LG Electronics India Shares May Jump 83%, Motilal Oswal Forecasts

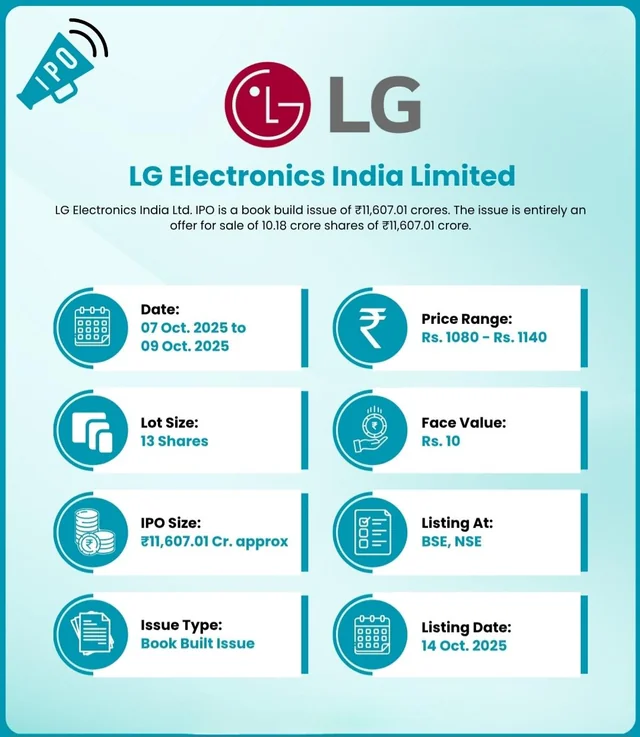

On October 14, 2025, LG Electronics India debuted on the stock exchange. Its shares jumped over 50% on the first day. This strong start drew attention from investors and analysts. The company is now seen as a key player in India’s growing electronics market.

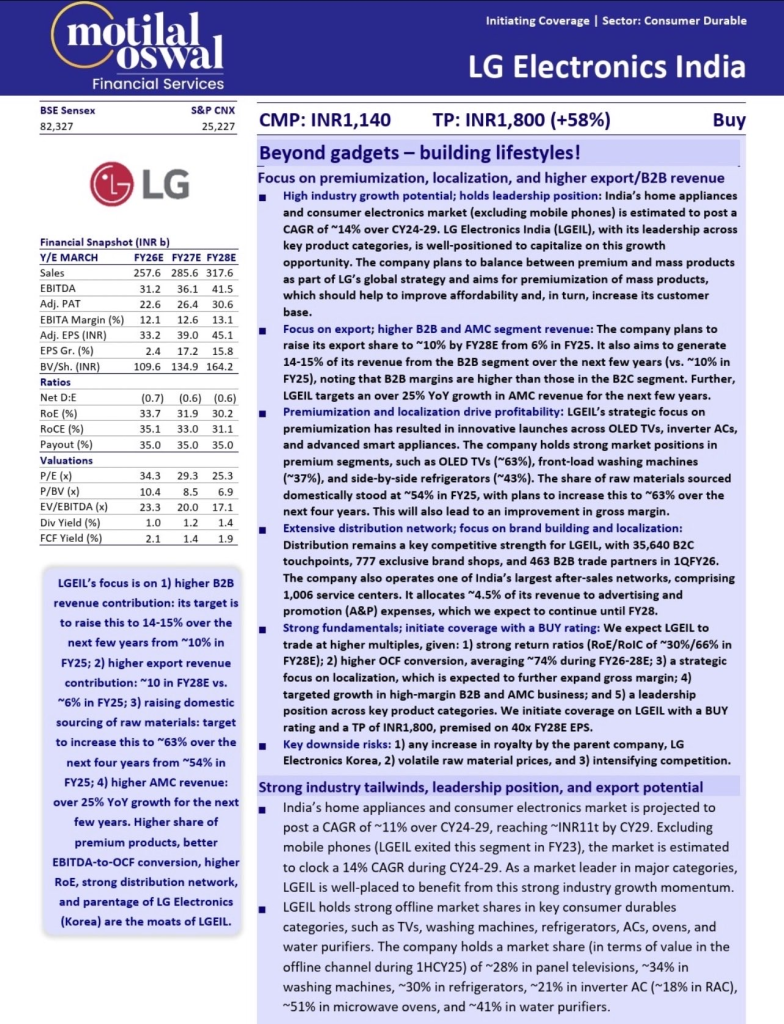

Motilal Oswal Financial Services gave LG Electronics India a ‘Buy’ rating. They set a target price of ₹1,800 per share. This shows a potential 58% rise from the issue price of ₹1,140. In a bullish scenario, the stock could reach ₹2,085, giving an 83% gain.

