Investor Confidence Boosts Mazagon Dock Shares Following P-75(I) News

India’s push for defense modernization is once again in the spotlight. Recently, Mazagon Dock Shipbuilders saw its stock price jump after news linked it to the much-awaited P-75(I) submarine project. This project is not just another defense order. It is a part of India’s long-term plan to strengthen naval power and reduce dependence on imports.

Mazagon Dock, a state-run shipbuilder, has already played a key role in building advanced warships and submarines. With the new project, it is being seen as a strong contender for future growth. Investors quickly noticed the opportunity. The stock gained momentum, showing how defense news can spark strong reactions in the market.

We often see that when the government backs strategic industries, confidence among investors rises. The same story is unfolding here. The P-75(I) news has created hope for steady contracts, higher revenues, and long-term stability.

For many, Mazagon Dock is now more than just a defense PSU. It is a symbol of India’s ambition to be self-reliant in critical technologies.

Background of Mazagon Dock Shipbuilders

Mazagon Dock Shipbuilders Limited (MDL) is India’s largest warship and submarine builder. It works under the Ministry of Defence. The yard has delivered destroyers, frigates, and submarines for decades. MDL built the Kalvari-class (Scorpene) submarines under the earlier Project-75 program. That work created rare skills and infrastructure in Mumbai.

The company is listed and widely held by public investors. Its investor page shows steady disclosures, results, and decks for each quarter, which helps the market track progress. Recent filings list FY25 and Q1 FY26 updates and presentations for analysts. This level of reporting is unusual for a shipyard and adds to transparency.

About the P-75(I) Project

Project-75(I) aims to build six advanced diesel-electric submarines in India. The program seeks transfer of technology and air-independent propulsion (AIP) so the boats can stay submerged longer. The plan also pushes higher local content over time. Reports note delays in the bid and evaluation stage, but the core goal has stayed the same: a modern, stealthy fleet built at Indian yards with a foreign partner.

In early 2025, naval trade coverage said the program moved forward while India also began work on a future indigenous line under “Project-76.” The request for proposal had shortlisted MDL and L&T as Indian strategic partners. AIP readiness and tech maturity were key hurdles in the vendor race.

In January 2025, major media reported that ThyssenKrupp Marine Systems (TKMS) with MDL emerged as the sole contender after the rival team failed to meet trial needs. That made price and terms the next step. AIP performance and battery tech were active topics in Indian defence briefings during the same period.

Market Reaction to the News

On August 25, 2025, MDL shares rose after the government cleared negotiations for the ₹70,000-crore P-75(I) deal. Intraday gains reached about 3-4% on the BSE. TV and digital outlets highlighted the step as a trigger for optimism. The update followed months of uncertainty on the program timeline, so even a move to formal talks sparked buying.

Some coverage also noted recent share swings tied to earnings. This included a drop after Q4 FY25 profits fell year on year, and another wobble after Q1 FY26 numbers. The policy push now appears to outweigh those near-term worries.

Drivers of Investor Confidence

The first driver is policy clarity. Approval to start talks reduces program risk and signals intent. The second driver is strategic value. Submarines are central to deterrence in the Indian Ocean. A large, multi-year contract brings stable cash flows once signed. The third driver is localization. The plan stresses in-country build and technology transfer. That supports jobs, skills, and future exports.

The fourth driver is partner strength. TKMS is a global name in non-nuclear submarines. Pairing that track record with MDL’s yard and workforce increases execution comfort for investors. The final driver is timing. Reports this week say the government moved after months of delay, which keeps the Navy’s renewal path on track. Each point feeds into higher confidence that the pipeline can convert to orders and revenue.

