Jaguar Land Rover to Restart Partial Production on Monday

On Monday, October 6, 2025, Jaguar Land Rover (JLR) will begin a partial restart of production in the UK. This comes after nearly a month of shutdown caused by a serious cyberattack that forced the company to suspend operations at its main factories.

We know the disruption has been painful. JLR had shut down its IT systems, halted vehicle output, and delayed supplier payments starting from late August. Now, the firm plans a phased, controlled return to work.

In the coming days, engine lines in Wolverhampton are likely to resume first. Workers, suppliers, and industry watchers will be watching closely. This move is more than a technical recovery; it’s a test of JLR’s resilience and a signal to the market about how quickly the company can bounce back.

Reason Behind the Shutdown

The incident began on 31 August 2025 when Jaguar Land Rover (JLR) reported a major cyberattack that hit its IT systems. The firm shut down systems to limit damage. Production stopped as a safety step. Many factories went idle. Staff were told not to come to work. The halt affected manufacturing in the UK and other countries.

This pause cut output sharply and delayed deliveries. Security teams and outside experts launched a forensic probe to find how the attackers entered the network and what was taken. Several reports named hacker groups claiming responsibility, but JLR kept details limited while the inquiry continued.

Details of the Production Restart

JLR announced a controlled, phased restart of operations in late September. The company planned to bring back limited lines first. Engine production at the Wolverhampton plant was scheduled to resume on 6 October 2025. Other sites were to follow more slowly.

The restart focused on lines that can run safely while IT systems are rebuilt. JLR stressed the restart would be careful and staged. The firm also restarted some digital services to pay suppliers and manage logistics. This helped to unblock parts flows before vehicle assembly fully restarted.

Impact on Workforce and Local Economy

The shutdown hit thousands of workers and many supply-chain jobs. JLR asked factory staff to stay home. Temporary and agency workers were hit first. Smaller suppliers saw cash flow dry up fast. Some suppliers warned of layoffs and closures without quick help.

Local economies in the West Midlands and Merseyside felt the pain. Towns that depend on suppliers and logistics saw orders and wages vanish for weeks. The government and industry groups moved to arrange emergency support to stop cascading job losses.

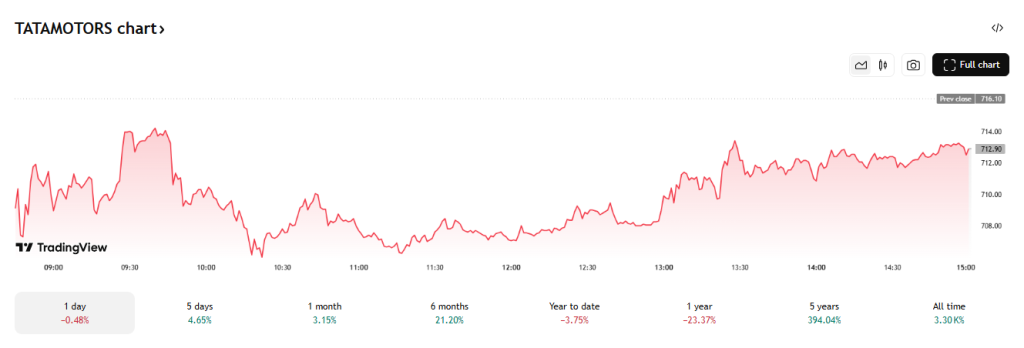

Market and Investor Reaction

Investors reacted with worry. Tata Motors, JLR’s parent, faced pressure on its shares. Analysts flagged risks to revenue and margins for the fiscal year. The UK government offered a major loan guarantee to stabilise the supply chain. Banks also arranged a liquidity facility to back JLR through the crisis. These steps reduced immediate funding stress.

Still, investors will watch the pace of recovery and how quickly full production can return. Some market watchers used an AI stock research analysis tool to re-run valuation scenarios given the outage and loan support.

Challenges Ahead

Several problems could slow a full comeback. First, the forensic work on IT systems takes time. Systems must be cleaned and tested before they can be trusted. Second, many suppliers still face cash gaps. Money from top-tier contracts may not reach smaller vendors fast enough. Third, global parts flow is fragile. Delays in one link can stall the whole line. Fourth, demand is uncertain in key markets like China and Europe. If demand falls, ramping back up quickly will be hard. In short, the road to full recovery is uneven.

Strategic and Long-Term Outlook

The crisis forced a strategic rethink. JLR’s long-term “Reimagine” plan already aims to shift the business to electric vehicles and digital services. The cyber incident added urgency to strengthen IT security and supply chain resilience. JLR may speed up investments in secure cloud systems, redundant networks, and supplier finance programs.

The company also faces pressure to show it can deliver EVs on schedule while protecting margins. How JLR handles this recovery will matter for its brand and for Tata Motors’ global strategy. If the restart holds, it could free resources to focus on electrification and growth.

What does this mean for Customers and Dealers?

Customers faced delays in deliveries and servicing. Dealers had limited stock and longer wait times for parts. Some buyers asked to push back orders or cancel. JLR moved to prioritise high-margin and urgent orders first. The firm also aimed to restore warranty and parts services quickly to protect customer trust. Clear and fast communication with dealers remains key to avoiding loss of confidence.

Wrap Up

The partial restart on 6 October 2025 marks an important step. It shows progress in recovery. However, many tests remain. Key things to watch in the coming weeks: whether other plants follow Wolverhampton; how quickly suppliers receive funds; the pace of IT restoration; and whether demand holds in export markets.

The loans and government guarantees ease short-term pain. Long-term resilience will depend on stronger cyber defenses and a firmer supply chain. The restart is hopeful. It is not the end of the crisis.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.