Ipsen Stock Jumps 6% on Strong Q3 Results and Somatuline Boost

Ipsen S.A., the French biopharmaceutical company, saw its stock jump 6% on October 22, 2025, after releasing strong third-quarter results. The rally came as investors cheered solid sales growth and renewed momentum from its blockbuster drug Somatuline. Ipsen’s quarterly report showed not just higher revenues but also stronger margins and improving guidance for the rest of the year.

Founded in 1929, Ipsen has built a reputation in oncology, neuroscience, and rare diseases, but this quarter proved how well it can balance innovation and steady product performance. Somatuline, one of Ipsen’s most profitable drugs, played a big part in this success, showing resilience even as biosimilar competition grows. Let’s have a look in detail.

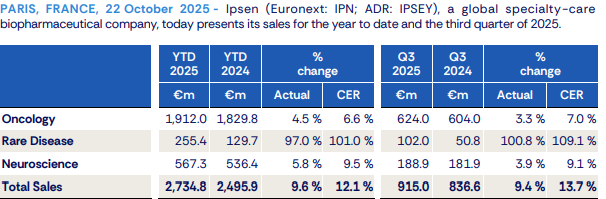

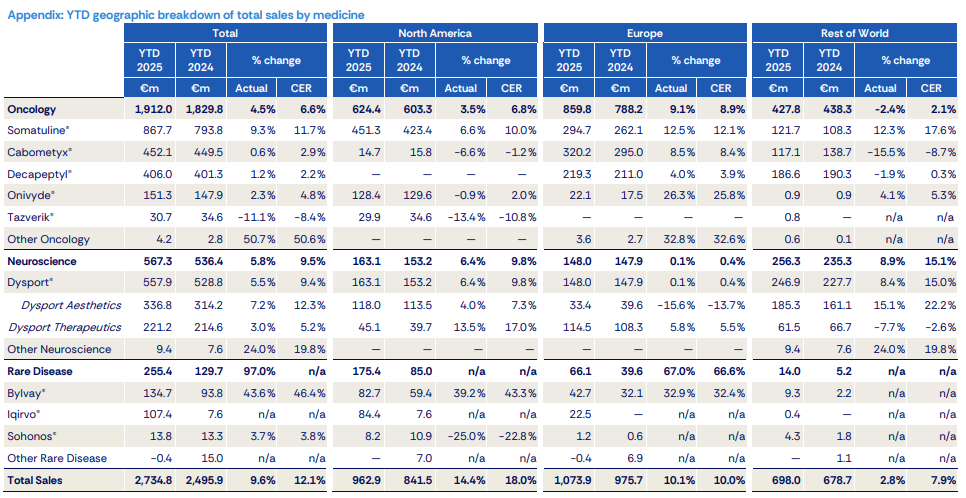

Ipsen Stock: Q3 2025 Financial Highlights

Ipsen published its nine-month and Q3 results on 22 October 2025. Total sales for the first nine months rose to about €2.73 billion, up 9.6% as reported and 12.1% at constant exchange rates. Q3 sales alone reached €915.0 million, beating expectations. Oncology led the gains. Rare diseases showed the fastest growth. Neuroscience also contributed. The group reported stronger margins and improved profitability compared with a year earlier. Management raised full-year targets after the quarter. These figures point to clear operational momentum going into 2026.

Somatuline: The Growth Engine

Somatuline (lanreotide) was a major driver in Q3. The drug delivered strong net sales of €279.1 million for the quarter. That number beat sell-side forecasts and helped lift overall revenue. Ipsen said Somatuline benefited from the tight supply of generic lanreotide in some markets. The product’s resilience eased investor fears about competition and helped justify the guidance upgrade. Somatuline remains central to Ipsen’s neuroscience franchise and to near-term cash flow.

Product Portfolio and Pipeline Progress

Ipsen’s portfolio is broader than a single hit. Key brands include Cabometyx, Bylyva, Iqirvo, Dysport, and Somatuline. Cabometyx and Iqirvo also beat expectations in the quarter. Rare disease treatments posted exceptional gains, partly because of new approvals and geographic rollouts.

R&D progress continued. Ipsen flagged regulatory filings and clinical milestones across oncology and rare disease programs. Recent strategic moves, including partnerships and bolt-on acquisitions, aim to expand the immuno-oncology and rare disease pipeline. This mix of mature cash generators and mid-stage assets helps offset single-product risk.

