India Grants Legal Status to Gig Workers, but Social Security Still Out of Reach

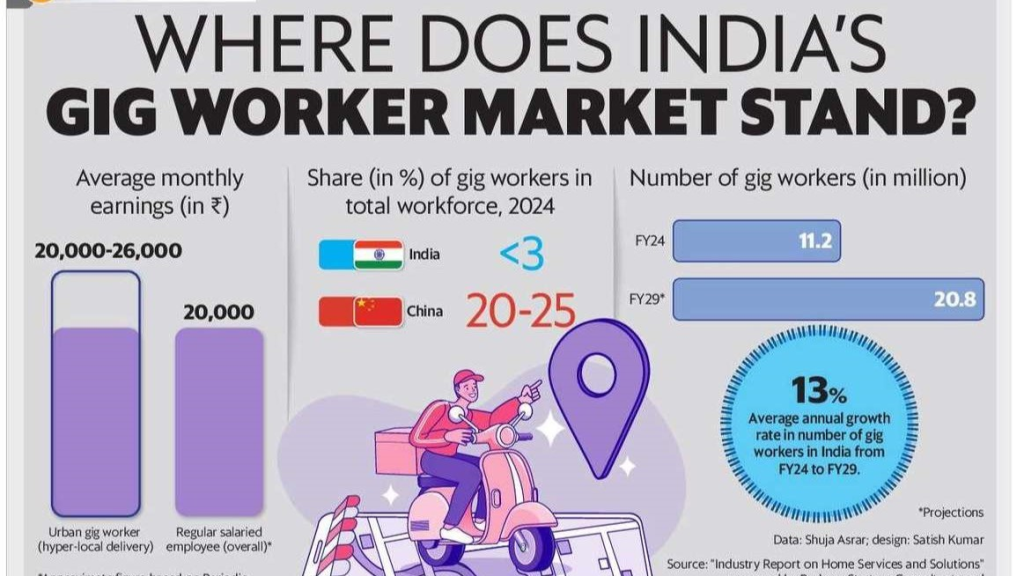

India’s gig economy has grown at a fast pace in recent years. Millions of people now work as delivery riders, drivers, and freelancers. On November 15, 2025, the Indian government took a major step and granted legal status to gig workers for the first time. This move shows that the country finally recognizes the role these workers play in daily life. It also gives hope to people who have long asked for fair rules and better treatment.

But legal status alone is not enough. Most gig workers still do not have social security. They do not get health support, accident cover, or long-term savings plans. This gap creates stress, especially when income is low or when a worker faces an emergency.

Many workers say the new law is a start, but the real change will come only when benefits reach them clearly and simply. India can shape a stronger future for gig work. But it must act fast to turn legal rights into real protections.

What does the new Legal Status mean?

The recent labour codes give gig workers a clear legal label. The Code on Social Security, 2020, now names gig and platform workers. That lets the state design schemes for them. The codes also require platforms to fund welfare.

Some rules say aggregators must put 1-2% of turnover into worker welfare, with limits on total contributions. These measures aim to make payments fairer and to create a route for benefits like insurance and provident funds. The change is a legal shift. It brings platform work into the scope of national labour law for the first time.

The Social Security Gap

Naming gig workers in law is a start. It is not the finish. The main gap is delivery. The law sets the framework. But rules and notifications still need to be written. That means details on eligibility, how much each party pays, and how benefits will be delivered are missing. Workers will not get automatic coverage until schemes are notified and systems are built.

On the ground, many riders and drivers still buy their own health cover. Many do not have provident fund accounts. The legal change creates promise. Implementation will decide if the promise becomes reality.

Why is Social Security Still out of Reach?

Several reasons slow down delivery. First, platform firms resist fixed obligations. They argue that business models rely on flexible contracting. Second, legal clarity on worker status remains thin. Courts and regulators still debate who is an employee and who is an independent contractor. That matters for contributions. Third, administrative hurdles are big.

Millions of gig workers lack formal IDs or regular bank accounts. That makes enrollment hard. Fourth, state and central rules differ. Some states move faster than others. Fifth, funding design is unsettled. Who pays, and how much, is still being negotiated. These factors combine to keep social protection distant for many.

Impact on Gig Workers and the Economy

Lack of social security raises everyday risk. Workers face high medical bills after accidents. Income gaps widen when work slows. Without old-age savings, retirement becomes insecure. Mental stress and financial shocks reduce productivity. For the economy, fragile gig incomes lower consumer demand. Firms may also face reputational and legal risks.

