Income Tax Audit Report Due Date Extended to October 31

Filing an Income Tax Audit Report is a vital duty for many businesses and professionals in India. As per tax law, certain taxpayers must get their accounts audited under Section 44AB. Normally, this audit report must be filed by September 30 every year. But in 2025, the Central Board of Direct Taxes (CBDT) gave relief by extending the due date to October 31, 2025.

This extension brings welcome relief to both taxpayers and auditors. Many face heavy pressure while preparing reports, reconciling books, and uploading details on the income tax portal. Technical issues and workload often create delays. The authorities allow us more time to prepare accurate reports and avoid penalties by giving us one extra month.

We must remember that this is not just a date change. It is an opportunity for better compliance. Timely filing reduces risks, helps maintain clean records, and ensures smooth tax processing. With this extension, we have more room to plan, check our accounts, and file without last-minute stress.

Background of Income Tax Audit Report

An income tax audit checks a taxpayer’s books and statements. It is required under Section 44AB of the Income-tax Act for many businesses and professionals. Taxpayers with turnover or gross receipts above specified limits must get their accounts audited and file the audit report. The audit report is submitted in prescribed forms such as Form 3CA, 3CB, and the detailed statement in Form 3CD. The audit helps the tax department verify figures in the return. It also supports correct tax assessments and claim substantiation.

Original Due Date and Reason for Extension

The original due date for filing audit reports for the financial year 2024-25 was September 30, 2025. On September 25-26, 2025, the Central Board of Direct Taxes (CBDT) issued a circular extending that deadline to October 31, 2025, for specified classes of assessees. The extension covers audit reports required under various audit provisions for the previous year. The CBDT cited representations from stakeholders and on-ground difficulties in making the decision. The official circular and press notes confirm the new timeline.

Impact of Due Date Extension on Taxpayers

The extra month gives more time to prepare accurate reports. Tax professionals and businesses can complete reconciliations. Complex items such as related-party transactions and settlement reporting get extra scrutiny. The extension reduces the risk of hurried mistakes. It also lowers the chance of portal errors caused by last-minute traffic. However, the extension does not change ITR deadlines for all taxpayers. Taxpayers should check whether their ITR due date is affected in their specific case.

Key Penalties for Missing the Due Date

Late or missing audit reports can trigger penalties under Section 271B. The penalty is generally 0.5% of turnover, sales, or gross receipts for the year. The maximum penalty is ₹1,50,000. The tax officer may waive or reduce the penalty if there is a reasonable cause. Examples of reasonable cause include natural calamities, serious illness, or other documented hardships. Even with the extension, filing as early as possible is safer than waiting.

Compliance Steps During the Extended Period

Start by finalising books for FY 2024-25. Ensure bank statements, ledgers, and vouchers match. Reconcile GST returns with sales and purchases. Check tax deductions and TDS certificates. Prepare Form 3CD schedules carefully. Coordinate with the statutory auditor to lock figures and sign reports. Maintain supporting documents for significant transactions such as share buy-backs, settlement payments, and large related-party transfers. Lastly, upload the audit report on the income-tax e-filing portal well before October 31, 2025.

Digital Platforms and E-Filing Challenges

The income-tax e-filing portal has improved over the years. Still, heavy traffic can slow uploads at peak times. Some taxpayers face XML validation errors or mismatches in form fields. The CBDT noted that the portal was functioning, but granted the extension due to other practical difficulties. Taxpayers should use updated utility versions, validate XML files locally, and avoid last-day submissions. Those using third-party accounting tools or an AI Stock Research Analysis Tool for data checks should ensure exports match the specified formats.

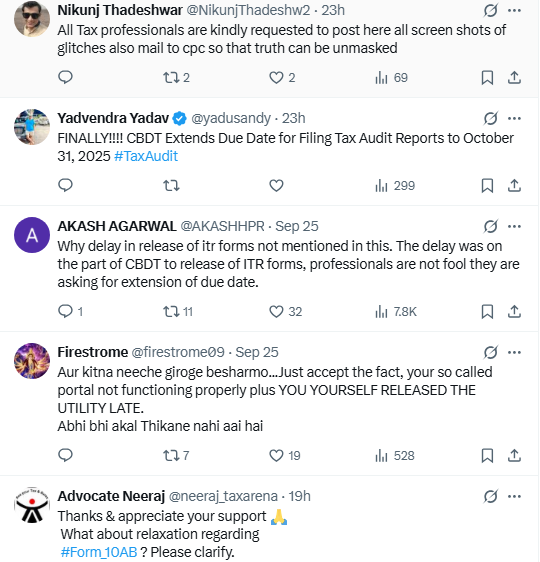

Expert Opinions and Industry Reactions

Chartered accountants and industry bodies welcomed the extension. Professional associations said the extra month will help auditors cope with heavy workloads. Some experts urged caution. They noted the extension is temporary relief, not a change in the audit rules. Others stressed improved record-keeping to avoid repeating last-minute crises. The consensus among commentators is that planned compliance beats extensions.

Way Forward: Best Practices for Taxpayers

Keep records updated throughout the year. Use reliable accounting software and run periodic reconciliations. Communicate early with auditors. Collect supporting documents for big transactions. Maintain a simple internal checklist for Form 3CD items. If unusual events delayed filing, document them. Preserve evidence that supports any claim of reasonable cause. These steps reduce the risk of penalties and make tax audits smoother in the future.

Wrap Up

The CBDT’s move to extend the audit report deadline to October 31, 2025, offers relief to many taxpayers. The extra time can improve accuracy and cut errors. Still, the legal duty to file and the penalty framework under Section 271B remain in effect. Taxpayers should use the extension to finalise accounts, reconcile records, and upload audit reports well before October 31, 2025. Early action helps avoid stress and possible penalties.

Frequently Asked Questions (FAQs)

The Central Board of Direct Taxes extended the due date. The last date to file the Income Tax Audit Report for FY 2024-25 is October 31, 2025.

If a tax audit report is not filed on time, the penalty may be 0.5% of turnover. The maximum fine is ₹1,50,000, unless reasonable cause is proven.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.