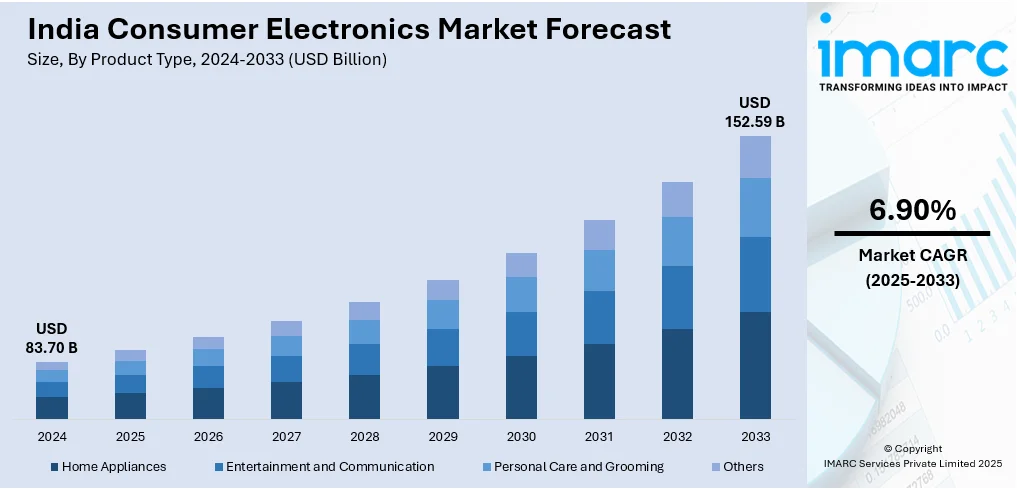

The positive outlook comes from several factors. India’s consumer durables market is growing at about a 14% CAGR from 2024 to 2029. Rising incomes and a larger middle class are driving demand. LG’s strong brand and leadership in key products make it ready to benefit.

The company focuses on localization, premium products, and high-margin segments like AMC and B2B services. These moves can boost profits and efficiency.

This article will explore why LG Electronics India’s debut was strong, why Motilal Oswal is bullish, and what investors should know.

LG Electronics: Company Overview

LG Electronics India is a part of South Korea’s LG Electronics Inc. It is a major player in India’s electronics and home appliances market. The company sells refrigerators, washing machines, air conditioners, and televisions. These products meet the needs of Indian consumers.

The company has a strong brand and focuses on innovation. This has helped it build a loyal customer base across the country. Its wide distribution network makes its products easily available. LG also emphasizes quality and after-sales service, which strengthens its position in the market.

In recent years, LG Electronics India has improved its product range and manufacturing. It invests in research and development to make energy-efficient appliances and smart home solutions. This matches the growing demand for sustainable and connected living. On October 14, 2025, the company made a strong debut on the Indian stock exchange. Its shares rose over 50% on the first day, catching the attention of investors and analysts.

Motilal Oswal’s Forecast

Motilal Oswal Financial Services has given LG Electronics India a ‘Buy’ rating. They set a target price of ₹1,800 per share. This shows a possible 58% gain from the issue price of ₹1,140. In a bullish scenario, the stock could reach ₹2,085, an 83% increase.

The firm expects strong earnings growth for LG Electronics India. It predicts about 10% growth in EBITDA and 12% growth in profit after tax from 2025 to 2028. Return on equity is expected to reach 30%, and return on invested capital could be 66% by 2028.

LG focuses on local sourcing and manufacturing, which should improve margins. The company is also growing in high-margin segments like B2B and AMC services. Its leadership in key products like washing machines, refrigerators, and air conditioners gives it a market advantage.

Key Drivers Behind the Expected Surge

India’s consumer durables market is growing fast, with a 14% CAGR expected from 2024 to 2029. Rising incomes and urbanization are boosting demand. LG Electronics India invests in product innovation. Energy-efficient and smart appliances meet consumer needs for modern and sustainable products. Its strong brand builds trust and loyalty, keeping demand high.

The company has a large distribution network with thousands of retail points and service centers. Its strategic focus on local production, B2B growth, and AMC services should help revenue and profits grow.

Risks and Challenges

The market is highly competitive. Companies like Samsung, Sony, and Whirlpool compete for market share. Economic factors, such as inflation and interest rates, can affect sales. Supply chain issues, like shortages of materials, may slow production. Regulatory changes, import duties, or new policies could increase costs. Currency fluctuations can also affect profits, as the company trades internationally.

Expert Opinions and Analyst Insights

Several analysts have shared their views on LG Electronics India. Emkay Global Financial Services set a target of ₹2,050 per share, citing strong brand and market leadership. Anand Rathi gave a ‘Buy’ rating with a target of ₹1,725, pointing to innovation and good after-sales service.

Antique Stock Broking also set a target of ₹1,725, highlighting strong financials. Equirus Securities recommended a ‘Long’ position, with a target of ₹1,705. These views show confidence in LG Electronics India’s growth potential.

Investment Outlook for Retail and Institutional Investors

LG Electronics India is an interesting option for investors. Its current valuation and expected growth make it appealing. The company has a good record of paying dividends, which provides regular income. Its focus on innovation, local production, and expansion supports long-term growth. Strong fundamentals and market leadership help reduce risk. Investors should still do careful research and consider their goals and risk tolerance before investing.

Final Words

LG India had a strong stock market debut. Leading brokerages have given bullish forecasts. The company is well-positioned in India’s growing electronics and home appliances market. Its focus on innovation, local manufacturing, and expansion should drive long-term growth. However, risks from competition, the economy, and regulations remain. Investors should make decisions based on careful analysis and their financial goals.

Frequently Asked Questions (FAQs)

On October 14, 2025, Motilal Oswal set LG Electronics India’s target price at ₹1,800. This suggests a possible gain of 58% from its issue price of ₹1,140.

LG Electronics India shares rose over 50% on October 14, 2025. Strong demand, a popular brand, and investor confidence in growth drove this significant stock market debut.

As of October 14, 2025, analysts are optimistic about LG Electronics India. The company shows strong growth potential, but risks like competition and market changes remain, so caution is advised.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.