Investors See US Stock Futures Flat After Record-Breaking Rally

After a record-breaking rally, U.S. stock Futures opened largely flat as traders paused to weigh fresh risks and Fed signals. Wall Street posted several record closing highs led by technology gains, but investors turned cautious ahead of key Fed remarks and economic data.

The pause shows how market optimism can cool quickly when uncertainty over rate cuts, earnings, and global flows increases.

Why are U.S. stock Futures flat today? Traders are waiting for clearer guidance on Federal Reserve policy, corporate earnings, and global economic cues before adding fresh bets.

Why Are US Stock Futures Flat After a Rally?

The stretch of record closes left markets stretched, and futures reflected that caution. The recent rally was driven by strong tech performance and a wave of optimism around artificial intelligence, yet traders flagged valuations and the timing of Fed cuts as key risks. With futures barely moving, investors signaled they would rather wait for Powell and fresh data than chase prices higher.

What pushed stocks to records

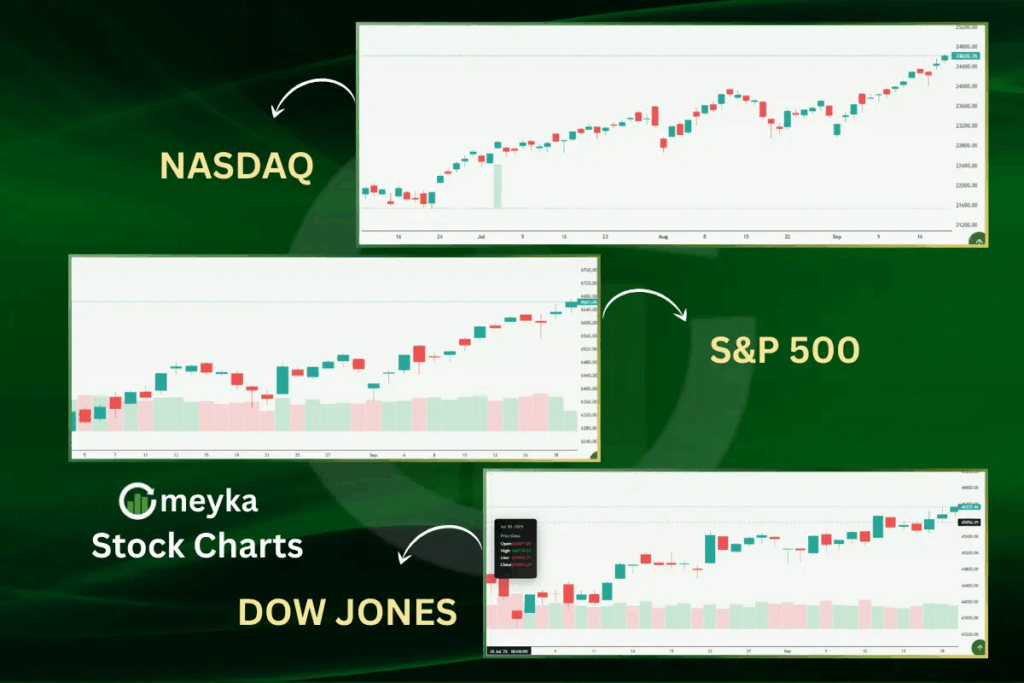

Tech leadership, heavy gains in chip and AI names, and robust ETF flows pushed the S&P 500 and Nasdaq to new highs. That momentum made the market more sensitive to any hint of tightening or disappointment.

Will the pause last long? That depends on upcoming Fed commentary and the cadence of earnings and economic prints over the next sessions.

Market Factors Influencing US Stock Futures

Several cross-currents shaped the futures market. Traders watched Federal Reserve signals for the path to rate cuts, U.S. Treasury yields for inflation expectations, and commodity moves like gold and oil for risk sentiment.

Safe haven demand pushed gold higher, while oil retreated on mixed demand signals, adding nuance to the risk-on trade. These macro clues matter for futures positioning ahead of the cash open.

Key macro reads to watch

- Federal Reserve comments and minutes.

- Bond yields which influence discount rates.Commodity shifts and their knock-on inflation expectations.

What is driving caution in the futures market? Uncertainty on the timing of rate cuts and the mix of macro data that could alter policy expectations.

Tech Stocks and the Role in the Recent Rally

Technology names led the charge, with chipmakers and AI-linked firms posting outsized gains. That group pushed indices to fresh records but also concentrated risk. Nvidia and other mega caps set the pace, and any wobble in those stocks can ripple across futures. Analyst sentiment noted stretched valuations even as earnings narratives remained strong.

