JPMorgan Report: Stablecoins Set to Boost Dollar Demand by $1.4 Trillion in 3 Years

As of October 8, 2025, JPMorgan released a striking prediction: stablecoins could drive $1.4 trillion more demand for the U.S. dollar by 2027. That is a huge number. But what does it mean in real life? We think it points to a financial shift at the heart of digital money.

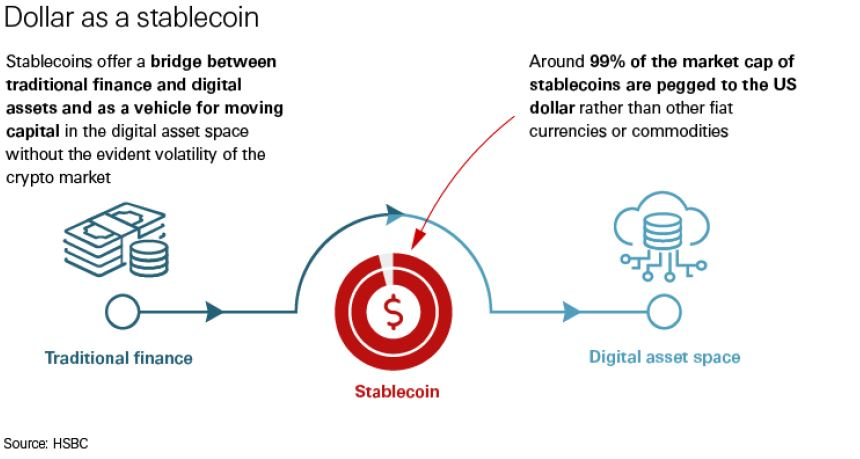

Today, stablecoins, digital tokens tied to assets like the U.S. dollar, are becoming more than just crypto tools. They are emerging as bridges between traditional finance and blockchain networks. If our world leans more into stablecoins, dollars will flow differently across borders, balance sheets, and reserves.

Let’s explore how JPMorgan arrived at this forecast. We then examine what it might spell for the dollar’s global role, banks, tech firms, and regulators. Along the way, we ask: What could go right? What risks lie ahead? And how will stablecoins reshape our money system by 2028?

What are Stablecoins?

Stablecoins are digital tokens. They keep a steady value by linking to real assets. Most tie their value to the U.S. dollar. Issuers hold reserve assets such as cash or short-term U.S. Treasuries. This backing is meant to stop wild price swings common in other cryptocurrencies.

People use stablecoins for payments, remittances, trading, and saving. Their speed and low friction make them useful across borders. The market has grown fast, driven by both retail and institutional use.

JPMorgan’s Findings Explained

On October 8, 2025, JPMorgan analysts published a note with a stark forecast. The bank said stablecoins could raise global demand for U.S. dollars by $1.4 trillion by 2027. The analysis envisions scenarios where stablecoin usage scales sharply in payments and custody.

JPMorgan models assume steady growth in blockchain rails and rising trust in tokenized dollar holdings. The bank also looked at reserve practices and how issuers convert fiat into safe assets. The $1.4 trillion is not a guaranteed outcome. It represents a plausible high-growth route if adoption accelerates.

The Dollar Connection: Why it Matters?

Most major stablecoins are pegged to the dollar. That means demand for those tokens can translate into real demand for dollar assets. When foreign firms or individuals buy and hold dollar-backed stablecoins, they often require actual dollars or dollar-denominated reserves behind the scenes. This can push central bank reserves, treasury yields, and short-term dollar funding markets.

In effect, stablecoins act like a new channel for global dollar allocation. If adoption widens in emerging markets, dollars could shift out of local banks and into digital dollar holdings. That change could alter cross-border flows and liquidity patterns.

Institutional and Market Implications

Banks and payment firms will adapt if stablecoins scale. Expect more custody services for tokenized dollars. Payment processors may add instant settlement options. Tech firms that link wallets to bank rails could see greater volumes. Asset managers might create products that mix tokenized money and short-term credit.

Some institutions will use analytics platforms and AI stock research analysis tool capabilities to track token flows and counterparty risk. Large market players could also issue their own stablecoins or partner with issuers to capture transaction margins. These moves would speed integration between traditional finance and crypto markets.

Regulatory Landscape

Regulation will shape how fast stablecoins spread. In the U.S., recent policy moves seek stronger oversight of issuers and reserves. Europe is pushing for more euro-based stablecoins and is watching how MiCA and related rules work in practice.

Regulators want consumer protection and reduced risk. Some proposals would require full audits and limits on the types of assets held as reserves. Clear rules could reduce uncertainty. But strict rules could also slow growth or push innovation to friendlier jurisdictions. Policymakers face a trade-off between safety and speed.

Risks and Concerns

Stablecoins carry real risks. Reserve opacity can hide liquidity shortfalls. If many holders try to redeem at once, an issuer could face a bank-like run. Concentration risk is another problem. A few large issuers control most circulating tokens. That raises questions about market power and systemic risk. Central banks worry about monetary control.

Large-scale dollar stablecoin use could reduce the role of local monetary policy in some countries. There are also legal risks tied to cross-border payments, sanctions, and anti-money-laundering rules. These issues mean adoption may come with heavy oversight and higher compliance costs.

Expert and Market Reactions

Reaction has been mixed. Some analysts see the JPMorgan figure as a plausible signal of dollar resilience in a digital age. Others warn against overestimating growth. Standard Chartered recently warned that stablecoins could pull large sums from emerging market banks, though outcomes depend on local habits and regulation.

Market participants have started to plan. Banks test tokenization pilots. Payment firms add wallet features. Central banks accelerate research on CBDCs and tokenized reserves to keep pace. Overall, markets treat the JPMorgan note as a strong prompt to act, not a final verdict.

Future Outlook & Final Words

If stablecoin adoption continues, global dollar flows could look different by 2027. Tokenized money could facilitate faster and cheaper cross-border payments. Treasury markets might see new demand patterns. Central banks could respond with digital alternatives or tighter rules.

A balanced outcome would combine innovation with stronger oversight. Yet several paths remain possible: rapid token growth, slow and regulated expansion, or fragmentation with multiple currency-pegged coins. Watch for policy shifts, major issuer transparency, and real-world pilots in cross-border trade. The coming years will decide whether stablecoins add a small ripple or a major tide to dollar demand.

Frequently Asked Questions (FAQs)

On October 8, 2025, JPMorgan said stablecoins backed by U.S. dollars could increase real dollar demand as global users buy and hold dollar-pegged digital tokens for transactions.

Regulators fear unstable reserves, sudden withdrawals, and a lack of control over money flow. They also worry about financial risks if too many people use stablecoins instead of local currency.

Yes. Reports in October 2025 warn that people may move savings into dollar-based stablecoins, reducing deposits in local banks and affecting their ability to lend or grow.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.