IPO News: Apollo-Backed Phoenix Education Partners Files in the US

The education sector is changing fast, and investors are paying close attention. In the United States, Phoenix Education Partners, backed by Apollo Global Management, has now filed for an IPO. This step is not just about raising money. It is about confidence, growth, and a strong signal to the market that education businesses can still create long-term value.

Phoenix Education Partners has built its name by offering learning solutions that meet the needs of today’s students and institutions. With Apollo’s support, the company has gained financial strength and credibility in a highly competitive space. Now, by going public, Phoenix is preparing to open its doors to everyday investors.

Why does this matter? Because the global education industry is worth billions and is still expanding. The shift to digital classrooms, hybrid learning, and skill-based training has created huge opportunities. An IPO like this allows us to see how far a company can go in shaping the future of education. It also raises the question Phoenix will deliver strong returns, or will the risks outweigh the promise?

Background of Phoenix Education Partners

Phoenix Education Partners traces its roots to the University of Phoenix. That university was founded in 1976 and grew into one of the largest for-profit online educators in the U.S. Over time, it built programs aimed at working adults. The company offers undergraduate degrees, graduate programs, certificates, and nondegree courses.

Today, Phoenix Education operates mainly online and serves learners who need flexible schedules and career-focused training. The business has shifted its focus toward digital delivery and career services to stay relevant in a competitive market. These changes helped steady revenue in recent years, according to the IPO filing and press coverage.

Role of Apollo Global Management

Apollo Global Management is the main backer of Phoenix Education Partners. Apollo and partners took the predecessor group private years ago. Since then, Apollo has supported investments and changes aimed at improving profit and efficiency.

Private equity backing gave Phoenix capital to invest in technology and marketing. That support also brought higher governance and access to big-bank advisors for a public offering.

For investors, Apollo’s name can signal discipline and deep pockets. Still, private equity exits sometimes raise questions about long-term strategy and fees.

IPO Filing Details

Phoenix Education Partners filed for an IPO in the United States with the SEC. The company plans to list on the New York Stock Exchange under the symbol PXED. Lead underwriters include Morgan Stanley, Goldman Sachs, BMO Capital Markets, and Jefferies. Some existing shareholders are expected to sell shares in the offering, not only the company issuing new stock.

Early media reports have mentioned a potential valuation band near $1.5 billion to $1.7 billion, though final pricing will depend on market demand. The filing covers nine months of results through May 31, 2025, and sets the stage for a fall listing if market conditions hold.

Phoenix Education’s Financial Performance

The IPO filing shows steady revenue growth in the most recent reporting period. For the nine months ended May 31, 2025, Phoenix reported higher revenue and higher net income versus the prior year. Revenue rose to roughly $750 million while net income was about $118 million in that period. The numbers reflect both program enrollments and cost controls.

Margins improved as the company pushed more learners into digital and lower-cost delivery models. Still, profitability depends on maintaining enrollment and keeping marketing and student support costs in check. The filing also notes that legacy overhead and regulatory compliance add ongoing costs.

Market Opportunity and Industry Outlook

The for-profit higher education and broader edtech space remain large. Demand for flexible and career-focused learning is strong. Employers still need workers with upskilled talent in many fields. Online degrees and certificate programs suit adult learners with jobs and families. Technology like AI and adaptive learning tools can make programs more efficient and relevant. That creates a long runway for companies that can deliver measurable career outcomes.

However, the sector is crowded. Competitors range from public universities to niche bootcamps and global MOOC platforms. Phoenix’s scale and brand in certain markets remain assets, but scaling profitably will require continued program quality and placement support.

Risks and Challenges

Regulation is a top risk. For-profit education often faces close oversight from federal and state agencies. Policy changes on student aid or accreditation can affect enrollments and revenue. Reputation risk matters too. Past controversies in the sector make earning trust harder.

Competition is fierce. Public and private rivals offer lower tuition or deep tech features. The company also needs to keep tech systems current and protect student data.

Finally, market timing matters. An IPO depends on healthy demand from investors for education names. If investor sentiment cools, pricing could be weaker than expected.

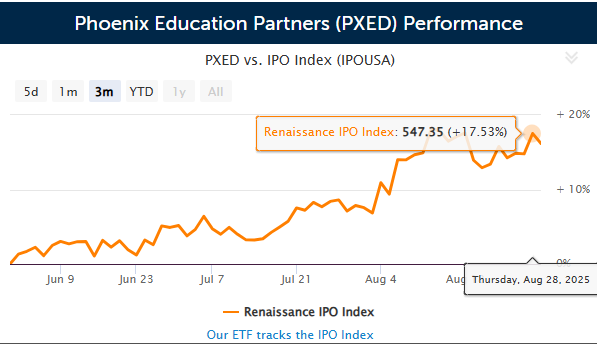

Investor Sentiment and Market Comparisons

Investors have grown pickier about education stocks after mixed results from recent listings. Yet large, profitable, and cash-generating education firms have drawn interest when growth is clear. Phoenix presents a mix: an established brand, improving earnings, and private equity backing that cleaned up the balance sheet. That can attract long-term value buyers and some growth investors.

Comparisons to recent education IPOs will shape expectations. Analysts will watch revenue trends, student retention, and how much of future cash flow will be reinvested in programs versus returned to shareholders. Underwriters and roadshow messaging will be critical in convincing investors that the deal is priced fairly.

Wrap Up

Phoenix Education Partners’ IPO is a high-profile test for the modern for-profit education model. The filing shows improved financials and a clear push to digital delivery. Apollo’s backing adds credibility and muscle. Still, regulatory, reputational, and competitive risks remain.

For investors, the listing will offer a chance to own a major player in adult online education. The final verdict will hinge on execution after the IPO. Watch enrollment trends, margin stability, and outcomes for graduates. Those metrics will decide if Phoenix can turn a private-equity success story into a public market winner.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.