Who to watch in tech

Large-cap AI leaders, cloud names, and chip suppliers remain the focal point for traders and futures pricing.

Can tech keep lifting futures? Yes, if earnings meet high expectations, but tech-led rallies are sensitive to rate and policy updates.

Global Markets Reaction to US Stock Futures

International markets showed mixed moves as U.S. futures paused. Asian and European bourses took cues from Wall Street’s highs, while safe havens like gold surged as some investors hedged risk. Oil’s retreat trimmed energy sector optimism.

The global pause emphasizes how U.S. signals still transmit worldwide, shaping flows into equities, bonds, and commodities.

Cross-market implications

Currency flows, regional stock performance, and commodity moves all feed back into U.S. futures, adding to the complexity of any sustained rally.

How much do global moves affect U.S. stock Futures? Quite a bit, especially when commodities or yields shift investor risk appetite across regions.

Expert Opinions and Social Media Buzz

Market voices and networks were active on social channels. A trading account flagged the calm in premarket deals, while broker commentary reminded clients to watch Fed remarks closely. Investment networks highlighted the pause in futures as a chance to reassess risk.

See reactions from traders and market outlets, including these posts: @TedPillows, @SchwabNetwork, and @EdwardCoronaUSA.

What are analysts saying? Analysts stress caution, advising investors to focus on risk management while awaiting clearer policy signals.

How Investors Are Approaching the Next Move

Investors are managing exposure through hedges, phased entries, and selective profit taking as U.S. stock Futures flatten. Some funds favored protective options, while others trimmed exposure in expensive names. Research desks are layering sector themes with macro views to size positions.

At the same time, thematic work such as AI stock research is guiding allocations into fast-evolving tech leaders, blending fundamental and momentum signals.

Practical strategies now

- Use staged buys and stop ranges.

- Consider options for downside protection.

- Watch flows into ETFs as a real-time liquidity signal.

Is it a good time to buy dips? For longer-term investors, disciplined buying on validated pullbacks can work, but short-term traders may prefer waiting for clearer catalysts.

The Role of Data, Technology, and Market Predictions

Algorithms and model-driven desks played a role in the quick turnaround from rally to pause. Quantitative signals, risk models, and sentiment feeds help set futures exposure. Firms increasingly use advanced tools to parse news, earnings, and Fed speak in real time, a trend that has expanded the speed of market moves.

This is where AI stock analysis has become a tool for both institutional and retail research teams.

Do models make markets more volatile? They can, because algorithmic reactions magnify moves when many systems act on the same signals simultaneously.

Looking Ahead: What Is Next for US Stock Futures?

Investors will watch Fed speakers, key economic prints, and corporate earnings for direction. If the Fed leans toward gradual cuts and earnings hold up, futures could resume an uptrend. Conversely, hawkish surprises or weaker profits could trigger a pullback.

Longer term, market participants are blending macro views with thematic tilts such as AI stock, monitoring how structural tech adoption feeds into valuations and capital flows.

Key dates to watch

- Fed speeches and minutes.

- Major company earnings this week.

- U.S. economic data that affects rate expectations.

What should investors do now? Stay informed, size positions for risk, and keep an eye on policy cues that can move futures quickly.

Conclusion

U.S. stock Futures are flat after a striking rally, reflecting a market that wants confirmation before charging higher. The mix of tech strength, Fed uncertainty, and global cues keeps traders cautious, while data-driven tools accelerate how quickly sentiment shifts.

For now, investors balance optimism with disciplined risk control, waiting for clearer signals that justify the next leg up.

Markets may pause, but the next catalyst could push futures decisively in either direction.

FAQ’S

The market dropped 700 points due to investor concerns over Federal Reserve policy, inflation risks, and weak global cues that pressured US Stock Futures.

US stocks are rallying because of strong earnings in tech, optimism about rate cuts, and rising confidence in the economy, which boosts US Stock Futures.

The all-time record high for the stock market was recently achieved by the S&P 500 and Nasdaq, with US Stock Futures also trading near record levels.

The sudden drop came from unexpected economic data and rising bond yields, leading US Stock Futures to turn cautious as traders pulled back.

Nvidia stock fell after profit-taking by investors and concerns over chip demand, which weighed on tech-heavy indices and US Stock Futures.

Disclaimer

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.