ITR Filing Deadline Extended, But 5.3 Crore Returns Already Submitted

The deadline for filing Income Tax Returns (ITR) has been extended, giving taxpayers some breathing space. Yet, more than 5.3 crore people have already filed their returns before the extension was even announced. This shows that many of us are becoming more aware of the importance of filing on time.

Every year, the last week before the due date creates stress. The e-filing portal gets heavy traffic, and taxpayers rush to complete the process. This year was no different. Despite that, millions filed early, showing improved financial discipline.

The extension offers relief for those who faced issues like missing documents, last-minute technical glitches, or a lack of guidance. It also helps small businesses and self-employed professionals who usually struggle to balance accounting work with day-to-day operations.

But an extended deadline should not be seen as a chance to delay. Filing early means faster refunds and fewer errors. As responsible taxpayers, we need to use this time wisely. The government’s step reflects a balance between enforcement and support, and aims to boost compliance and reduce stress.

Current Status of ITR Filing

More than 5.30 crore income tax returns have been filed this season. The figure rose rapidly in the days leading up to the extended deadline. Many taxpayers used the e-filing portal and mobile apps. Professional firms reported a heavy workflow. Early filers include salaried employees, pensioners, freelancers, and small businesses. The pace of filings shows rising digital adoption but also last-minute pressure on the system.

New Deadline Announcement

The government officially set the last date to file ITRs for FY 2024-25 as 15 September 2025. This extension moved the original July 31 deadline to mid-September. The Income Tax Department published the updated tax calendar and press notes with the revised date. Taxpayers who do not require an audit must file by this date to avoid higher late fees.

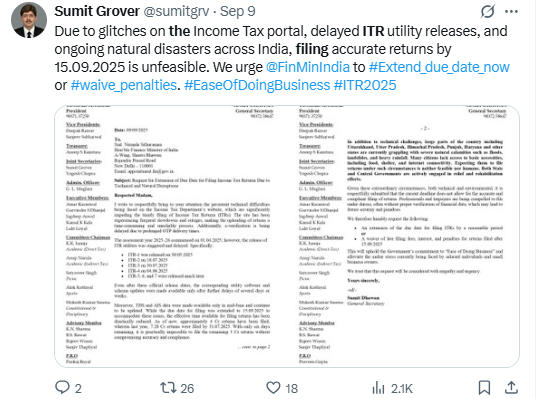

Reasons Behind the Extension

Multiple reasons pushed authorities to give extra time. First, new ITR forms and updated Excel utilities were released late. Second, taxpayers and chartered accountants faced validation and upload errors on the portal. Third, some forms for non-corporate entities followed updated ICAI formats, confusing. Finally, many professional bodies formally requested more time to complete filings accurately. These factors combined to justify the extension.

Benefits of the Extension for Taxpayers

The extra time allows for more careful filing. Taxpayers can gather missing documents like Form 16, bank statements, and proof of investments. It offers a chance to claim legitimate deductions and check tax credits in Form 26AS. For small businesses and freelancers, it reduces the rush to finalize accounts. For many individuals, it also lowers the risk of avoidable errors that can delay refunds. Accurate filing now means fewer corrections later.

Challenges Despite the Extension

The extension does not solve all problems. Portal glitches persist and may reappear as traffic spikes again. Many taxpayers still lack full documentation. Tax professionals warn of concentrated workloads as the new deadline approaches. There is also a risk that refund processing could slow down if returns pile up. Further extensions, if any, may encourage last-minute filing behavior rather than timely compliance.

Government and Expert Statements

The Income Tax Department and officials have emphasized pre-filled forms and faster processing to ease filing. They urged taxpayers to verify pre-filled data like TDS and dividend entries before submission. Professional groups such as ICAI chapters and tax associations asked for more stability in utilities and suggested a longer window for audit-related filings. Authorities are balancing compliance needs with practical relief for taxpayers.

Impact on Compliance and the Economy

An extended deadline can lift overall compliance rates. More taxpayers will likely file complete returns rather than skip the process. This helps the tax department build a clearer revenue picture. It also supports financial planning, as timely returns enable faster refunds and cleaner personal accounts. However, repeated extensions may weaken the culture of filing on time and complicate fiscal forecasting for the government.

Practical Risks for Taxpayers

Missing the new deadline moves the return to a “belated” status. Belated returns attract interest under Section 234A and may invite late fees under Section 234F. Those with refund claims should note that delayed filing can push back refund timelines. Taxpayers who require audit reports have tighter schedules, since audit deadlines and tax return timelines are linked. Late filing also risks complications when validating investments for tax reliefs.

Tips for Smoother Filing

Start with a checklist. Match bank interest, TDS, and dividend entries against Form 26AS. Use the official e-filing portal for pre-filled data and verified utilities. If possible, file early rather than waiting for the last week. For complex returns or business filings, consult a chartered accountant well before the deadline. Keep digital copies of proofs and declarations to speed up e-verification.

Final Words

The extension to 15 September,2025 provides much-needed breathing space. Millions have already filed, showing improving compliance. The extra time should be used to file accurately and to avoid penalties. Taxpayers and professionals must also watch for portal reliability and complete verifications early. Filing on time remains the best way to secure refunds and avoid avoidable charges.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.