JSW Energy Shares in Spotlight After Fresh Acquisition Spree

India’s energy demand is rising at one of the fastest rates in the world. Power companies are under pressure to expand quickly and shift toward clean energy. In this race, JSW Energy has become a name to watch.

The company has stepped into the spotlight again after a wave of new acquisitions. These deals are not random. They fit a clear plan to boost renewable capacity and cut reliance on coal. We see this as part of India’s larger mission to reach net-zero by 2070.

For investors, acquisitions often raise two key questions: Will they create real value? And can the company manage the risks? With JSW Energy, both questions are now being tested. The stock has already reacted, pulling attention from analysts and market watchers.

What makes this moment interesting is the balance between growth and risk. On one hand, the company is securing future-ready assets. On the other hand, it must handle debt, policy shifts, and fierce competition. That’s why JSW Energy’s moves are more than business news; they reflect the energy future we are stepping into.

Background on JSW Energy

JSW Energy is a large power company in India. It works in both thermal power (coal, etc.) and renewable energy (solar, wind, hydro). It also owns storage assets and is pushing into green hydrogen. Its parent, JSW Group, has many businesses, but energy is one of its fastest-growing. JSW Energy wants to reduce its carbon footprint. It aims for carbon neutrality by 2050.

The Fresh Acquisition Spree

JSW Energy has made several big purchases lately. In December 2024, its subsidiary JSW Neo Energy acquired a 4.7 GW renewable energy (RE) platform from O2 Power (backed by Temasek & EQT) for about US$1.47 billion. This move greatly increased its green capacity.

More recently, JSW Neo agreed to buy Tidong Power Generation Private Ltd, a 150 MW hydro project in Himachal Pradesh, for ₹1,728 crore. These acquisitions are part of a plan to reach 30 GW of generation by fiscal year 2030, with renewables making up ~70% of the portfolio.

