Kaynes Technology Share Price: Jefferies sees up to 45% Upside Potential

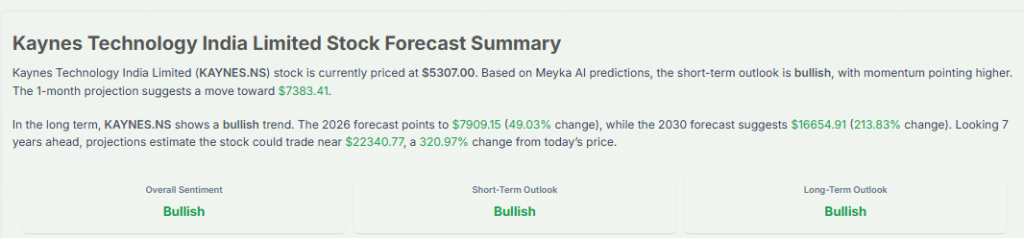

Share price of Kaynes Technology India Ltd. are once again drawing investor attention after Jefferies raised its price target to ₹7,780, pointing to a potential upside of about 45 per cent from current levels.

As of November 2025, the stock trades well below that target yet the broker believes the company’s growth story remains intact. This surge in optimism stems from strong demand for electronics manufacturing, expanding global orders, and Kaynes’ move into high-margin segments like OSAT and multi-layer PCBs.

For investors watching India’s EMS sector, this makes Kaynes one of the most interesting mid-cap stories today. Let’s dive into what backs Jefferies’ bullish view and whether the KAYNES share price can indeed climb higher.

Kaynes Share Price: Why does Jefferies’ Call Matter Now?

Jefferies raised its forecasts and kept a Buy stance in early November 2025. The firm points to a fast-growing order book and rising export wins. It also expects profit per share to expand strongly over the next few years. That combination explains the 45% upside figure often quoted in news summaries. Jefferies’ update is a major catalyst because global broker views shape flows and sentiment for mid-cap industrial names like Kaynes.

What Jefferies Actually Highlighted?

Jefferies sharpened earnings estimates by boosting EPS forecasts. The broker flagged several growth levers. These include higher export volumes, capacity expansion (OSAT and PCB investments), and an improving margin profile from operational scale.

Jefferies also noted that the management’s capex plan and approvals under India’s electronics schemes make the growth path plausible. These are concrete, not just optimistic buzz.

Recent Price Action and where We Stand

Kaynes traded near ₹5,300-₹5,400 in early December 2025. The stock peaked at about ₹7,800 earlier in the past 12 months and has pulled back since then. On 3-4 December 2025 it showed intra-day swings and higher trading volumes, which is typical around broker notes and corporate triggers like QIPs and lock-in expiries. For live price history and recent closes, market feeds such as Yahoo Finance and Investing.com are useful.

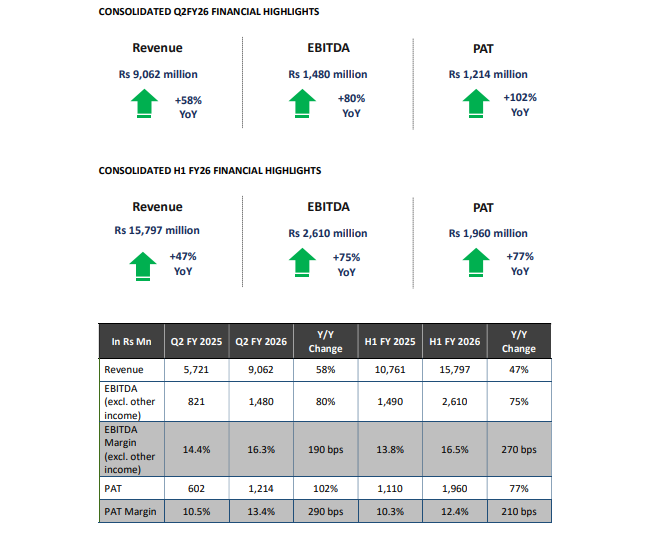

What the Company Delivered Recently?

Kaynes reported strong Q2 / H1 numbers for FY26. Revenue jumped about 58% year-on-year in the quarter that ended Sep 30, 2025. Net profit roughly doubled compared with the prior year quarter. The company disclosed an order book of around ₹80,994 million as of 30 Sep 2025. Margins expanded and operating leverage improved. These results form the factual backbone for broker optimism. The earning call transcript (05 Nov 2025) provides the details.

Why do Analysts think the Upside is Possible?

