Indian Market Live: Sensex Drops 450 Points, Nifty Slips Below 26,050 in Volatile Trade

On 8 December 2025, the Indian stock market took a sharp U-turn. The BSE Sensex fell by over 600 points, and the NSE Nifty 50 slipped below 26,000. Investors were jolted. Many blue-chip stocks dropped hard. Market mood turned cautious in just a few hours.

This sudden slide caught many off guard. What triggered the sell-off? Was it foreign money flowing out, or fear about global economic risks? Or did traders simply book profits after recent gains?

Let’s explore the real reasons behind today’s fall. We map which sectors were hit the worst. We also look at what this means for traders and long-term investors.

Market Overview: Why the Indices Cracked Today?

On December 2, 2025, major benchmarks turned volatile as profit booking rose and foreign sellers stepped in. The BSE Sensex slipped several hundred points, and the NSE Nifty slid below 26,050 during the session. Traders noted sharp intraday swings and thin liquidity in some midcap names.

Global cues added to the pressure. Investors also watched bond yields and the dollar for signs of capital flow shifts. This was not a single-factor move. It was a mix of profit-taking, FII selling, and jittery global sentiment.

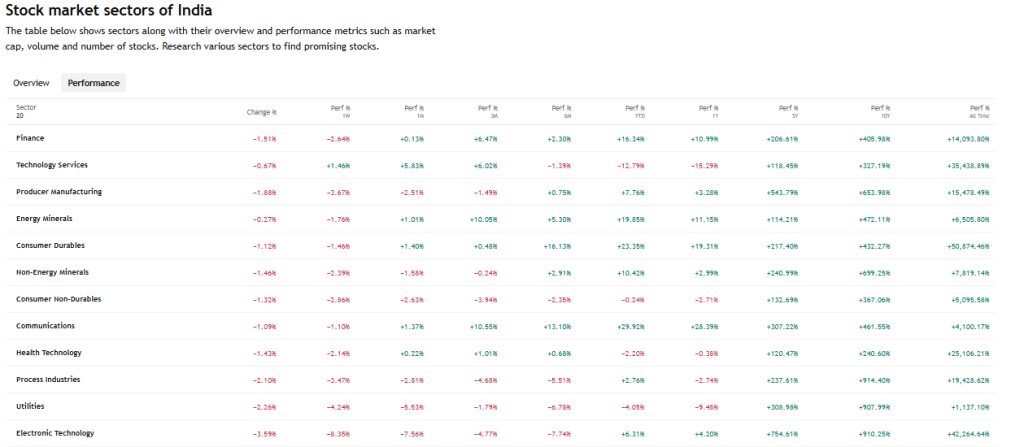

The Big Movers: Which Sectors Led the Selloff and Why

Banking names bore heavy selling. Higher global yields and worries about margins put pressure on lenders. Financials were among the biggest drags on the indices. Auto and oil stocks also fell as commodity moves and demand concerns weighed.

IT shares saw mixed action; currency swings hit exporters while software services names held up in pockets. Consumer staples and select pharma names offered some support. The sector moves were linked to real drivers: currency action, yield shifts, and earnings expectations.

Key Stock Highlights: Dramatic Winners & Losers

Large-cap leaders showed wide dispersion. Some blue chips fell sharply after profit-booking and repricing of futures and options positions. Others gained from selective buying and positive news flow. For example, FMCG names underperformed in sessions where cyclical stocks corrected.

A few midcap names bucked the trend on takeover or contract wins. Active option strikes and block trades amplified individual stock swings. Monitor high-volume moves for clues about institutional intent.

Global Market: The External Shocks Dragging Indian Equities

Asia and Europe set a cautious tone ahead of major central bank events. Markets priced expectations around the US Federal Reserve and other policy moves. Commodity volatility, especially in oil, added another layer of uncertainty. Safe-haven flows pushed yields and the dollar in ways that hurt emerging market equities. These global threads pulled at the Indian market through currency and foreign fund flows.

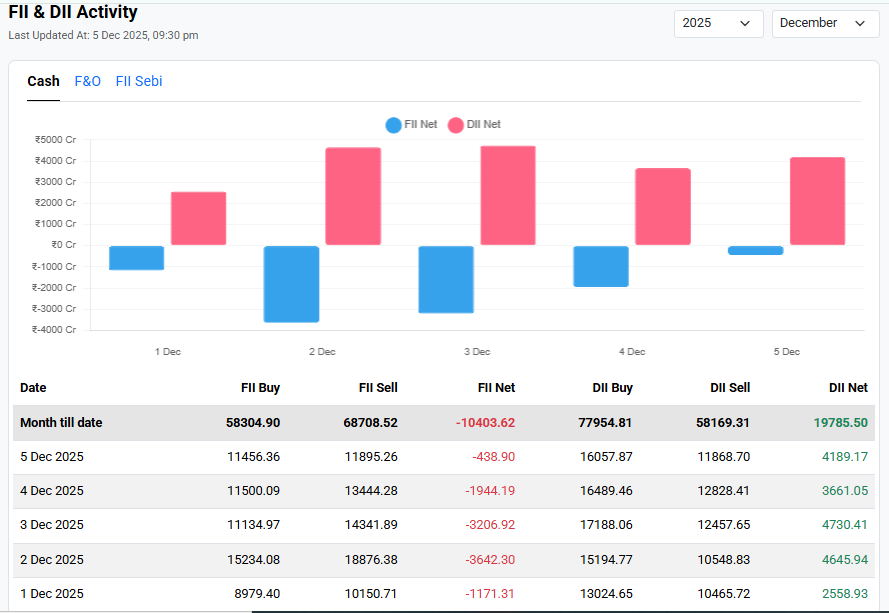

FII–DII Equation: The Real Force Behind Today’s Volatility

Foreign institutional investors continued to show net selling in recent sessions. That selling pressured index-heavy stocks. Domestic institutional investors and mutual funds acted as partial buyers in pockets.

