IPO Watch: GMPs Range from 0% to 107% for 9 Issues This Week

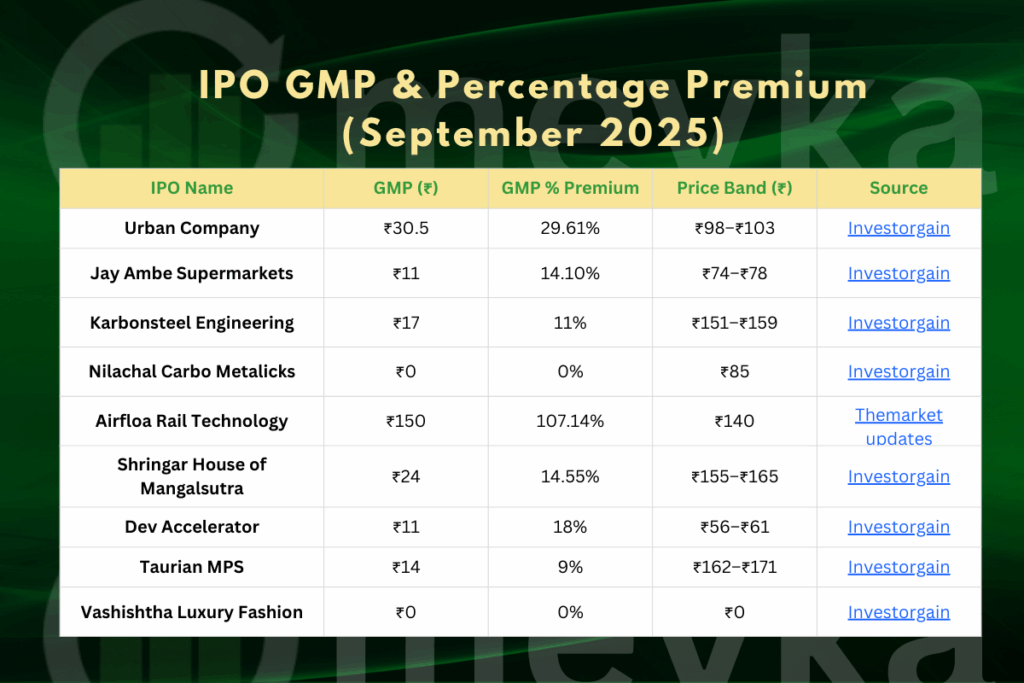

The IPO market is buzzing again this week with nine new issues lined up. What caught our eye is the sharp difference in their Grey Market Premiums (GMPs). Some IPOs are trading flat with no premium, while others are showing an impressive jump of over 100%. This wide range, from 0% to 107%, tells us how mixed investor sentiment really is.

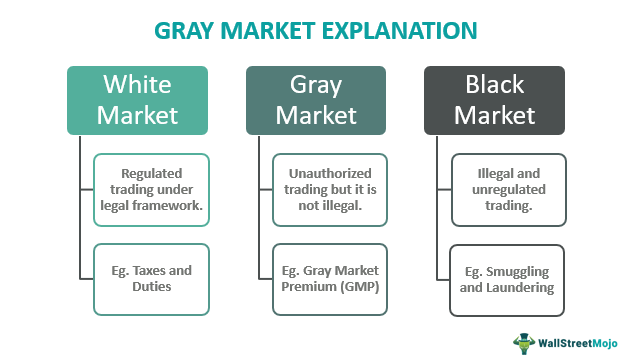

For those new to the term, GMP is the extra price investors are willing to pay for IPO shares in the unofficial market before listing. It does not come from the stock exchange, but it gives us a clue about how the market expects the stock to perform on the listing day.

We often see investors chasing high GMPs, thinking it guarantees big profits. But that is not always true. Some IPOs with strong GMPs fail to deliver, while others with low premiums surprise everyone. This makes it important for us to look at the bigger picture, business strength, sector demand, and market mood.

This week’s IPO lineup is a perfect example of these contrasts, and we will break it down in detail.

About GMP in IPOs

GMP shows how much investors are willing to pay for an IPO before it lists. It represents the premium or discount at which IPO shares are traded in the grey market before they are officially listed on the stock exchange. For instance, if an IPO’s issue price is ₹100 and the GMP is ₹20, the shares are expected to list at ₹120, indicating a 20% potential gain.

While GMP can provide insights into market expectations, it’s essential to approach it with caution. GMP is not regulated and can be influenced by various factors, including market rumors, investor speculation, and overall market conditions. Therefore, relying solely on GMP for investment decisions is not advisable.

IPO Market Snapshot This Week

This week, the IPO market is witnessing significant activity with nine new issues opening for subscription. These offerings span a diverse set of industries, including retail, engineering, metals, and technology services. Notable names among the IPOs include Urban Company, a well-known service-based platform, and other niche players such as Jay Ambe Supermarkets, Karbonsteel Engineering, and Nilachal Carbo Metalicks.

The Grey Market Premiums (GMPs) for these IPOs range significantly, with some companies recording a strong GMP of up to 107%, which indicates strong investor enthusiasm, while others have not yet gained substantial traction. The diverse array of businesses and the varying levels of pre-listing demand suggest a dynamic week ahead for investors eyeing primary market opportunities.

Key Trends Observed

The wide disparity in GMPs indicates selective investor enthusiasm. Mid-cap and small-cap IPOs are leading the GMP rally, while larger IPOs are facing moderate to no premiums due to concerns over valuation. Retail and institutional investor participation varies across these offerings, influencing the overall market dynamics.

Factors Driving GMP Movements

Several factors contribute to the fluctuations in GMP:

- High liquidity can lead to increased investor participation, driving up GMP.

- High demand in Qualified Institutional Buyer (QIB), High Net-worth Individual (HNI), and retail categories can positively impact GMP.

- Sectors such as technology and pharmaceuticals are currently favored, which results in higher GMPs for companies in these industries.

- The performance of recent IPOs can influence investor sentiment towards upcoming offerings.

Risks of Relying Solely on GMP

While GMP can provide insights into market sentiment, it is an unofficial indicator and can fluctuate rapidly. Instances where high GMP didn’t translate into strong listing gains highlight the risks involved. Market volatility and global cues can also affect listing day outcomes. Therefore, it’s essential to conduct thorough due diligence beyond GMP.

Expert Views and Investor Strategies

Analysts caution against speculative frenzy based solely on GMP. Retail investors are advised to check fundamentals, valuations, and business models before applying. A balanced approach, including diversification and risk assessment, is recommended for IPO investments.

What to Expect in the Coming Weeks?

The upcoming IPO pipeline includes several offerings across various sectors. The high GMP momentum observed this week may be sustained if market conditions remain favorable. However, investor sentiment can change rapidly, and it’s crucial to stay informed about broader market conditions that could influence IPO demand.

Bottom Line

This week’s IPO market showcases a wide range of GMPs, from 0% to 107%, reflecting diverse investor sentiments. While GMP can serve as a useful sentiment indicator, it is not a guarantee of listing day performance. A balanced approach, considering company fundamentals and market conditions, is advisable for retail investors.

Frequently Asked Questions (FAQs)

A GMP of 10-30% usually shows healthy investor interest. It is neither too high nor too low. This indicates balanced demand as of September 2025.

If GMP is zero, investors are not paying extra in the grey market. It means interest is low or neutral, but the listing may still perform well.

No. GMP shows pre-listing demand but does not promise profits. Even high GMP IPOs can list flat or fall. Always check company fundamentals before investing.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.