JD Sports Shareholders Eye Progress Despite US Consumer Weakness

Sportswear has become more than just clothing; it is now part of lifestyle and identity. JD Sports, often called the “King of Trainers” in the UK, has grown into a global leader in athleisure and retail. With stores across Europe, Asia, and North America, the company has built a strong reputation for offering trendy sneakers and sports fashion that connect with younger shoppers. But in the United States, things are not looking as bright.

Rising prices, cautious spending, and tough competition are testing JD Sports’ strength in this critical market. Many US shoppers are cutting back on non-essential items, and that directly affects sneaker and apparel sales. Yet, we see something interesting: shareholders are still confident. Why? Because JD Sports is not relying on just one region. Its global reach, smart partnerships, and expansion plans are helping it stay on track.

Let’s explore how JD Sports is handling US challenges, why investors remain hopeful, and what the future could look like for one of the world’s most influential sports retailers.

JD Sports at a Glance

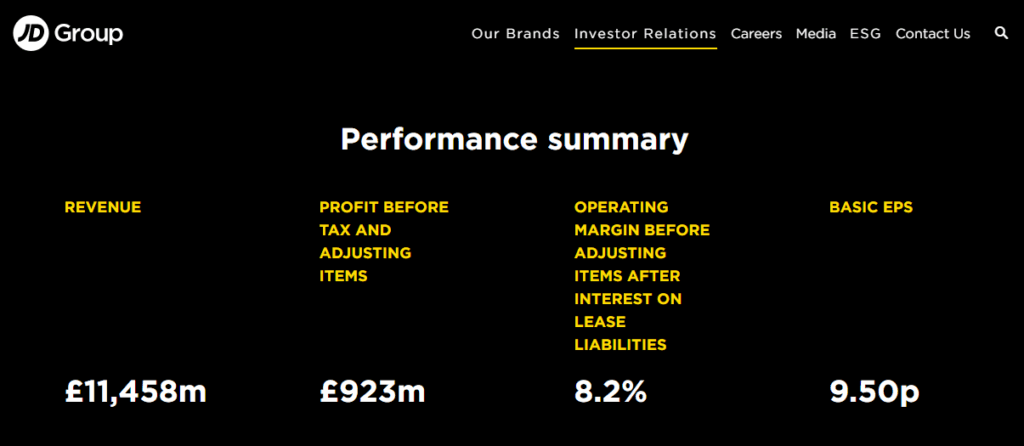

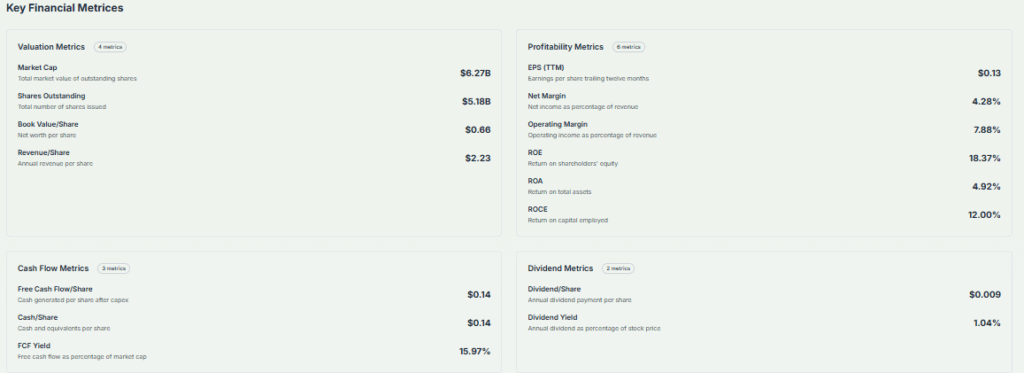

JD Sports is a top sports-fashion retailer based in the UK. It sells shoes, clothes, and accessories across the world. For the year ending February 2025, it booked around £11.5 billion in sales and a profit before tax of about £715 million, down from £811 million last year.

Despite thinner profit, the company brought in strong cash flow. It earned about £1.2 billion in operating cash and kept profits near its own guidance at £923 million before adjusting items.

The US Market Weakness

The US market is tough for JD Sports now. Consumer spending is slow. Retailers are offering deep discounts. JD’s US sales face pressure from these trends.