Still, net flows favored outflows on the worst days. This tug-of-war often magnifies intraday moves. Traders should track live FII and DII numbers to read where real buying or selling is coming from. The analysis used included an AI stock research analysis tool to spot flow patterns in real time.

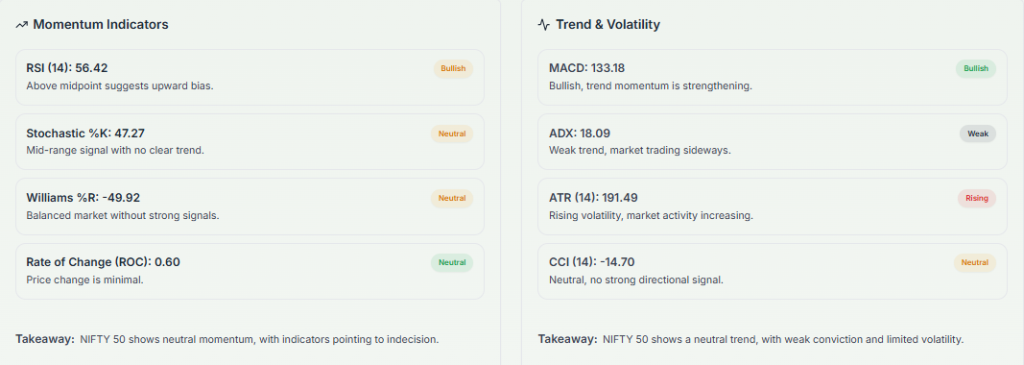

Technical Breakdown: Why 26,050 Is a Danger Zone for Nifty?

The 26,050 level has been tested multiple times in recent weeks. A decisive break below that mark invites short-term stop-loss triggers. Technical indicators showed rising intraday volatility and larger-than-normal volumes on down days.

Momentum oscillators signaled short-term weakness while some moving averages acted as nearby support. Traders should watch for sustained breaches, not just intraday probes, to confirm a trend change.

Market Sentiment: What Traders and Investors are Doing

Fear moved into the market in two forms. One was profit-taking by short-term traders. The other was caution among long-term buyers who paused fresh purchases. Options data hinted at higher put activity at strike levels below current prices. That skew suggested protective trades or speculative bearish bets. Retail participants showed selective buying in beaten-down quality stocks, while algorithmic flows exaggerated swings in liquid names.

Analyst Reactions: What Brokerages are Advising?

Analysts urged caution but avoided blanket calls. Many suggested using rebounds to trim exposure in high-beta names. Others recommended holding quality franchises that could weather short-term volatility. Several broker notes cited macro risks and advised watching events such as central bank statements and economic prints for the next directional cues. Short-term strategies centered on risk management rather than chasing large gains.

Short-Term Outlook: What to Expect in the Next 48-72 Hours

Expect continued choppy trade. Key triggers include global policy remarks, domestic data, and any fresh corporate news. If Nifty closes and holds below 26,000 on consecutive sessions, follow-through selling could widen. If global sentiment improves or yields ease, a technical rebound toward recent highs is possible. Active traders should keep position sizes small and use tight stop losses. Longer-term investors should focus on fundamentals rather than daily noise.

Long-Term View: Is This Correction an Opportunity or the Start of a Bigger Pullback?

A single volatile day does not define a bear market. Structural factors still matter. India’s growth prospects, corporate earnings trends, and domestic savings flow support the market over time. Yet risks remain. A prolonged rise in global yields, a deeper slowdown in demand, or persistent foreign outflows could cause a larger correction. Balance the portfolio with a mix of quality growth and defensive assets. Reassess positions with fresh data rather than headlines.

Final Takeaway: Practical Moves for Different Investors

In the Indian Market, short-term traders should avoid overleveraging. Use defined stops and favour liquid names. Swing traders can look for reversal signals at the next confirmed support. Long-term investors should use volatility to average into high-conviction holdings. Keep cash ready for clear buying windows. Stay informed on foreign fund flows and global central bank moves. Monitor the news flow and use facts to guide action, not fear.

Frequently Asked Questions (FAQs)

On 8 December 2025, Sensex fell 450 points due to profit booking, foreign fund selling, and weak global cues. Investors were cautious amid rising bond yields and market uncertainty.

Nifty slipped below 26,050 on 8 December 2025 as banking and auto stocks declined. Global market pressure and domestic selling triggered a short-term correction in the index.

On 8 December 2025, banking, auto, and oil stocks were most affected. IT and consumer goods showed mixed performance while investors reacted to global and domestic market signals.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.