JingDong Industrials to Launch IPO Next Week, Seeking Up to $500 Million

JingDong Industrials is set to make a big move in the market next week. The company plans to launch its IPO in the last week of November 2025, and it aims to raise $500 million. This news has gained attention because it comes at a time when global markets are still trying to balance slow growth and rising demand for industrial tech.

JingDong Industrials is part of the larger JD.com group. It plays a key role in China’s fast-growing industrial supply and smart equipment market. The firm helps factories work better with digital tools, data systems, and modern machines. Because of this, many investors see it as a strong player in the industrial tech space.

The upcoming IPO shows the company’s plan to grow faster and reach more global partners. It also comes during China’s push to upgrade its industries with new technology. For investors, this IPO may offer a chance to enter a sector that is changing quickly and becoming more digital. The next few days will show how the market responds to this important step.

About JingDong Industrials

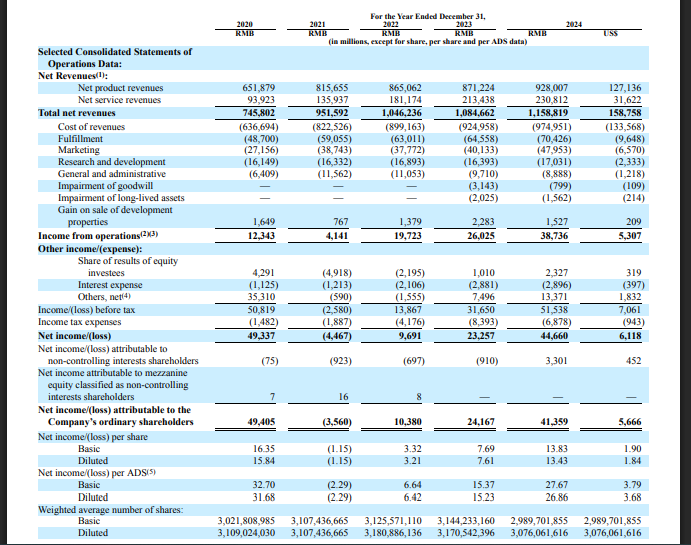

JingDong Industrials (JDi) is the industrial supply and services arm spun out of JD.com in 2023. The unit focuses on procurement, warehousing, logistics, and smart equipment for business customers. It sells digital tools to factories and large firms. The company reported revenue of 10.3 billion yuan in the first half of 2025.

JD.com still owns roughly 79% of the unit. JDi built its business by combining JD’s logistics network with new industrial software and services. These assets give it scale across China’s factories and warehouses.

Details of the JingDong Industrials Upcoming IPO

JDi plans to launch its Hong Kong IPO in the coming week. Sources said the company may aim to raise $500 million. The firm is targeting pricing on December 8, 2025, and a listing date of December 11, 2025, though timing could shift with market demand. Top banks on the deal include Bank of America, Goldman Sachs, UBS, and Haitong.

The company began investor education meetings on November 24, 2025, as part of its roadshow process. Proceeds will likely fund technology upgrades, capacity build-out, and possible acquisitions.

Why the IPO Is Happening Now?

The timing reflects several trends. Hong Kong’s IPO market revived through 2025. That offered a window for large Chinese groups to list spinoffs. Regulators approved JDi’s filing only in September 2025 after a two-year review.

At the same time, China is pushing industrial modernisation. Firms need new digital tools and smarter supply chains. JDi can sell those solutions. The company may also use public capital to reduce parent-group risk and unlock value for JD.com shareholders. Finally, the deal size is modest. That may help secure strong investor demand in a cautious market.

Company Financials and Growth Drivers

JDi showed steady top-line growth in early 2025. Reported sales rose nearly 19% year-on-year in H1 2025. Core revenue comes from procurement services, logistics, and smart factory software. Margins can improve as software and services scale. The firm benefits from JD’s captive customers. Large retailers and manufacturers already use JD’s logistics backbone.

JDi can cross-sell higher-margin digital offerings. Investments in data systems and smart equipment also open new revenue streams. Analysts will watch whether growth can stay above industry averages after listing.

Market Opportunity and Competition

China’s industrial B2B market is large and under-penetrated for digital tools. The shift to automation and smarter supply chains creates demand. JDi sits at the junction of logistics, procurement, and industrial software. This gives it a broad addressable market. Yet competition is rising. Local rivals and global suppliers offer niche tech, cloud services, and automation hardware. Some domestic peers focus on logistics alone.

Others sell specialized industrial software. JDi’s advantage is scale and ecosystem access through JD.com. Success will depend on execution, pricing, and the ability to convert large customers to higher-margin services.

Risks and Challenges Ahead

Several risks could pressure performance. Global demand may slow because of weaker trade. Geopolitical tensions could hit cross-border deals. China’s regulatory environment has shown volatility for tech spinoffs.

Market sentiment for new listings also remains fragile. Some recent tech debuts posted lackluster results, which can weigh on JDi’s pricing. Integration risks exist when adding acquisitions. Finally, investors may demand proof that software revenue can scale while protecting margins. These factors could lead to valuation pressure at the IPO.

What Does the JingDong Industrials IPO Mean for Investors?

The IPO gives investors a direct play on China’s industrial upgrade. The business mixes physical logistics and digital services. That blend may appeal to investors chasing durable demand and tech-enabled margins. A $500 million raise is modest. It could allow the company to expand without over-diluting JD.com’s stake.

For long-term holders, the bet is on secular growth in automation and smarter supply chains. Short-term traders will watch pricing, order books, and early secondary performance. Analysts will track revenue mix and margin trends closely after the listing.

Conclusion and What to Watch Next?

The coming week will be pivotal. Watch the final pricing on December 8, 2025, and the listing on December 11, 2025. Track investor demand in the book-building phase. Monitor near-term guidance on how the $500 million will be used. Also, follow whether the sales mix shifts toward higher-margin software. That change would support a stronger valuation.

Lastly, keep an eye on the broader market appetite for Chinese tech listings. That will shape how JDi performs after it goes public.

Frequently Asked Questions (FAQs)

The JingDong Industrials IPO is expected to list in the second week of December 2025. The final date will depend on market conditions and pricing decisions made during the roadshow.

JingDong Industrials plans to raise up to $500 million through its IPO. The final amount will depend on investor demand when pricing takes place in early December 2025.

Yes. JingDong Industrials is a spinoff from JD.com, and JD.com will stay the main shareholder after the listing. The company was officially separated in 2023.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.