IMF Approves $1.2 Billion for Pakistan as Economic Reforms Show Progress

On December 8, 2025, the International Monetary Fund (IMF) made a big decision. It approved a fresh $1.2 billion payment to Pakistan. This came after Pakistan showed real progress on key targets set by the IMF. The move was not just about money. It was a sign that global lenders see Pakistan’s economy moving in the right direction.

The funds are part of Pakistan’s longer IMF program that began in 2024 and link support to reform work. Islamabad had to meet strict economic goals to unlock this cash. The approval also reflects efforts to fix long-standing issues like weak public finances and low foreign reserves.

This decision brings new hope for stability. But it also raises questions about what comes next for Pakistan’s economy, ordinary families, and future growth.

What Exactly the IMF Approved and Why It Matters?

On December 8, 2025, the IMF’s Executive Board approved a $1.2 billion disbursement to Pakistan. The package includes $1 billion under the Extended Fund Facility (EFF) and $200 million from the Resilience and Sustainability Facility (RSF). This brings total IMF disbursements under the two arrangements to roughly $3.3 billion so far.

The money boosts Pakistan’s foreign exchange buffers. It also unlocks short-term liquidity for the government. The IMF stressed the need for continued fiscal discipline and faster reforms to keep confidence high.

Which Reforms Opened the IMF’s Door

Officials met several concrete tests before the board signed off. Pakistan completed steps agreed at a staff-level deal reached on October 14, 2025. These steps included tighter monetary stance, improvements in revenue collection, and early actions on state-owned enterprises. The IMF also noted progress on climate resilience measures linked to the RSF.

Energy sector actions were central. Authorities moved to limit tariff delays and to reduce circular debt growth. The tax administration stepped up audits and brought more transactions into the formal system. These moves were seen as the immediate reasons the IMF approved the tranche.

The IMF’s Not-So-Subtle Warnings: Risks Still Loom

The Fund’s tone was positive. But it also laid out clear risks. Circular debt in the power sector remains a drag. Exports have not yet accelerated enough to stabilize the external account. Remittances can be volatile and may fall short of forecasts.

The IMF warned that any easing of fiscal control, especially before elections, would threaten gains. The Fund highlighted the need to keep real interest rates positive until inflation is fully under control. These warnings mean the $1.2 billion buys breathing room. It does not solve deep structural problems.

Pakistan’s Strategy Going Forward: What the Government Promised

Islamabad framed the approval as a vote of confidence. The finance ministry pledged to use the funds to shore up reserves and to avoid emergency cuts in key social programs. The government promised follow-up reforms.

These include stricter fiscal discipline, faster privatization plans, and a push to widen the tax base. Officials also said they would press banks and state firms to improve governance. The administration signaled plans to return to international capital markets in 2026. Implementation speed will be the real test.

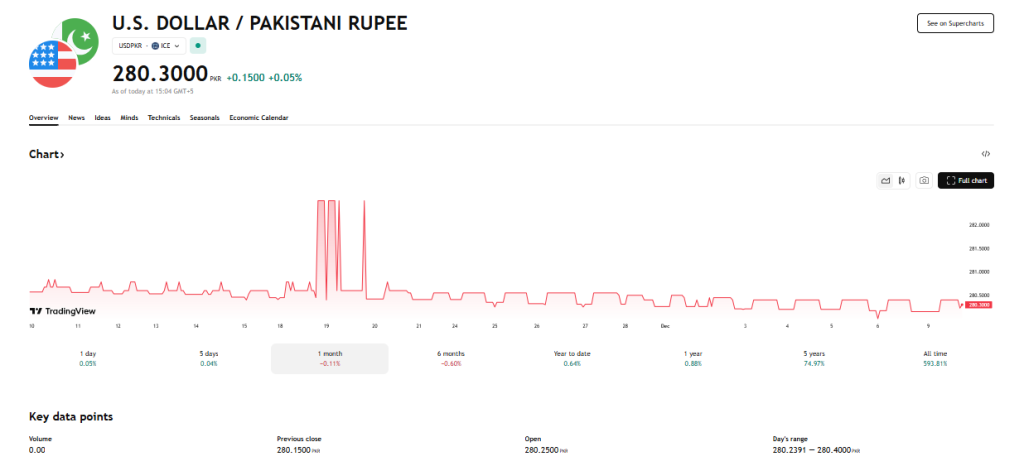

Market Reaction: Currency, Stocks, and Bonds

Markets reacted with guarded relief. The Pakistani rupee stabilized modestly after the announcement. Local bond yields fell a little, and the stock market saw selective gains in banks and energy firms. International investors noted the IMF backing as a risk-reduction signal. Yet analysts warned that real foreign inflows will depend on sustained policy action.

Some market watchers also used modern analytics, including an AI stock research analysis tool, to parse bond and equity moves and to estimate medium-term capital flows. Overall, the market treated the tranche as confidence capital not a cure.

How This Tranche Affects Ordinary Pakistanis?

The immediate effect on daily life will be subtle. The cash helps stabilize import financing. That reduces the chance of sudden shortages of fuel or medicine. But the package also carries conditional measures. Households may feel higher fuel and electricity prices if cost-recovery moves forward.

Tax reforms aimed at broadening the base could touch small businesses and service vendors. On the safety net front, the IMF asked for better targeting of support to protect the most vulnerable. If reforms hold, the near-term pain could ease inflation later. If they stall, ordinary people will face prolonged uncertainty.

Global Context: Why the IMF Is Backing Pakistan More Firmly

The IMF’s stronger engagement reflects multiple factors. Pakistan’s economy matters regionally. Donors and creditors have been more active since the crisis of 2023-24. The May 2025 IMF review set an earlier positive tone by allowing a drawdown that helped stabilize markets. The RSF element shows the Fund’s greater focus on climate resilience after severe flooding.

Geopolitics also plays a role. A functioning economy in Pakistan has larger strategic implications for trade and regional stability. The IMF’s stance signals that lenders want Pakistan to succeed but only if reforms continue.

Conclusion: IMF Money Buys Time, Not Transformation

The December 2025 tranche is important. It eases short-term pressures. It also makes the next quarter less risky for the government. But the core challenges remain. Pakistan must raise sustainable revenue, fix the energy sector, and spur real export growth.

The IMF loan gives room for those steps. It does not replace them. The next few months will show whether policy promises turn into firm action. If they do, the country may move from stabilization toward real recovery. If not, the relief will be temporary.

Frequently Asked Questions (FAQs)

The IMF released $1.2 billion on December 8, 2025, because Pakistan met key reform steps and kept its economic program on track. The funds support stability and foreign reserves.

The IMF loan may lead to higher electricity and fuel prices because Pakistan must follow cost-recovery rules. These steps help control losses but can increase bills for families.

Pakistan may seek a new IMF program in 2026 to keep support and continue reforms. Talks will depend on progress, revenue plans, and economic stability in coming months.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.