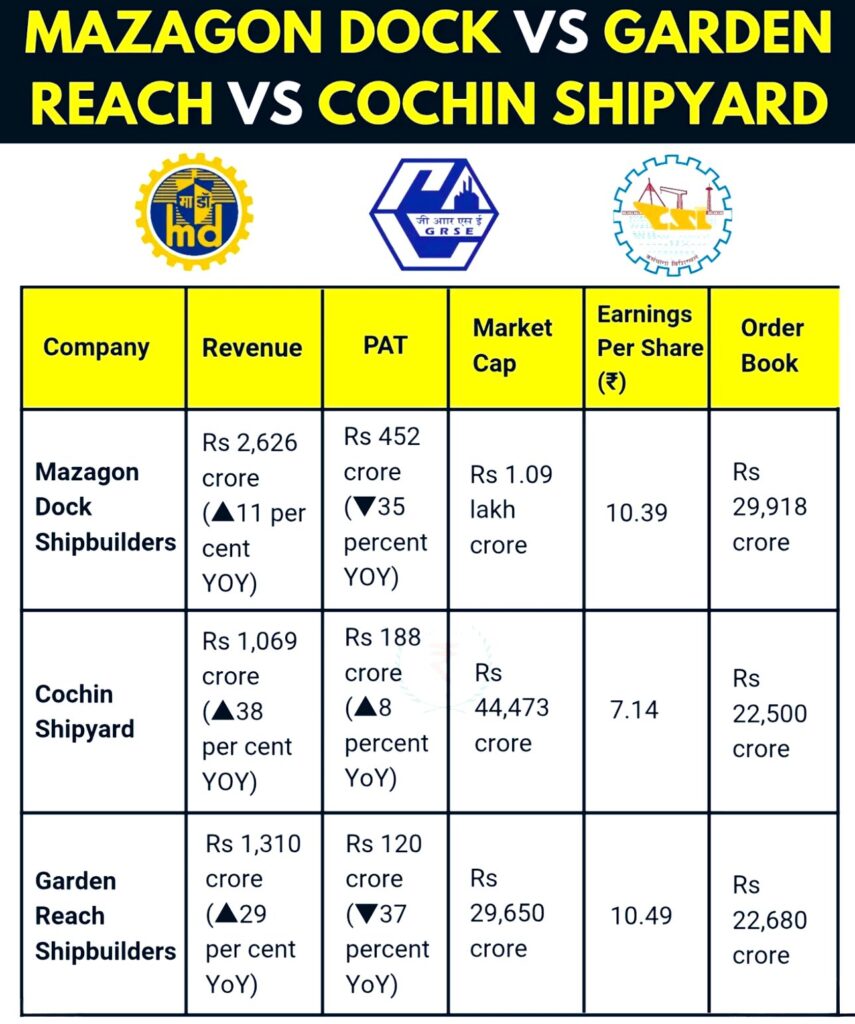

Competition Analysis

MDL is not the only shipyard in India. L&T has strong capabilities and has worked with foreign partners, too. Garden Reach Shipbuilders & Engineers (GRSE) and Cochin Shipyard compete in surface ships. For P-75(I), the field narrowed as technical demands rose.

Media reports show TKMS-MDL as the last team standing after the Spanish option, with L&T lagging on trials. That does not end competition in other naval programs. It does, however, shape the submarine space for this cycle. The partnership model, with strict local content and tech transfer, remains the playbook across projects.

Risks and Challenges

Program scale brings risk. Submarine builds are complex and prone to delays. Cost overruns are common in long defence contracts. AIP integration, battery upgrades, and software baselines can slip. Exchange rates and import content can lift costs. Export controls and licensing can also slow schedules.

On the market side, MDL’s profits can be lumpy across quarters. In Q4 FY25, consolidated profit fell year on year, which showed how milestone timing affects results. Any snag in negotiations or trials could hit sentiment again. The share price already showed volatility around earnings in late July.

Future Outlook for Mazagon Dock

The near-term milestone is price and commercial terms with the chosen partner. Reports indicate formal negotiations are now cleared by the government. If the contract is signed, the build phase would stretch over several years, with clear delivery gates. That would anchor order book growth and enhance revenue visibility. Domestic manufacturing under P-75(I) also supports spin-offs in materials, batteries, sensors, and maintenance.

Trade coverage notes India’s parallel effort on an indigenous submarine line, which could keep MDL busy beyond this project. The outlook, therefore, mixes a large anchor order with a pipeline of follow-on work and lifecycle support. Investors will watch three signals: negotiation closure, payment schedules, and progress on AIP and local content.

Bottom Line

The fresh green light for P-75(I) talks has lifted MDL’s stock and cut some program uncertainty. The news fits a broader push for local defence production with foreign tech help. It also matches the Navy’s need for modern submarines with longer underwater endurance. Short-term earnings noise remains, but the strategic case is strong. If negotiations close and the yard executes well, MDL stands to gain scale, skills, and steady cash flows over many years.

Frequently Asked Questions (FAQs)

Mazagon Dock looks stable with rising orders and strong earnings. Yet, stock swings and high price-earnings ratios call for careful thought before buying.

Shares rose because the Indian government cleared negotiations for the big ₹70,000 crore P-75(I) submarine order. That boosted investor optimism.

Analysts expect the share to reach about ₹2,846.6. Antique raised its target to ₹3,858.

As of August 25, 2025, the trailing twelve-month P/E ratio is around 50.2 times earnings.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.