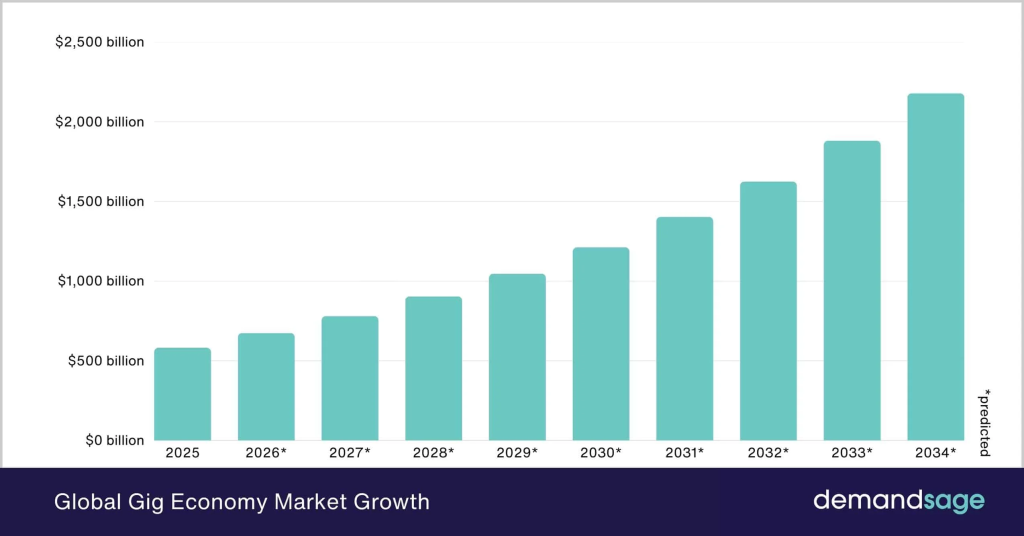

On the plus side, a clear legal category could attract insurers and service providers to design low-cost products for gig workers. Analysts using an AI stock research analysis tool have noted how clearer rules might change investor views of platform companies. But these market shifts depend on rule clarity and enforcement.

Global comparison: Where India Stands?

India now joins a small group of countries that treat gig work in law. The European Union adopted a platform work directive to strengthen rights. The UK has tightened tests on employment status in some cases. The United States continues to wrestle with contractor versus employee rules across states.

India’s move is notable because it ties social security to platform contributions in a national code. But other jurisdictions have moved faster on enforcement, dispute resolution, and benefits delivery. India may lead on defining gig work, but delivery of portable benefits and easy enrollment still lags many EU experiments. Context matters: India’s size and informal networks make implementation uniquely hard.

Gig Workers India: What Experts Say?

Policy experts applaud legal recognition. They warn that a law without systems will do little. Labour economists ask for clear contribution rules. Unions want wage floors and safety standards. Platform representatives stress the need for predictable compliance, not abrupt cost spikes. Social policy researchers call for a national registry and digital ID linkages.

Gig worker groups urge immediate notifications and pilot schemes. Several think tanks recommend phased rules with monitoring built in. The message is uniform: recognition is welcome, but paperwork and delivery must follow fast.

What Needs to Happen Next?

Large steps are urgent. First, publish scheme notifications with clear eligibility and contribution rates. Second, build a single national portal for gig worker registration. That portal should accept common IDs and bank details. Third, mandate aggregator contributions with a transparent audit trail. Fourth, run pilots for easy benefit delivery, health cover, accident insurance, and portable provident accounts.

Fifth, strengthen enforcement and grievance redressal. Sixth, coordinate state and central rules to avoid fragmentation. Finally, design public-private partnerships to keep costs low and speed rollout. These actions can turn legal recognition into real security for millions.

Wrap Up

Legal recognition is a major step. It gives the gig economy a place in law. But many workers still sit outside social protection. The next weeks and months will show if the promise becomes practice. Clear rules, easy registration, and firm enforcement are the keys. If they come fast, millions of gig workers can get health cover, savings, and safer work. The clock for real change is already ticking as of November 25, 2025.

Frequently Asked Questions (FAQs)

On November 15, 2025, India legally recognized gig workers. They get rights like fair payments, dispute resolution, and a route to welfare schemes. But social security is still limited.

Although the law names gig workers, rules for health cover, pensions, and accident insurance are not fully ready. Implementation and platform contributions are still being worked out as of 2025.

India can improve benefits by launching clear schemes, building a national registration portal, requiring platform contributions, and ensuring fast enforcement of social security rules in 2025.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.