Indian Markets Seen Higher as Investors Await RBI Policy Decision

Indian stock markets are starting October on a positive note. On October 1, 2025, both the Sensex and Nifty opened with mild gains, showing that investors are hopeful. The focus is now on the Reserve Bank of India’s monetary policy review scheduled later this week.

Why does this matter? Because the RBI’s stance sets the tone for interest rates, liquidity, and inflation control. These factors directly shape how banks lend, how companies invest, and how consumers spend. Markets react instantly to even a single line in the governor’s statement.

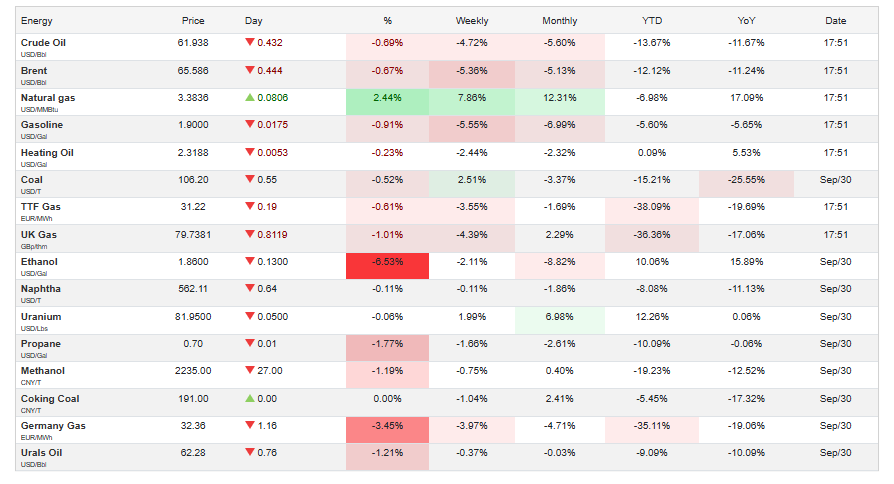

We are at a point where global and local cues are colliding. Crude oil prices remain volatile. The U.S. Federal Reserve is still cautious about rate cuts. Meanwhile, India’s domestic demand is steady, with festive season sales picking up. This mix of signals makes RBI’s decision even more important.

Investors wait to see if RBI will stay focused on inflation or shift towards supporting growth. The outcome will guide where markets head next.

Factors Driving Optimism

Indian markets are experiencing a surge in optimism, driven by several key factors. The Reserve Bank of India’s (RBI) decision to maintain the repo rate at 5.5% on October 1, 2025, has provided a sense of stability and confidence among investors. This move indicates the RBI’s commitment to supporting economic growth while keeping inflation in check.

Additionally, the Indian government’s recent measures, such as consumption tax cuts and pro-growth policies, have further bolstered investor sentiment. These initiatives are expected to stimulate domestic demand and enhance corporate earnings in the coming quarters. The combination of a stable monetary policy and supportive fiscal measures has created a favorable environment for market growth.

RBI Policy Expectations

The RBI’s monetary policy review on October 1, 2025, was eagerly anticipated by market participants. The decision to keep the repo rate unchanged at 5.5% was in line with market expectations and reflects the central bank’s cautious approach amid global uncertainties. RBI Governor Sanjay Malhotra emphasized the need to balance growth support with inflation management.

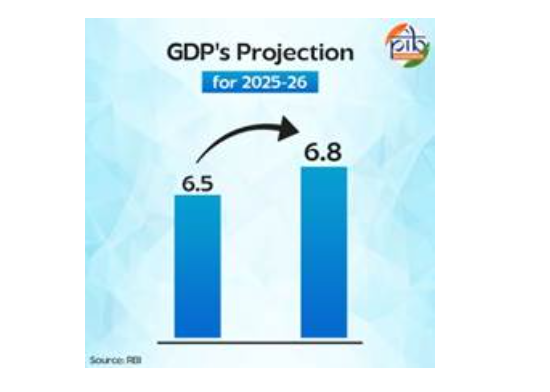

The committee projected India’s GDP growth at 6.8% for the fiscal year 2025-26, citing robust economic performance in the first quarter driven by private consumption and investment. Inflation has moderated to 2.1% in August 2025, providing room for the RBI to maintain its accommodative stance. However, the committee also acknowledged risks arising from global trade tensions and external factors that could impact the domestic economy.

Impact on Key Sectors

Banking & Financials: The RBI’s decision to maintain the repo rate has had a mixed impact on the banking sector. While private sector banks like ICICI Bank and HDFC Bank saw gains, public sector banks experienced a decline in their stock prices. The neutral monetary policy stance has provided stability but limited immediate benefits to the sector.

Real Estate: The real estate sector is poised to benefit from the RBI’s accommodative policy. Lower interest rates can reduce borrowing costs for developers and homebuyers, potentially stimulating demand in the housing market. However, the sector remains sensitive to factors such as liquidity and consumer sentiment.

IT & Exporters: The information technology sector faces challenges due to global trade tensions and changes in visa policies. The recent increase in U.S. tariffs and higher H-1B visa fees have impacted investor confidence in IT stocks. Companies in the export sector are also affected by currency fluctuations and international demand.

Consumer Goods & Retail: The consumer goods sector is benefiting from increased domestic consumption, supported by tax cuts and festive season demand. Companies like Hindustan Unilever have shown resilience, outperforming the market despite broader economic challenges.

Energy & Metals: The energy sector is influenced by global commodity prices and domestic demand. Fluctuations in crude oil prices can impact input costs for energy companies. The metals sector is affected by global demand and supply dynamics, with infrastructure projects playing a significant role in driving growth.

Investor Strategies Ahead of Policy

Investors are adopting a cautious yet optimistic approach in light of the RBI’s recent policy decisions. Short-term traders are focusing on sectors that are expected to benefit from the current economic environment, such as consumer goods and real estate. Long-term investors are looking for opportunities in quality stocks with strong fundamentals. Diversification remains a key strategy, with investors balancing their portfolios across different asset classes to mitigate risks. Analysts recommend monitoring key index levels and sectoral performances to make informed investment decisions.

Risks & Challenges

Despite the positive outlook, several risks and challenges could impact the Indian markets. Global trade tensions, particularly the imposition of higher U.S. tariffs, pose a threat to export-oriented sectors. Rising crude oil prices can increase input costs, affecting profitability across industries. Additionally, domestic factors such as political uncertainties and fiscal policy changes can influence market sentiment. Investors need to stay vigilant and adapt their strategies to navigate these challenges.

Final Words

The Indian stock markets are showing resilience, supported by a stable monetary policy and favorable domestic conditions. The RBI’s decision to maintain the repo rate at 5.5% reflects a balanced approach to managing growth and inflation. While challenges persist, the overall economic environment provides opportunities for investors. Continued monitoring of global developments and domestic policies will be crucial in shaping the market’s trajectory in the coming months.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.