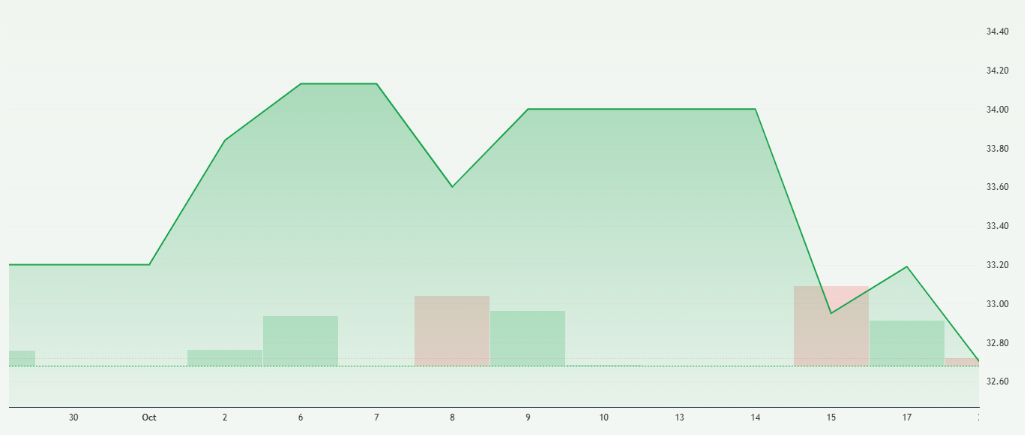

Stock Market Reaction and Investor Sentiment

Ipsen stock rose about 6% on 22 October 2025 after the results and guidance update. Traders reacted to both the headline numbers and the quality of the sales mix. Volume spiked on the news. Analysts revised models and some lifted price targets.

Commentary from brokers pointed to stronger-than-expected core margins and the company’s ability to convert R&D spend into higher-value launches. Short-term returns were driven by the Somatuline surprise. Longer-term interest stems from the upgraded FY25 outlook.

Strategic Outlook and Guidance

Ipsen raised its full-year guidance on the back of the Q3 showings. The company now expects total sales growth of around 10.0% at constant exchange rates for fiscal 2025. Management also signalled a stronger core operating margin for the year.

Strategy focuses on three areas: deepen presence in rare diseases, expand oncology indications, and improve manufacturing and launch execution. Capital allocation appears balanced between R&D and selective M&A. The firm’s public comments stressed disciplined spending while pressing for higher-return programs.

Risks and Near-term Challenges

Several headwinds deserve attention. First, patent cliffs and biosimilar erosion remain risks over the medium term. Second, pricing and reimbursement pressures could compress margins in major markets. Third, supply disruptions or regulatory setbacks could slow uptake for new indications. Currency swings also affect reported results.

Ipsen’s plan to broaden the pipeline and diversify geography helps mitigate these issues, but vigilance is required. Analysts will watch upcoming trial readouts and any biosimilar market entries closely.

Why this Quarter Matters in Context?

The Q3 beat and guidance uplift show Ipsen executing on strategy. Growth came from multiple products. That reduces reliance on one blockbuster. The rare disease segment’s double-digit gains reflect successful launches and approvals. The outlook upgrade shifts investor focus from near-term volatility to structural improvement in margins and revenue mix. Tools like an AI Stock Research Analysis Tool would flag this quarter as a positive re-rating event for a mid-cap biopharma.

Wrap Up

Ipsen’s Q3 performance on 22 October 2025 combined stronger sales, higher Somatuline receipts, and clearer guidance. The result pushed the Ipsen stock price up and renewed analyst interest. The company’s mix of established brands and pipeline progress creates a plausible path to steady growth.

Risks remain, but current data justify a more optimistic view of Ipsen’s near-term trajectory. Investors should track upcoming clinical milestones and potential biosimilar developments to judge sustainability.

Frequently Asked Questions (FAQs)

Ipsen’s stock rose 6% on October 22, 2025, after strong Q3 results showed higher sales, better profit margins, and strong demand for its key medicines.

Ipsen’s Q3 2025 results were boosted by solid sales of Somatuline, growth in rare disease treatments, and higher revenue from oncology and neuroscience products.

Yes. Somatuline continued to perform well in Q3 2025, helping Ipsen’s total sales grow even as biosimilar competition increased in several global markets.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.