India’s VIX Slips to Record Low, Traders Expect Calm Ahead

India’s volatility index, better known as the India VIX, has slipped to its lowest level on record. This number matters because it tracks how nervous or calm traders feel about the market. A low VIX usually means less fear and more stability. For many, it signals a calmer phase where sudden swings may be rare.

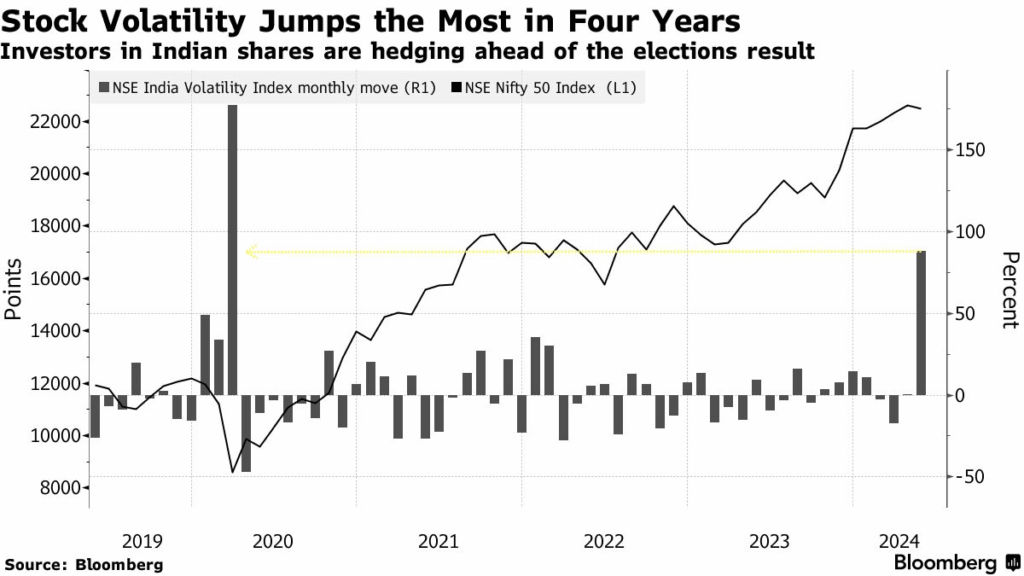

We know that markets move in cycles. High VIX levels often appear during crises, like the COVID-19 crash, while lower levels show up in steady growth phases. Right now, the record low is telling us that traders expect fewer shocks ahead. It reflects strong domestic flows, steady global cues, and confidence in India’s economic outlook.

Still, calm waters can hide risks. When investors grow too comfortable, they may ignore warning signs. That is why understanding what a low VIX means is so important. We can explore what this trend says about market mood, risks, and opportunities in the coming months.

About India VIX

The India VIX measures expected volatility on the Nifty. It is computed from prices of near-term Nifty options. Traders use it as a forward-looking fear gauge. A high VIX means traders expect big swings. A low VIX means traders expect calm. The index is openly published by the exchanges and tracked by platforms such as NSE and Investing.com.

Current Scenario: Record Low Levels

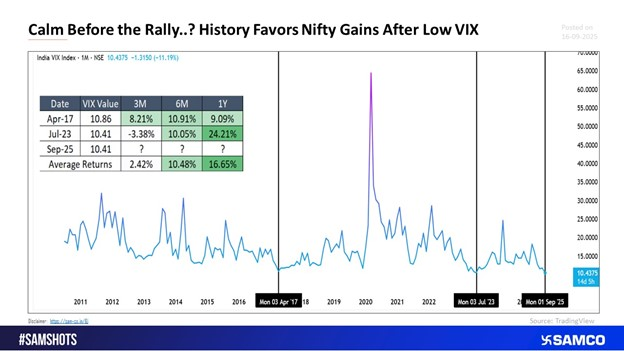

The India VIX has fallen to levels close to its all-time lows in September 2025. Recent reads hovered around the low tens, with several data providers showing values near 10-11. These levels are far below the long-term average for the index. Market reports tie the drop to thin headline risks and steady domestic flows that have kept option-implied swings small. Historical charts also show that such low readings are rare and usually short-lived.

Why Traders Expect Calm Ahead?

Low implied volatility means traders currently price in fewer surprises. Lower option premiums reduce the cost of hedging and speculative short-volatility trades. Domestic institutional investors (DIIs) have been steady buyers. That buying helped blunt pressure from foreign outflows. Meanwhile, global cues have been mixed but not sharply negative. Together, these factors make many traders bet on a stretch of low near-term swings.

Potential Risks Behind the Calm

Calm markets can hide risk. When implied volatility sits at low levels, the market can become complacent. That complacency raises the odds of a sharp move if a big shock hits. Global risks include changes in US monetary policy, a sudden rise in crude oil, or fresh trade tensions. Domestic risks include currency stress and policy surprises. Recent reports noted rupee weakness and FPI outflows at times, which could re-ignite volatility if they worsen. Traders should not confuse low VIX with no risk.

Impact on Market Participants

Traders see direct effects when VIX is low. Option premiums fall. That makes hedging cheaper but also reduces the payoff for selling volatility. Short-term traders may favor range trading and delta-neutral strategies. Long-term investors may use low volatility as an entry chance, but must pick quality names. Institutions and foreign investors find it easier to deploy capital in steady conditions. At the same time, market makers and volatility sellers must manage tail risk more carefully.

Lessons from History

Past episodes of very low India VIX did not always precede calm forever. In some cases, low volatility gave way to sharp rebounds in VIX and sudden market corrections. Seasonality studies show that VIX behavior can vary by month, and September has historically delivered mixed outcomes. Technical and seasonal patterns suggest that low VIX can either signal a rally or act as a setup for a quick reversal if a trigger appears. Investors should study both price action and macro signals before taking big bets.

Outlook: Short- to Medium-Term Expectations

Near term, volatility is likely to stay muted unless a clear trigger emerges. Key watchers remain the US Fed’s policy path, domestic macro headlines, and any sudden swings in commodity prices. If any of these turn sharply, implied volatility could jump fast. Conversely, steady global data and continued domestic buying could keep India VIX low for weeks. Traders should keep stop-loss rules tight and avoid assuming low VIX means guaranteed gains.

Practical Takeaways

Low India VIX lowers option costs and supports calm trading. It also increases the risk of complacency. Use hedges that protect against rare but large moves. Balance exposure across sectors. Watch policy cues and currency moves closely. Keep allocation flexible so sudden volatility spikes can be handled without panic. Historical patterns show that markets can switch from calm to chaotic quickly. Plan for both paths.

Final Thoughts

The record low in India VIX highlights a market that feels steady and confident. It shows strong domestic flows, fewer global shocks, and a calmer trading mood. But history reminds us that low volatility does not erase risk. Shocks can return suddenly when investors least expect them. Traders and investors should treat this phase as a chance to plan, not a reason to relax. The smart path is to balance optimism with caution. Use the calm to build stronger portfolios, but stay ready for quick changes. In markets, quiet periods often set the stage for the next big move.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.