IPO Watch: University of Phoenix Backers Secure $136 Million from Market Launch

On October 3, 2025, the University of Phoenix made headlines when its financial backers secured $136 million during its long-awaited market launch. This move surprised many people, because the university has faced years of debate over its role in for-profit education. Yet, investors still showed strong interest. Why? Because online learning is booming, the University of Phoenix has decades of experience in this space.

Today, millions of adults want flexible learning options that fit busy lives. Companies also need skilled employees, and they are partnering with education providers more than ever. This IPO signals a major shift. It is not just about raising money. It is about rebuilding trust, modernizing programs, and proving that a long-standing education brand can evolve in the digital age.

Let’s explore how the deal happened, who is behind it, and what the $136 million means for the future of the university, the stock market, and the entire online education industry.

Background: Who are the “Phoenix Backers”?

Phoenix Education Partners is backed by Apollo Global Management and Vistria Group. Apollo took the University of Phoenix private in 2017. Vistria joined as a partner in that deal. The private owners restructured the business after several years of scrutiny. They focused the company on adult learners and on online delivery. Apollo still holds strong voting control after the listing.

Why the IPO Now?

The timing reflects a few forces. Demand for online and career-focused programs grew after the pandemic. Employers want more job-ready training. Private equity owners also saw a window where markets were open to selective IPOs. Regulators have also shown signs of clearer rules, which reduced some investor fear. The sale lets existing owners monetize part of their stake while keeping control.

Phoenix Backers: IPO Details

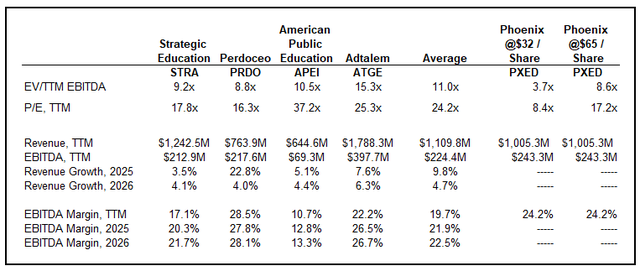

Phoenix Education Partners priced its shares at $32 each. The offering sold about 4.25 million shares. That raised roughly $136 million for selling shareholders. The shares were all secondary, meaning existing owners sold stock rather than the company issuing new shares. The stock began trading on the New York Stock Exchange under the ticker PXED on October 9, 2025. Major banks led the deal, including Morgan Stanley and Goldman Sachs.

Use of Proceeds

Because the IPO was a secondary sale, the company did not raise large new cash for operations. The money largely went to selling shareholders. The company still benefits indirectly. A public listing may ease future access to capital. It can also fund smaller strategic moves, such as tech upgrades or partnerships. Management has signaled interest in boosting online tools and employer ties. Investors will watch closely to see where new capital flows in the coming quarters.

Financial Health Snapshot

Recent filings show improving profits and steady revenue. For the nine months ending May 31, 2025, Phoenix reported $118 million in net income on $750 million in revenue. That marked a rise from the prior year. Enrollment has stabilized after earlier declines. The model depends on adult students and shorter programs. Margins improved as the company cut non-core operations and focused on higher-margin online delivery. These results helped support the IPO price range.

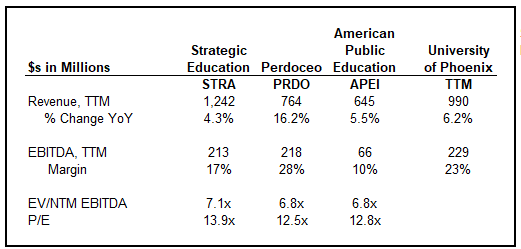

Competitive Overview

The University of Phoenix competes with public universities, nonprofit online programs, and edtech firms. Names like Coursera, 2U, and Grand Canyon University target parts of the same market. Phoenix’s strength is its long brand history in adult education. It keeps flexible schedules and offers many certificate programs. Critics note that newer platforms use different credential models and lower per-student costs. The company must keep its programs relevant to employers to stay competitive.

Regulatory and Legal Considerations

Regulatory risk remains a core concern. The University has faced past investigations and reputational damage. Government rules on federal aid and reporting can quickly affect revenue. Some news coverage points to a lower measured risk today, but policy shifts would still hit hard. Investors must watch federal education policy and any actions that change student aid rules. Management says compliance is a priority.

Market Sentiment and Analyst Opinions

Analysts gave mixed early responses. The bull case highlights stable cash flows, a focused adult-learner market, and the chance to expand corporate partnerships. The bear case points to legacy reputational issues, rising competition, and the risk of policy reversals. Some analysts noted the IPO price was set in the middle of the marketed range, a sign of steadily balanced demand. Traders will track first-day trading and subsequent quarterly results for clearer signals.

Investor Perspective: Opportunities

Investors see clear chances. Adult learners are a big market. Employers are ready to pay for skills training. The University has a wide program list and reaches into working-adult markets. Scaling online delivery can be cost-effective. A public listing provides trading liquidity and more transparent reporting. Some funds may use an AI stock research analysis tool to model enrollment and revenue sensitivity. If execution holds, the company can be a play on workforce training demand.

Investor Perspective: Risks

The risks are real. Federal aid rules could tighten. Bad press or new lawsuits could hurt enrollments. Competition from low-cost platforms and community colleges is sharp. The stock may also be volatile because much ownership remains with private equity. If performance slips, selling pressure could follow. Investors should weigh valuation against long-term execution plans.

Long-Term Growth Strategy

The firm’s path forward centers on adult upskilling and employer ties. That means more short courses and certificates. Partnerships with companies could secure direct pipelines for students to jobs. Digital tools and AI-driven le arning may lower costs and improve outcomes. Management has discussed improving student supports and career services to boost placement rates. Expansion in professional certifications may also raise lifetime value per student.

Comparison with Other Recent Education IPOs

Recent education listings, like Coursera and others, offer a useful lens. Those companies often focused on platform scale, software, and broad user bases. Phoenix is different. It is a legacy, degree-granting institution with a for-profit history. That makes investor expectations unique. The market will watch whether the stock tracks the same path as tech-led education names or follows a steadier higher-education cadence.

What This IPO Signals for the EdTech/For-Profit Sector

This IPO marks a return of private equity-backed education assets to public markets. It could open a window for similar deals. The listing shows investor belief in career-focused adult education. It also highlights the tension between old-school degree providers and nimble tech platforms. Policy and execution will decide whether this moment becomes a trend or a one-off.

Conclusion and What to Watch Next?

The IPO raised $136 million on October 8-9, 2025. The deal restored some investor confidence in a company with a checkered past. Key items to watch next include quarterly enrollment trends, any regulatory news, and progress on employer partnerships. Also watch ownership shifts as selling shareholders adjust stakes. The market will decide if the University of Phoenix Backers can convert an IPO event into long-term growth.

Frequently Asked Questions (FAQs)

The University of Phoenix returned to the stock market on October 9, 2025, to unlock value, attract investors, and benefit from the rising demand for online education.

Yes, as of 2025, the University of Phoenix reports steady revenue and rising profits, helped by online programs, adult learners, and cost control, despite earlier reputation issues.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.