High tariffs on imports from Vietnam and other key production countries are another concern. These extra costs could mean higher prices for US shoppers, making things even harder.

Despite all that, the company calls its trading “volatile but in line with expectations”.

Shareholder Perspective

Investors are still hopeful. JD launched a £100 million share buyback plan. This move helped lift their stock momentarily.

Analysts remain cautiously optimistic. Peel Hunt still calls JD an “exceptional business” with good cash reserves and growth plans. Shore Capital also points to smart cost control and margin discipline.

Strategic Moves by JD Sports

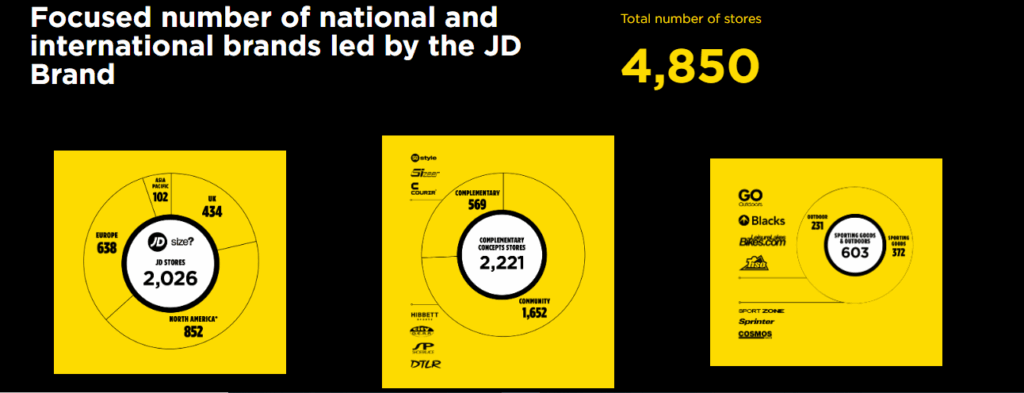

JD has ramped up its global buying. It acquired the US chain Hibbett and the French retailer Courir. These deals bring stronger footholds in North America and Europe.

CEO Régis Schultz has shifted the company’s sourcing to more countries like Egypt, Turkey, and North Africa to avoid tariffs and improve agility. The firm also still partners closely with Nike. It supports Nike’s move toward premium sports products. That shows trust in their long-term partnership.

New store openings remain on the agenda. JD plans around 150 new shops globally this year, mostly in Europe, along with some in emerging regions. It will close about 50 underperforming stores in Eastern Europe.

Financial Performance and Outlook

Group revenue rose 8.7 % to £11.5 billion. Organic sales growth was about 6 %, more than double the market average. Gross margin held at 48 % before factoring in acquisitions.

Profit before tax and adjusting items came in at £923 million, right on the company’s target. Free cash flow remained strong at over £1.2 billion.

For the year ahead, JD expects profits between £915 million and £935 million, about flat versus this year. That assumes continued volatility and excludes potential extra tariff effects.

Industry & Competitor Landscape

JD is not alone in facing a slow athleisure market. Consumer taste now steers toward lifestyle and performance brands, including On Running and Hoka, both grabbing share from big names like Nike. Despite that, JD keeps its edge with trend-led and affordable fashion and deep brand partnerships.

Risks & Challenges

The US remains a big risk. It now accounts for nearly 40 % of JD’s revenue. Weak spending or higher costs there would hit hard.

Tariff hikes are another looming threat. The fallout could dampen both supply chains and consumer buying.

Lastly, JD must manage integration costs from its acquisitions and keep margins stable amid stiff competition and higher costs.

Opportunities & Long-Term Growth

JD’s move to diversify sourcing reduces future risk. It can now lean on more agile supply chains.

Strong partnerships with Nike and other brands remain core. JD’s shared strategy supports recovery and growth.

Global expansion continues. The firm invests in new stores and grows its franchise model in regions such as the Middle East, Southeast Asia, Africa, and South America.

Bottom Line

JD Sports is in a challenging spot. US consumer weakness and tariffs test its strength. Yet global reach, partnerships, and cash reserves give it hope. The firm stays agile and focused. Shareholders watch progress closely, but there are signs that JD is built to adapt and thrive.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.