Keurig Dr Pepper to Acquire JDE Peet’s in $18 Billion Deal

Keurig Dr Pepper has taken a brave step by announcing its plan to purchase JDE Peet’s for $18 billion. The deal, valued at €15.7 billion ($18.4 billion), marks one of the largest acquisitions in the coffee and beverage industry. With this purchase, Keurig Dr Pepper seeks to strengthen its global position in the coffee market while reshaping its overall structure.

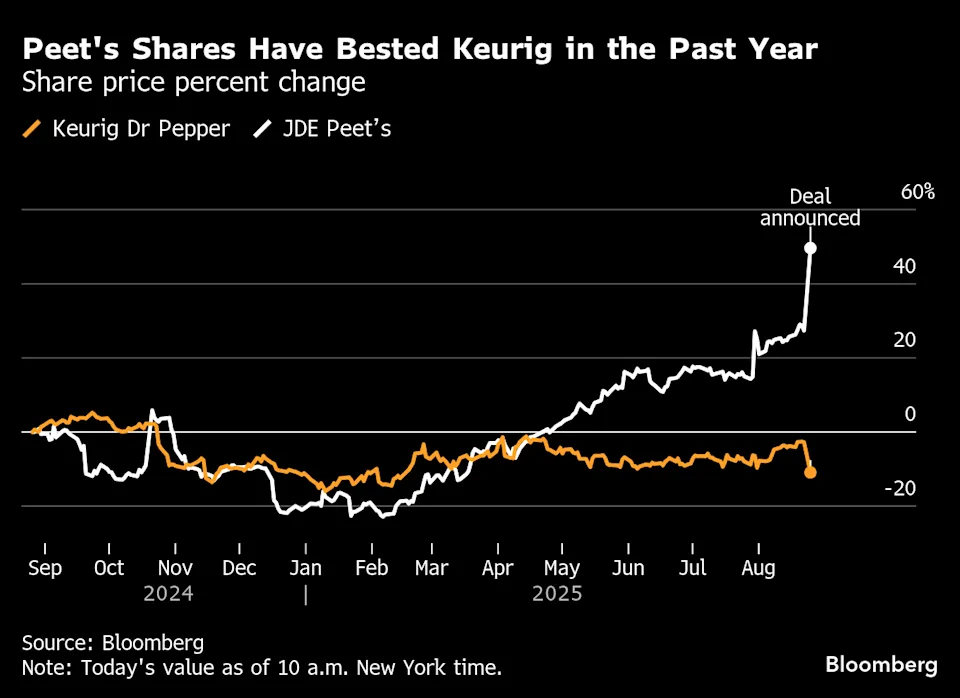

The transaction places the value of JDE Peet’s shares at €31.85 each, representing between 20 and 33 percent above recent prices. In the short term, shares of Keurig Dr Pepper fell in a range of 7 to 11 percent because investors were wary, but in the long term, this is an effort toward building a global coffee leader.

This strategy includes a planned split into two independent companies, one focused on coffee and the other on beverages.

Deal Structure and Financial Details

The agreement sets JDE Peet’s valuation at nearly $18.4 billion. Key points include:

- Valuation per share: €31.85

- Premium offered: 20–33 percent above market prices

- Cost synergies: $400 million projected within three years

- Expected closing: First half of 2026

This structure not only rewards JDE Peet’s investors but also reshapes the future of Keurig Dr Pepper.

Impact on Keurig Dr Pepper

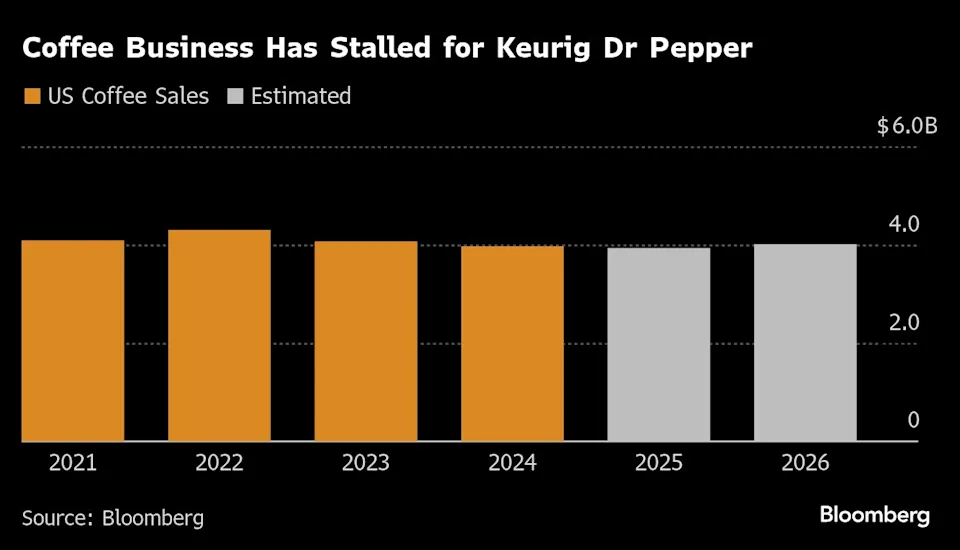

Boosting the Coffee Business

Keurig Dr Pepper’s U.S. coffee sales slipped 0.2 percent in the second quarter. By bringing JDE Peet’s under its umbrella, the company aims to:

- Expand its reach in global coffee markets

- Improve its premium product offerings

- Achieve higher efficiency with projected synergies

Future Company Split

Once the acquisition closes, Keurig Dr Pepper will create two new companies:

- Coffee Company

- Estimated annual sales: $16 billion

- Focused solely on coffee and related products

- Beverage Company

- Estimated annual sales: $11 billion

- Dedicated to sodas, teas, and non-coffee drinks

This separation effectively unwinds the 2018 merger of Keurig Green Mountain and Dr Pepper Snapple.

