Iron Ore: BHP Downplays China Dispute as Negotiations Remain Ongoing

Iron ore sits at the heart of Australia’s trade with China, the world’s biggest buyer of the metal used to make steel. But in October 2025, headlines sparked concern when reports suggested tensions between BHP Group and Chinese buyers were rising. China’s state-backed China Mineral Resources Group (CMRG) was said to be pushing for lower prices and more deals in yuan instead of US dollars. Some media even hinted at a short-term suspension of BHP shipments.

Yet, BHP quickly calmed the storm. The company stated that negotiations were still underway and that shipments to China had not stopped. This response came during BHP’s annual meeting in mid-October 2025, where leaders stressed their long-term partnership with China.

The situation highlights more than just a pricing issue. It reveals how global trade power is shifting as China looks to reshape how key resources like iron ore are priced and paid for in the years ahead.

China & BHP: Background and Market Context

China is the world’s largest buyer of seaborne iron ore. Its mills use the metal to make most of the steel in global supply chains. BHP is one of the top suppliers. The scale of trade means any buyer-seller spat matters for prices and shipping. Recent commentary underlined China’s ongoing influence on iron-ore demand and noted that BHP flagged slower Chinese growth but still called demand “resilient” in October 2025.

What is the BHP & China dispute about?

At the core are price and payment terms. Reports in late September and October 2025 said China’s state buyer, China Mineral Resources Group (CMRG), pushed hard for deeper discounts. Some reports said CMRG ordered mills to pause purchases of specific BHP cargoes, especially Jimblebar fines. That move looked tactical. It targeted certain grades and shipments rather than a total embargo. Reuters and other outlets recorded those developments in mid-October 2025.

Trade Mechanics and Recent Shifts

Long-term contracts still underpin much of the trade. But spot trades have grown. That gives big buyers more negotiating power. Another factor is currency. Multiple reports in October 2025 said negotiators discussed settling part of the trade in Chinese yuan rather than US dollars. That shift would change price risk and settlement routines across the market. Analysts noted BHP had begun testing yuan-settled deals for a portion of shipments.

BHP’s Public Stance

BHP has sought to calm markets. Company leaders described the talks as commercial negotiations. A Bloomberg story on 22 October 2025 quoted BHP officials saying talks continued and that supply lines were not cut off. The tone aimed to reassure investors and customers. That public messaging also sought to contain any escalation in stock or freight reactions.

Visible Signs on the Water and in Ports

Even with calm words, some ripples appeared. Data and market reports in October 2025 showed Jimblebar stockpiles rising at certain Chinese ports. The pileups suggested selective buying pauses, rather than a full stoppage of all BHP cargoes. These port builds can tighten certain grades while leaving others flowing. That can shift blending choices at steel mills and tweak short-term freight rates.

Financial Stakes and Wider Fallout

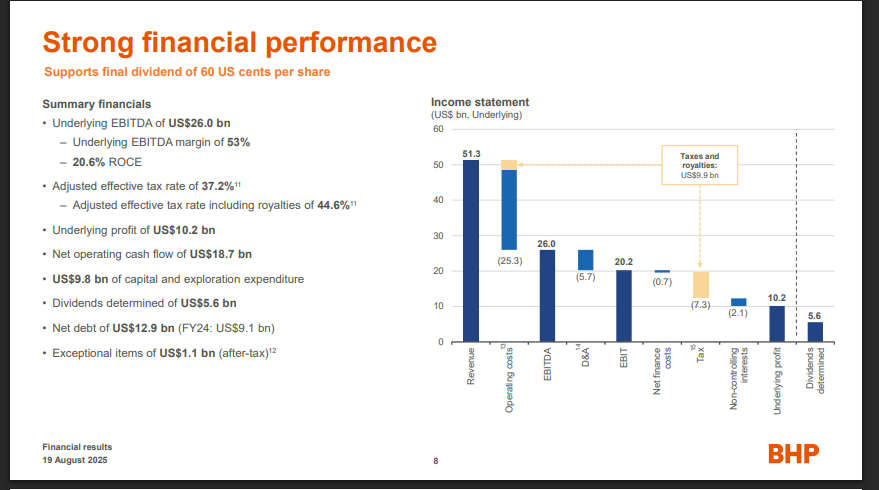

BHP’s earnings already felt pressure from lower iron-ore prices. The company reported its smallest annual profit in five years in August 2025, driven largely by weaker ore prices and softer Chinese steel output.

Any prolonged discounting or lost volumes would hit revenue. For China, the buyer’s tactic could secure lower near-term prices. But shifting too fast away from high-grade Australian ore could raise processing costs or complicate blending at Chinese mills.

Likely Scenarios and Market Signals to Watch

There are a few realistic outcomes. One is a short deal that keeps shipments largely normal. Another is a drawn-out negotiation that forces miners to reprice and redirect cargoes. A third is a gradual shift to more yuan-settled spot trades and new contract terms.

Watch iron-ore spot prices, Port Hedland and major Chinese port stock levels, freight rates on Australia-China routes, official statements from CMRG, and any public contract announcements from BHP. Also, look for how tools such as an AI analysis tool interpret shipment and price flows; these tools can flag early shifts in volumes and buyer behaviour.

Closing Remarks

This episode is more than a pricing row. It may mark a turning point in how major buyers and miners set terms. Short fixes could restore normal flows. Long disputes could nudge the market toward new settlement currencies and fresh contract structures.

The dates to remember from the recent coverage are late September to October 2025, when the dispute first hit headlines and negotiation reports became public. Keep tracking port inventories, contract notices, and official buyer statements for the clearest signals of how the market will settle.

Frequently Asked Questions (FAQs)

As of October 2025, BHP and China are still in talks. BHP says shipments continue, and the issue is only a pricing negotiation.

Prices may stay unstable until a deal is made. Traders watch closely, as any delay in talks could lift global iron ore rates.

Yes, as of October 2025, China still buys from BHP. Some shipments slowed, but both sides say trade has not completely stopped.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.