank shareholder quota if eligible.

Listing Scenarios to Watch

Three realistic listing outcomes exist. First, a stable debut near the issue price if demand meets expectations. Second, a small premium listing may be considered if the subscription overshoots and market sentiment is bullish. Third, a muted or discounted listing if markets turn weak or investors balk at valuation. Monitoring subscription data during December 12-16, 2025, will provide a clear signal on which scenario is unfolding.

Final Takeaway

This IPO offers a way into a market leader in Indian asset management. The offer size, price band, and anchor backing show strong institutional interest. At the same time, the OFS nature, high valuation, and regulatory risk make timing and investor profile key. Apply only after matching the IPO’s risk-reward profile to a clear investment horizon and plan. For many investors, this listing is a long-term exposure to India’s savings shift. For others, it may be a trade not worth the price today.

Frequently Asked Questions (FAQs)

The GMP changes every day based on demand. It shows how much buyers are willing to pay in the unofficial market. Check the latest GMP update for December 2025 before applying.

The ICICI Prudential AMC IPO is expected to list on the stock exchanges around December 19, 2025. The final date may change based on market and exchange approvals.

Apply only if the business model, price band, and risks match your goals. The IPO is large, but returns depend on the market mood and listing price in December 2025.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.