Investor Shifts Lead Citigroup to Boost Ether, Reduce Bitcoin Estimates

As of October 2, 2025, Citigroup updated its cryptocurrency forecasts. The bank changed its outlook for Ethereum (ETH) and Bitcoin (BTC) due to shifts in investor behavior and the economy.

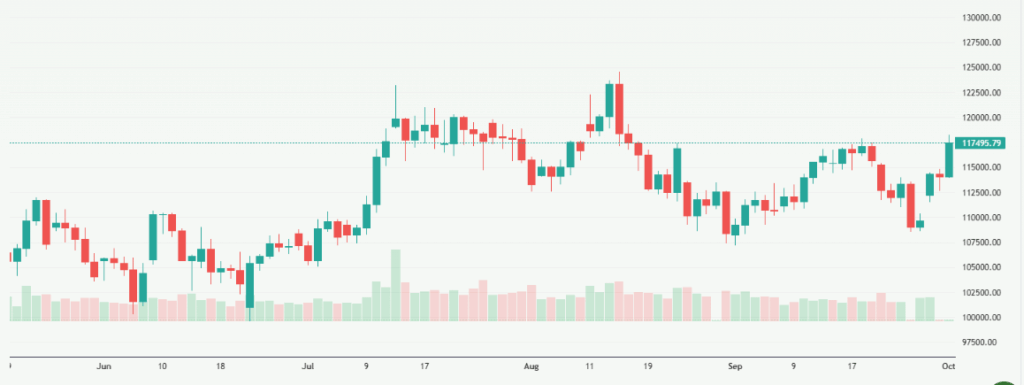

Citigroup raised Ethereum’s year-end price target from $4,300 to $4,500. This increase comes as more investors put money into exchange-traded funds (ETFs) and digital asset treasuries. In contrast, Bitcoin’s forecast fell slightly from $135,000 to $133,000, affected by a stronger U.S. dollar and lower gold prices.

This change shows a clear trend: investors are favoring Ethereum over Bitcoin. Ethereum’s growing uses, like decentralized finance (DeFi), stablecoins, and tokenization, give it more value beyond just being a digital currency. Its staking system also lets investors earn rewards, attracting institutions seeking income. Bitcoin, on the other hand, relies mainly on price growth and is more affected by inflation and interest rates.

Citigroup’s update highlights how fast the crypto market can change. Investor choices and economic conditions can shift prices quickly. Watching these trends will be key for anyone investing in digital assets.

Citigroup’s Latest Crypto Outlook: A Shift Toward Ethereum

On October 2, 2025, Citigroup adjusted its cryptocurrency forecasts, raising its year-end price target for Ethereum (ETH) to $4,500 from $4,300. This revision reflects increased investor interest, particularly from exchange-traded funds (ETFs) and digital asset treasuries. Conversely, the bank slightly lowered its Bitcoin (BTC) forecast to $133,000, citing macroeconomic factors such as a stronger U.S. dollar and declining gold prices.

Factors Influencing Ethereum’s Outlook

Institutional Adoption and Yield Generation

Ethereum’s appeal has grown among institutional investors due to its staking mechanism, which offers yield generation opportunities. This feature contrasts with Bitcoin’s reliance on price appreciation, positioning Ethereum as a more attractive option for entities seeking income-producing assets.

ETF Inflows and Digital Asset Treasuries

The rise of ETFs and digital asset treasuries has significantly contributed to Ethereum’s price increase. These investment vehicles provide broader access to Ethereum, enhancing liquidity and driving demand.

Network Upgrades and Layer-2 Solutions

Ethereum’s ongoing network upgrades, including the transition to proof-of-stake and the development of Layer-2 solutions like Arbitrum and Optimism, have improved scalability and reduced transaction costs. These advancements enhance Ethereum’s utility and attractiveness to developers and users.

Factors Affecting Bitcoin’s Outlook

Macroeconomic Influences

Bitcoin’s price is influenced by macroeconomic factors, including the strength of the U.S. dollar and gold prices. A stronger dollar and declining gold prices can reduce Bitcoin’s appeal as an alternative investment, leading to a slight decrease in its forecasted value.

Market Volatility and Investor Sentiment

Bitcoin’s market is characterized by high volatility, which can impact investor sentiment and influence price movements. Recent market fluctuations have led to adjustments in Bitcoin’s price forecasts, reflecting changing investor perceptions.

Implications for Investors

Citigroup’s revised forecasts suggest a shift in investor focus from Bitcoin to Ethereum. The increased institutional interest in Ethereum, driven by its yield-generating capabilities and network upgrades, positions it as a more attractive investment option. Investors may consider reallocating their portfolios to align with these market dynamics.

Bottom Line

Citigroup’s updated cryptocurrency outlook highlights the evolving landscape of digital assets. With Ethereum’s growing institutional adoption and enhancements in its network, it presents a compelling case for investors seeking opportunities in the crypto market. As the market continues to mature, staying informed about such developments is crucial for making informed investment decisions.

Frequently Asked Questions (FAQs)

On October 2, 2025, Citigroup increased its Ethereum year-end price target to $4,500, up from $4,300. This adjustment reflects strong investor inflows from exchange-traded funds (ETFs) and digital asset treasuries.

Citigroup reduced its Bitcoin price forecast to $133,000 from $135,000, citing macroeconomic factors such as a stronger U.S. dollar and declining gold prices. These elements have influenced investor sentiment and market dynamics.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.