Labour Laws Update: Tata Motors to Exit Sensex as IndiGo Joins; HAL Slips After Crash

Markets saw a major shift on 24 November 2025, and it grabbed the attention of both investors and workers. Tata Motors is set to leave the Sensex, while IndiGo will join the index for the first time. At the same time, HAL shares moved lower after a crash involving one of its aircraft. These events may look like simple market updates, but they also highlight deeper issues linked to India’s changing labour laws.

Companies today face new compliance needs, tighter safety checks, and higher pressure to protect workers. Aviation firms must follow strict crew and pilot rules. Manufacturing giants must manage large teams and union demands. Defence firms like HAL must meet strong safety laws to protect their staff and reputation.

So, when the market shifts, it is not only about stock prices. It also reflects how well companies follow labour laws, manage people, and handle new workplace risks. This mix of market action and labour policy makes the recent changes more meaningful for both investors and employees.

Overview of the Recent Labour Law Landscape

India moved to a new labour code framework in November 2025. The government consolidated many older laws into four modern codes. The goal is to standardize rules across states. The codes promise a national minimum wage, social security for gig workers, and clearer safety norms. Employers gain increased flexibility in hiring and shift hours. Trade unions reacted with strong protests and called the reforms harmful to worker rights. The debate is intense and public. The new rules change how large firms plan hiring, contracts, and workplace safety.

Tata Motors’ Exit From the Sensex: Why It Matters?

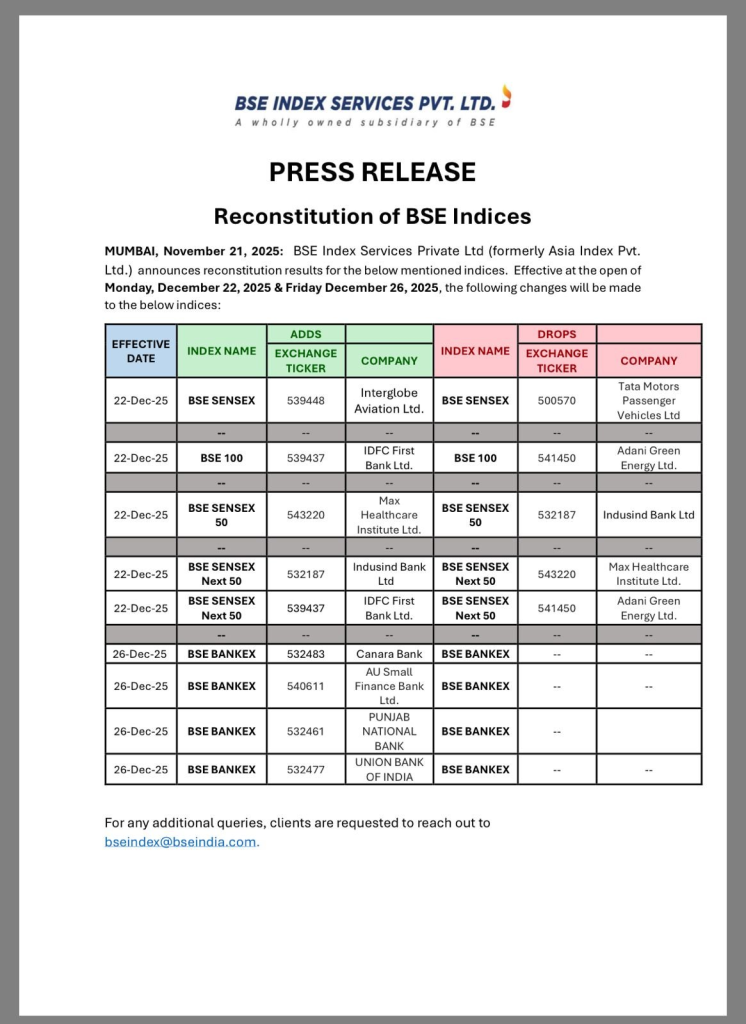

BSE Index Services announced a reconstitution of the Sensex in late November 2025. InterGlobe Aviation (IndiGo) will enter the 30-stock index. Tata Motors Passenger Vehicles (TMPV) will be removed. The reshuffle becomes effective at the market open on 22 December 2025. Index changes reflect market value, liquidity, and sector weight.

A seat on the Sensex brings steady demand from index funds. Losing that seat reduces passive inflows and can pressure a stock in the short term. Analysts view the removal as a signal that passenger vehicle valuations lag recent market leaders.

Labour and Compliance Angle for Tata Motors

Large auto makers employ tens of thousands of workers. New labour rules shift thresholds for layoffs and set clearer contract standards. For carmakers, this affects cost planning and labour flexibility. Firms must now document job offers, wages, and social security more formally. That raises compliance workloads.

It may also change how temporary staff are used. Human resources teams will face more compliance checks. These changes can influence operating costs and, by extension, investor valuations in capital-intensive industries like auto manufacturing.

IndiGo’s Entry: Aviation Meets the Benchmark

IndiGo’s parent, InterGlobe Aviation, earned the slot after rising valuations and market momentum. Aviation is a cyclical, high-growth sector right now. Rising passenger demand has boosted airline revenues and investor interest. Inclusion in the Sensex will likely trigger inflows from passive funds and ETFs. That can lift IndiGo’s share liquidity and visibility.

