J.P. Morgan Downgrades Wendy’s Amid High Capex and Sluggish U.S. Sales

On December 3, 2025, J.P. Morgan lowered its rating for Wendy’s stock from “Buy” to “Neutral.” The firm also dropped its price target for Wendy’s, from $12 to $9. The downgrade did not come from hype. It came from real concern. According to J.P. Morgan, Wendy’s is spending big money on upgrades. But at the same time, sales at U.S. restaurants are weak.

That contrast is important. On one hand: big bets on remodels, tech, and new builds. On the other: shrinking customer traffic and falling same-store sales. This tug-of-war could push Wendy’s into a rough patch. And it might change how Wall Street sees the fast-food giant not as a growth story anymore, but as a risky bet.

This article explores why J.P. Morgan sounded the alarm and what it might mean for Wendy’s future.

What Triggered J.P. Morgan’s Downgrade?

On December 3, 2025, J.P. Morgan cut Wendy’s rating from “outperform” to“Neutral.” The firm also lowered its price target. The move followed concern about heavier capital spending and weak U.S. sales. Analysts pointed to rising capex plans that pressure near-term cash flow. They flagged slower same-store sales trends in the U.S. as a core worry.

The combination changed the risk profile. What once seemed like a growth investment now looks riskier in the short run. The downgrade was not a surprise to traders. It signaled a recalibration of expectations.

Wendy’s High-Capex Strategy: Smart Long Game or Heavy Weight?

Wendy’s has poured money into tech and stores this year. The company disclosed investments in digital menu boards, drive-thru upgrades, and kitchen improvements during Q3 2025. These moves aim to modernize the chain. They also raise costs now. Management calls it Project Fresh. The plan covers brand refreshes, operational fixes, and targeted builds.

Investors must choose between short-term pain and potential long-term gain. If remodels lift average unit volumes, the investments will look wise. If traffic does not return, the capex will erode margins. The balance is delicate. The Q3 filing showed notable spending on technology and remodels.

Sluggish U.S. Sales: The Real Red Flag Behind the Downgrade

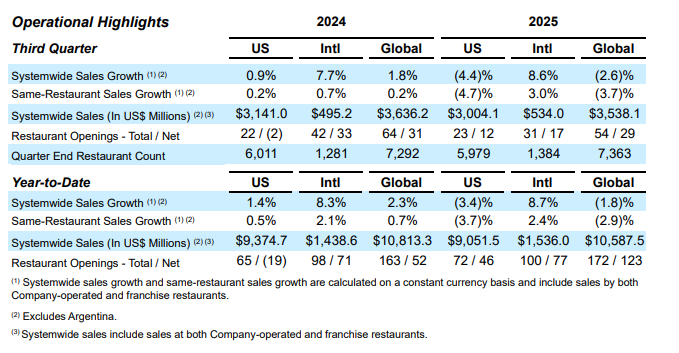

U.S. same-store sales slid through much of 2025. Wendy’s reported multiple quarters of soft results. The company said U.S. systemwide sales were down year-to-date. Management cited tougher traffic and shifting customer behavior. Value chasing and higher grocery competition reduced casual dining trips.

Wendy’s also noted commodity pressure, especially on beef. The brand moved to close underperforming units and shift marketing toward value offers. Closing older stores is meant to stop profit leakage. Still, declines in U.S. comps are the central problem that triggered analyst caution.

Franchisee Pressure: The Hidden Factor Most Headlines Ignore

Franchisees feel the cost burden more than most readers see. Many locations are run by small operators. Heavy capex expectations mean franchisees may need to pay for remodels or upgrades. That can squeeze their margins. Some franchisees hesitate to invest.

Others may seek delays or exits. A weak unit base can slow systemwide rollouts. Franchise fatigue can also blunt the speed of improvement. When operators reduce investment, the brand’s upgrade timeline stretches. That outcome raises the risk that corporate forecasts miss reality. Wendy’s has said it will support development, but franchise economics matter.

Investor Reaction: Sentiment, Stock Movement, and What It Signals

The wendy’s stock fell after the downgrade. Traders reacted to the shorter cash runway and slower U.S. sales. Option flows and short interest ticked higher in the immediate days after the note. Some investors view Wendy’s as a turnaround play.

Others now see it as a value trap. The downgrade narrowed the margin of safety. For hedge funds, timing matters. For long-term holders, the question is whether remodels and menu work will restore traffic. Analysts trimmed earnings estimates and adjusted price targets. That reshaped multiple investor models in December 2025.

Strategic Outlook: What Wendy’s Must Do to Regain Momentum

Wendy’s must act on several fronts. First, sharpen the value message to win back price-sensitive guests. Second, temper capex where returns look weak. Third, speed up winning pilots like new chicken items and loyalty refinements that show clear uplift. Fourth, partner with franchisees to ease upgrade costs or offer incentives.

Fifth, target underperforming stores for closure or sale, while investing in high-AUV locations. Execution is the test. Project Fresh outlines the plan. Success will depend on faster U.S. traffic recovery and disciplined capital allocation. If those two things happen, the downgrade may prove temporary. If not, the company will face tougher choices.

Why Does This Matters for the Industry?

Wendy’s case is a canary for other chains. Many operators are modernizing at the same time. Tech spend, drive-thru automation, and kitchen upgrades are industry trends. If customers pause visits while chains pour money into stores, a wider profitability drag could appear.

Investors will watch who controls the balance. Competitors that can deploy capital more efficiently may take share. The risk is not limited to Wendy’s. It touches the whole quick-service category.

Closing Take: Is the Downgrade a Warning or a Reset?

The downgrade on December 3, 2025, is a clear warning. It highlights timing risk in Wendy’s strategy. The brand is investing to compete. But sales must improve to justify the cost. Franchise economics and execution will decide the outcome.

Market watchers should track U.S. comps, franchise uptake on remodels, and cash flow trends in upcoming quarters. An AI tool could help model scenarios. The next several quarters will show whether the investments become a turning point or a drag.

Frequently Asked Questions (FAQs)

J.P. Morgan downgraded Wendy’s on December 3, 2025, because the company is spending more on upgrades while U.S. sales are slowing. This raised concerns about short-term growth.

After the December 2025 downgrade, the stock outlook became cautious. Analysts expect slower gains because higher spending and weak traffic may limit growth until sales trends improve.

Yes. Wendy’s reported softer U.S. sales throughout 2025. The company faced weaker traffic, more price-sensitive customers, and rising costs, which made sales growth harder to maintain.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.