Investor Reaction and Stock Market Outlook

The stock market response was immediate and cautious. Following the announcement:

- Keurig Dr Pepper shares dropped 7 to 11 percent

- Investors worried about debt load and execution risk

- Some questioned whether the premium price was justified

However, history demonstrates that large acquisitions typically gain skepticism and doubt before seeing worth once the integration has taken place. If the projected $400 million savings materialize, investor sentiment could shift.

JAB Holding Co. and Shareholder Benefits

JAB Holding Co., a major shareholder in JDE Peet’s, stands to receive more than $12.5 billion in cash. This payout strengthens JAB’s liquidity while still keeping the company engaged in the coffee market through other investments.

Global Coffee Market Implications

This acquisition changes the landscape of the coffee industry. By combining two powerful names:

- Keurig Dr Pepper now has access to JDE Peet’s global footprint

- The new coffee entity will compete with Nestlé and Starbucks

- A larger portfolio allows more influence in pricing and distribution

The deal underscores how vital coffee remains as a growth driver in the stock market.

Challenges Ahead

While the deal carries potential, several risks exist:

- Integration difficulties: Aligning two global companies is complex

- Market reaction: Initial stock decline reflects investor doubts

- Execution risk: Delivering $400 million in synergies requires discipline

If Keurig Dr Pepper fails to integrate smoothly, the benefits could be delayed or reduced.

What This Means for the Stock Market

This acquisition highlights broader trends:

- Premium deals attract scrutiny: Investors react strongly to high-priced takeovers

- Coffee demand drives strategy: Beverage firms are prioritizing coffee for growth

- Future spin-offs matter: Two separate companies may unlock greater stock market value

For traders and analysts, the next few quarters will reveal whether Keurig Dr Pepper can deliver on its promises.

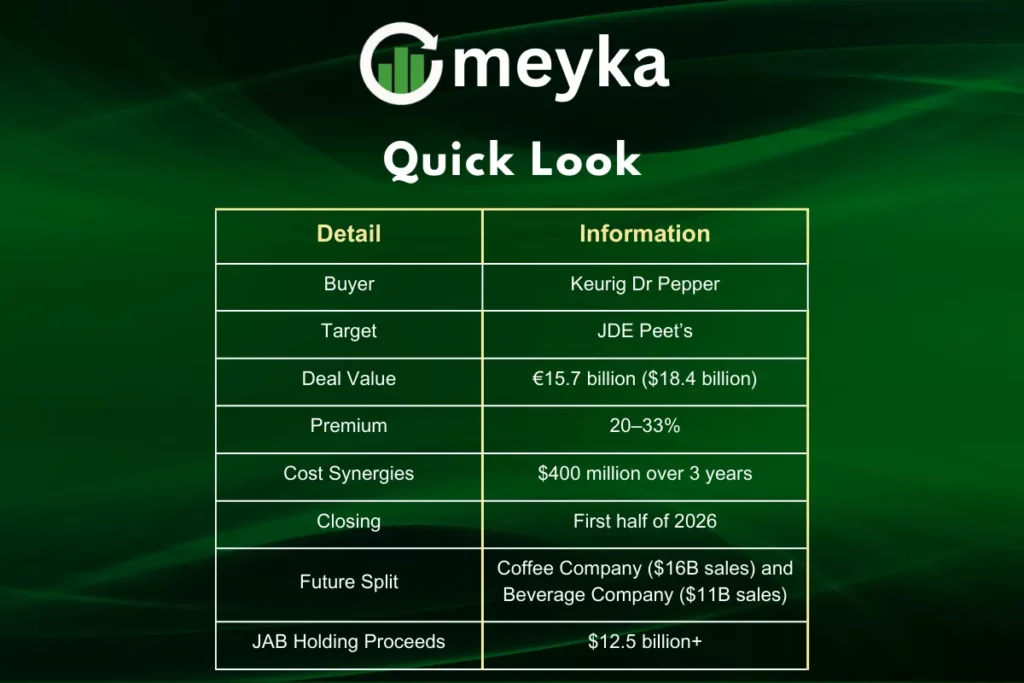

Key Facts in One Look

Conclusion

Keurig Dr Pepper’s $18 billion acquisition of JDE Peet’s marks a major milestone for the company and the worldwide coffee industry. Despite investor caution, the plan to split into two businesses could reshape its future in the stock market. The focus now shifts to execution, as success depends on achieving synergies and strengthening the coffee portfolio.

Frequently Asked Questions

The deal is valued at €15.7 billion ($18.4 billion).

This acquisition strengthens its coffee segment and foreshadows its future as two companies — coffee and beverage.

Shares dropped due to investor concerns about costs, debt, and execution risks.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.