KRBL Shares Fall 12% After Director Resigns Over Governance Issues

KRBL, India’s largest basmati rice exporter, saw its shares drop by almost 12% in one trading day. The fall came after a board director quit, pointing to governance issues. Sudden exits like this often scare markets, and this case was no different. Investors sold quickly, and the stock slipped.

KRBL is not just another company. It is a household name. Its brand, India Gate, is known worldwide. But even strong brands can face storms when governance is in doubt. Good governance builds trust between a company and its investors. Without it, even strong profits may lose value in the market.

The resignation has raised big questions about transparency and accountability. For shareholders, the worry is simple. Can KRBL restore trust?

For the rice industry, the impact is wider. A slip by one leader can shake confidence across the sector. This article looks at the resignation, the stock reaction, and what it means for KRBL’s future.

Background on KRBL

KRBL is one of India’s oldest and largest basmati rice companies. The firm sells under well-known brands and runs big export operations. Over the years, KRBL built a strong presence in retail and wholesale markets at home and abroad. The company has shown steady revenue from rice processing and value-added products, which made it a favorite among many investors. Recent years saw volatile moves in the stock, but KRBL remained a key name in the agri-export space.

Details of the Director’s Resignation

Anil Kumar Chaudhary, an independent director on KRBL’s board, submitted his resignation effective September 8, 2025. His resignation letter, later filed with the stock exchanges, pointed to persistent governance concerns. He said that dissent was often “suppressed or sidelined” and that this environment caused professional and ethical dilemmas for him. The letter described issues that, in his view, were not resolved despite repeated attempts to raise them.

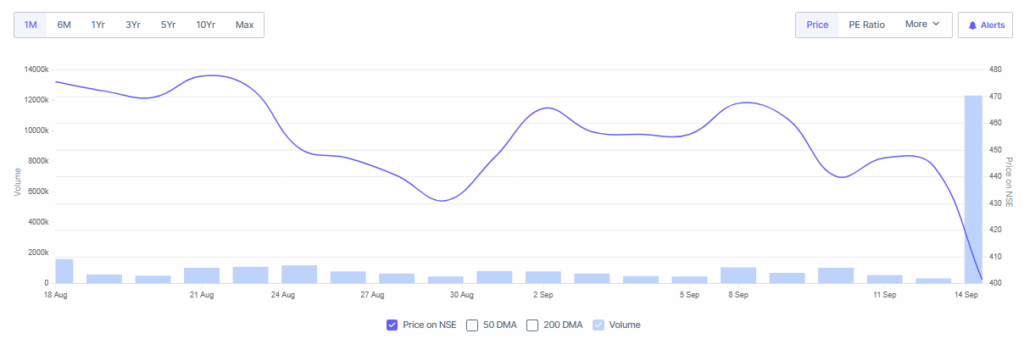

Immediate Stock Market Reaction

Markets reacted sharply after the exchange filing became public. KRBL’s shares tumbled as much as 12–13% in intraday trade and hit an intraday low near ₹387 on the BSE. Trading volumes spiked as retail and institutional participants sold the stock. The fall came even as benchmark indices were largely steady, which underlined that the move was stock-specific and driven by governance worries rather than broader market forces.

Corporate Governance Issues Highlighted

The resignation letter flagged a range of governance gaps. It mentioned inconsistent meeting records, withheld information, and unexplained financial write-offs that made oversight difficult. Such claims strike at the role an independent director is supposed to play: protect minority shareholders and ensure board transparency.

When an independent director raises these points publicly, it raises an alarm about how decisions are made at the highest level. Investors often price in the risk of poor governance by selling first and asking questions later.

Expert Analysis and Investor Views

Analysts described the resignation as a clear governance red flag. Some brokers flagged the potential for short-term volatility and advised caution. Comments on social media and trade forums showed traders worried about the lack of clarity on the issues raised. Long-term investors, however, focused on fundamentals like export demand and margins. For now, sentiment leaned negative because governance concerns hit trust quickly, and trust is hard to rebuild.

KRBL Management Response

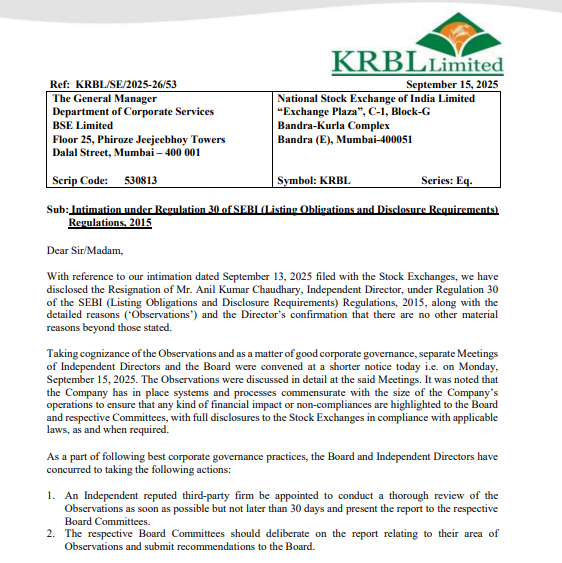

Company management has responded to the situation through exchange filings and public statements. The company said it informed the exchanges promptly after the resignation and noted steps to examine the observations made by the outgoing director. KRBL indicated intent to appoint an independent third-party firm to review the concerns. Management also stressed that business operations were normal and that the board remained committed to governance norms. Investors will watch how quickly and transparently the review is carried out.

Implications for the Rice Industry and Competitors

A governance scare at a market leader can shift buyer and investor focus across the sector. Competitors may see short-term gains if clients or buyers prefer stable partners. Exporters that follow robust corporate practices could attract new contracts or investor flows. However, the underlying demand for basmati rice remains intact. Buyers usually return once clarity emerges, provided contracts and quality stay reliable. The immediate impact is more on perceptions than on the physical rice trade.

Conclusion and Future Outlook

The director’s exit exposed governance cracks that investors could not ignore. The share price drop reflected fear more than operating weakness. The way KRBL handles the independent review will decide how fast confidence returns. Clear, prompt disclosure and corrective actions can calm markets. If management shows openness and fixes problems, the stock can recover. If the review finds material lapses, deeper changes will be needed. For now, monitoring official filings and the third-party review will be critical for anyone tracking KRBL.

Disclaimer:

The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.