Market Reaction and Stock Performance

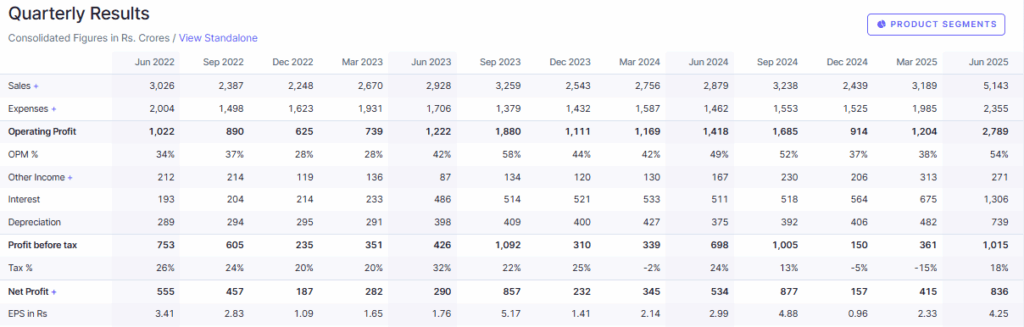

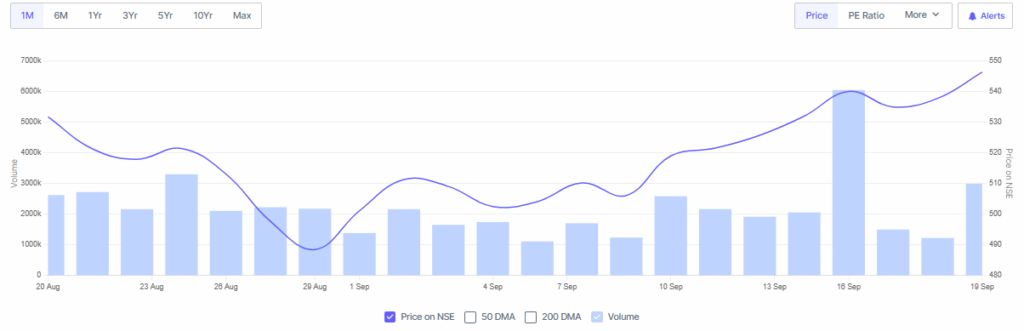

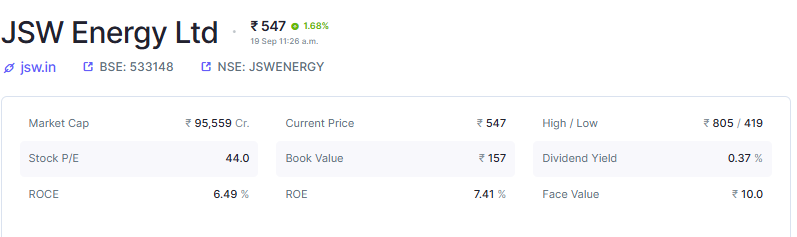

Investors reacted positively. After the strong Q1 FY26 numbers, shares of JSW Energy rose by about 4%. The company reported a net profit of ₹743 crore in Q1 FY26. That was a 42.4% rise year-on-year. Revenue grew almost 78%. EBITDA nearly doubled.

However, stock value is not without risk. The P/E ratio is high compared to many peers. Some analysts think investors are pricing in strong future growth.

Industry Context: India’s Energy Transition

India has set aggressive clean energy goals. The government aims for a very large non-fossil (renewable + nuclear) capacity by 2030. Many policies support renewables. Subsidies, incentives, and auctions are common.

The power sector is crowded. Companies like Adani Green, Tata Power, and NTPC Renewables are expanding fast. Any company must match speed, finance, and policy compliance.

Hydro, wind, solar hybrids, energy storage, and green hydrogen are gaining focus. Grid stability and transmission capacity are major concerns. JSW Energy’s push into hydro and acquisition of ready-to-operate renewable assets puts it in a strong spot in this competitive field.

Financial Health & Growth Outlook

Financial numbers show mixed strength. Q1 FY26 numbers were strong. Profit up 42%, revenue up ~78%. EBITDA margin also improved. Debt remains high. Net debt rose significantly after recent buy-outs. Depreciation and interest expenses are increasing.

The acquisition of O2 Power’s 4.7 GW assets boosted operational green capacity. The purchase of Tidong adds hydro capacity. Together, these moves make JSW closer to its 30 GW target.

Forecasts suggest continued revenue growth if project execution is smooth. But delays in regulatory approvals or construction could hurt results.

Opportunities and Risks

The hydro purchase in Himachal gives JSW more clean energy. It reduces dependence on coal and helps with seasonal power supply. Hybrid projects (wind + solar) can smooth power output. JSW’s status as a large player lets it access funding and scale. Clean energy targets by the government give incentives.

High debt loads and rising interest costs could pressure cash flows. Regulatory delays or political changes could slow project completions. Competition is fierce: many rivals are chasing similar green goals. Also, the capacity to manage multiple acquisition integrations is challenging.

Expert & Investor Views

Analysts have noted the high P/E ratio. Some call it justified, given JSW’s growth path. Others warn of over-valuation if growth slows.

Institutional investors seem interested. Big deals like O2 Power and Tidong are seen as signs JSW is serious about renewables. Retail investors are more cautious. They like the strong quarterly performance. But they worry about debt and execution risks.

Future Outlook

If everything goes right, JSW Energy can meet its 30 GW goal by FY30. The company also targets 40 GWh in storage capacity. Green hydrogen and pumped hydro storage may also become part of the next phase.

JSW is likely to continue buying renewable assets rather than building from scratch, as this approach can be faster and less risky. Share performance over the next 3-5 years will depend on project completion, regulatory stability, and how well it controls its debt.

Bottom Line

JSW Energy’s recent acquisitions show ambition. They push the company towards a renewables-led future. The financials are good now, but the burden of debt and risk remains. Success will need smart execution and steady support. For investors, JSW is a stock to watch closely.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.