Three structural factors support the bullish thesis. First, India’s EMS (electronics manufacturing services) sector is shifting to higher-value work. Kaynes aims to move beyond simple assembly into advanced PCB, OSAT, and high-density interconnect work.

Second, the company is winning defense and industrial contracts that are typically sticky. Third, export mix is rising, which can lift margins. When combined with aggressive capex, these trends justify higher forward EPS forecasts in analyst models.

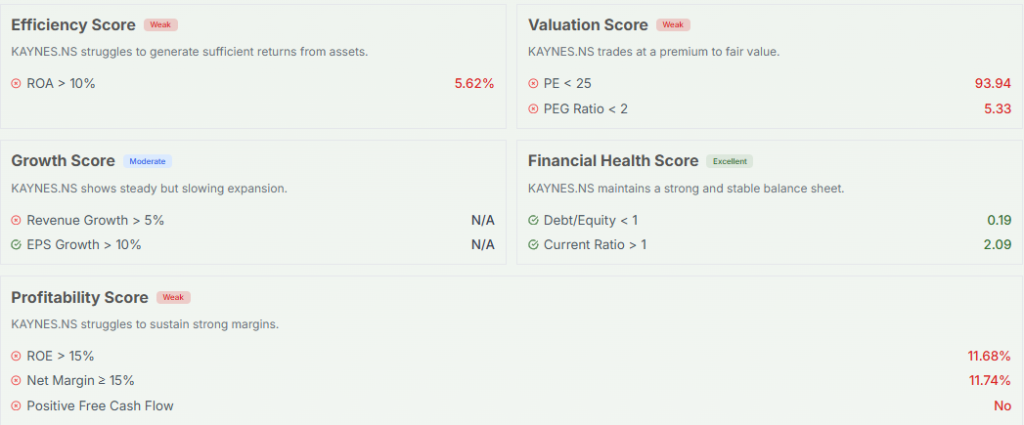

Valuation and whether the Premium is Fair

Kaynes’ multiples are not cheap. The stock trades above many peers on forward P/E and PB metrics. Brokers who like the name argue that growth justifies the premium if execution stays on track. Skeptics point to high working capital intensity and stretched cash conversion days. In short: upside is plausible if growth and margins continue to beat expectations. The market will penalize the stock hard if cash flow and working capital don’t improve.

Key Recent Corporate Events that Matter

A few recent events are material. Management launched a large QIP to raise capital for capex. That can dilute near-term earnings but fund the planned OSAT and PCB expansion. Some large blocks of shares also became tradable after lock-in expiry in mid-November 2025. Those supply dynamics added pressure to the share price even as fundamentals improved. Track QIP progress and lock-in expiries closely.

Risks that could Derail the 45% Upside

There are clear risks. One is working capital strain. The company disclosed elevated working capital days in its results. Another is the timing and success of capex projects. Delays or higher-than-expected capex could hurt margins and cash flow. Also, global electronics demand is cyclical.

A tech slowdown would reduce order inflow and compress multiples. Finally, broker target prices differ widely; not all houses are aligned. Kotak, for example, has taken a more cautious tone in recent notes.

Near-term Catalysts to Watch

Watch four items for immediate impact. First, new defense or export orders that increase the order book. Second, quarterly margins and cash conversion in the next earnings report. Third, updates on the QIP subscription and how management intends to deploy proceeds. Fourth, broker re-ratings any upward revision from large international houses often drives fresh flows. Headlines on any of these could push the stock sharply.

Market Sentiment Snapshot

Jefferies remains bullish and lifted forecasts. Prabhudas Lilladher recently set a target in the ₹7,500-₹7,800 band. Nomura also showed a bullish view, with potential upside from recent troughs. But not all houses agree: Kotak trimmed estimates and urged caution on subsidy timelines and capex timing. This split explains why the stock can be volatile even as core metrics improve.

Bottom Line: What an Investor should Take Away?

Kaynes has clear growth engines. It has a big order book and rising exports. Jefferies’ 45% upside is rooted in those facts. But the stock already carries a premium. Execution and cash flow will decide whether the market awards that premium. If you believe management will deliver on large capex and convert the order book into profitable sales, the upside case is strong. If you worry about cash conversion or capex execution, treat the stock with more caution.

Frequently Asked Questions (FAQs)

Some analysts expect Kaynes share price to rise. For example, Nomura sees up to ~46% upside as of late November 2025, based on a strong order book and growth plans.

On 3 December 2025, Kaynes Technology share price stood at ₹5,314.00 on NSE / BSE.

Jefferies sees Kaynes as promising because of strong export potential, growth in PCB/OSAT capacity, and a big order pipeline.

Disclaimer

The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.