The airline will face fresh scrutiny on labour practices. Aviation depends on trained pilots, cabin crew, and ground staff. The new labour codes change contract terms and social security benefits for many aviation workers.

HAL Slips After the Tejas Crash: Facts and Fallout

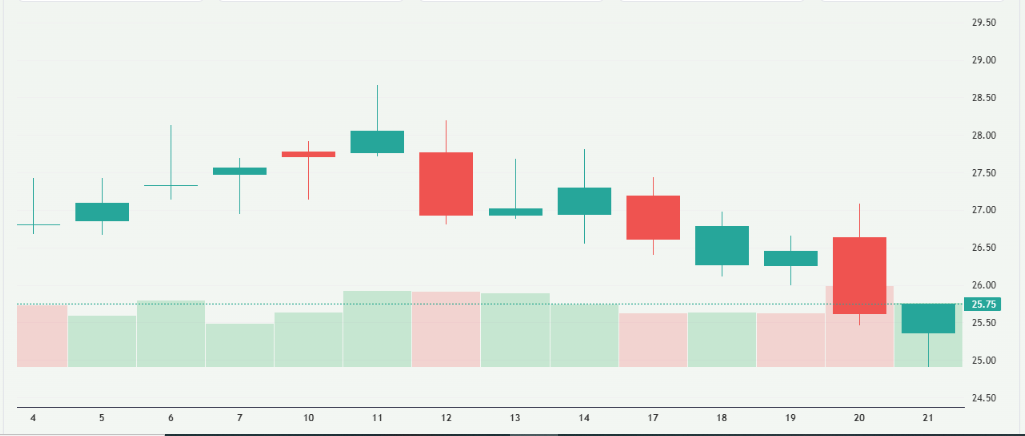

On 21 November 2025, a HAL-built Tejas fighter jet crashed during a display at the Dubai Airshow. The pilot died. The Indian Air Force ordered a court of inquiry. Global videos of the crash circulated widely. HAL’s stock fell sharply after the incident.

Investors reacted to safety concerns and potential program delays. Defence-sector reputations hinge on safety and quality. A high-profile crash can slow pending orders and export talks. Markets often price such risks quickly.

Labour, Safety, and Corporate Reputation

Aviation and defence firms have narrower margins for error on safety. New labour codes place greater emphasis on occupational safety and medical checks. For HAL, this means more intense public and regulatory scrutiny of maintenance, pilot training, and manufacturing standards.

Firms may face longer internal probes. They may need to expand safety audits and worker training. That can raise near-term costs. Yet rigorous safety upgrades also restore long-term trust. Investors watch both the pace of corrective action and the transparency of reporting.

Market Rebalancing: How Labour Laws Changes Link to Index Moves?

Index reshuffles and labour reforms are not independent events. Labour law changes alter cost structures and risk profiles for big employers. Index providers consider financial health and sector trends when rebalancing. The removal of an automaker and the addition of an airline reflect where growth and investor confidence sit today.

Portfolio managers adjust holdings to match the new index weights. An AI stock research analysis tool flagged expected flows into aviation stocks after the BSE announcement, underscoring how algorithmic strategies react to index news. These flows can magnify short-term moves.

What does this mean for Employees and Companies?

For employees, the codes promise better documented wages and extended social security. Gig and contract workers get recognition. That can improve job security and access to benefits. At the same time, unions fear longer shifts and easier hiring-and-firing rules. For companies, the rules mean more paperwork and compliance costs. Firms must upgrade payroll systems, safety audits, and HR policies. Firms with strong governance will adapt faster. Those with weak compliance will face fines, strikes, or reputational damage.

Practical Steps Companies Can Take Now

Companies should audit HR and safety processes. Update contracts to match the new codes. Strengthen training and medical checks. Improve record-keeping for wages and hours. Communicate changes clearly to staff and unions. Transparent action limits business disruption. Investors will reward firms that show swift, credible compliance. A clear safety review and public timeline can help calm markets after incidents like the Tejas crash.

Wrap Up

The late-November 2025 market events are more than headline moves. The Sensex reshuffle, driven by BSE’s decision announced on 21 November 2025 and effective 22 December 2025, shows which sectors attract investor capital today. The Tejas crash on 21 November 2025 highlighted how safety and labour compliance affect market confidence.

The new labour laws implemented in November 2025 create a new operating reality for big employers. Companies must act fast on compliance and safety. Employees stand to gain clearer rights. Markets will reward firms that manage both people and risk well.

Frequently Asked Questions (FAQs)

Tata Motors will leave the Sensex on 22 December 2025. Its market value fell compared to other companies. Index rules pick stocks with higher market cap and liquidity.

IndiGo entered the Sensex on 22 December 2025. It shows strong growth and investor confidence. The move may increase trading and attract more funds to the airline.

On 21 November 2025, a Tejas fighter jet crashed. HAL shares fell after safety concerns. Investors worry about delays, costs, and stricter safety rules for the company.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.