Lyft Announces Pricing of $450 Million Convertible Senior Notes Offering

Lyft has taken another bold step in its financial journey. The company recently announced that it will raise $450 million through a convertible senior notes offering. For those of us watching the ride-hailing market, this is more than just a funding update. It reflects where Lyft stands today and how it plans to compete in the fast-changing mobility industry.

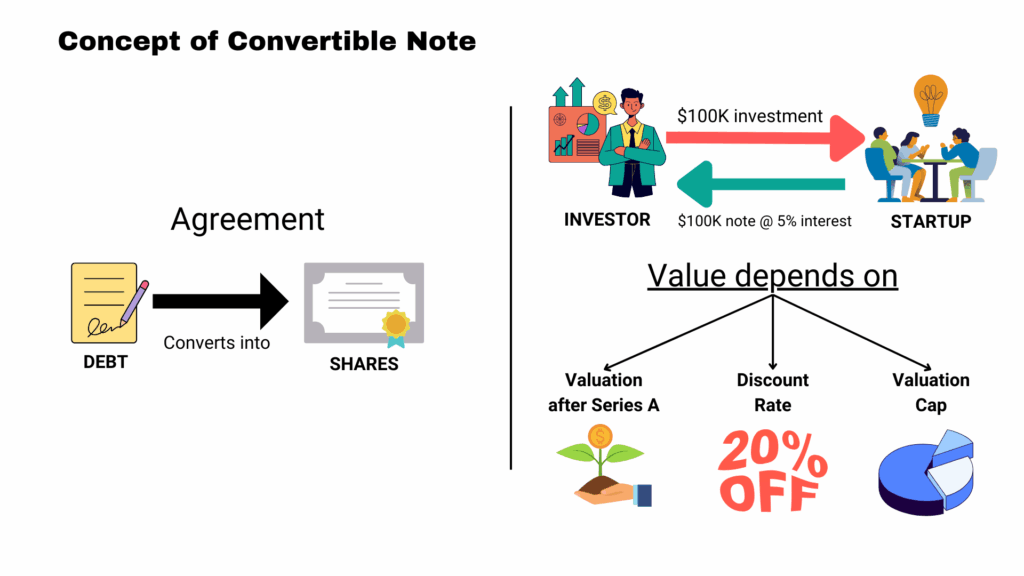

We know Lyft has been working hard to cut costs, improve efficiency, and win back investor confidence. Choosing convertible notes shows the company wants to secure capital without directly issuing more stock, which can cause dilution. At the same time, it gives investors a chance to convert debt into equity if the stock performs well.

This move comes at a time when ride-hailing demand is steady, but competition and regulation still bring challenges. We look deeper into this decision and can see what Lyft hopes to achieve and what it could mean for its future growth.

Details of the Offering

Lyft has priced a private offering of $450 million in convertible senior notes due 2030. The notes will be senior and unsecured obligations of the company. The offering includes an option for initial purchasers to buy an additional $50 million. The sale is expected to settle on September 5, 2025, and net proceeds are estimated at about $438.8 million after discounts, commissions, and estimated expenses.

The notes will mature on September 15, 2030, unless they are earlier redeemed, repurchased, or converted. Lyft may not redeem the notes before September 20, 2028, and any redemption after that date would be subject to customary conditions tied to the company’s stock performance.

Initial terms show the notes are convertible into cash, Class A common stock, or a combination of both. The initial conversion rate is 42.5170 shares per $1,000 principal, which equals a conversion price near $23.52 per share. That represents a roughly 40% premium over Lyft’s closing price on September 2.

Why does Lyft Choose Convertible Senior Notes?

Convertible senior notes let a company borrow now with the option to convert the debt into equity later. This typically lowers near-term interest cost versus straight debt. It also gives investors a chance to gain from future stock upside. For Lyft, that trade-off helps raise capital while limiting immediate dilution for current shareholders. The capped call transactions tied to the deal can further protect against conversion-related dilution for shareholders.

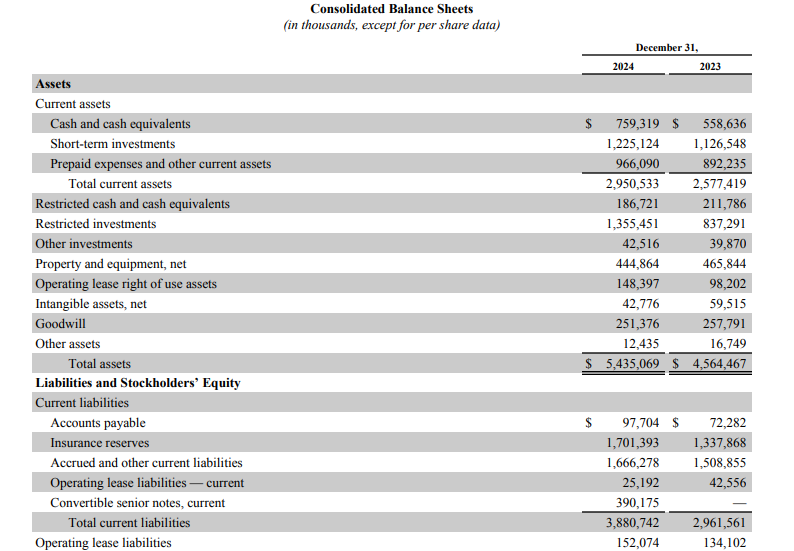

Current Financial Position and Where this Fits

Lyft has pushed to improve operating efficiency over recent quarters. Revenue growth and margin improvements have shown progress, but the company still manages a careful balance between growth investment and profitability. Adding convertible notes strengthens the balance sheet and provides cash to execute near-term priorities without a full equity issuance. Recent filings indicate Lyft holds enough liquidity to operate, but targeted capital raises like this one help preserve optionality for expansion or strategic moves.

Market Context and Timing

The broader ride-hailing sector is in a steady but competitive phase. Ridership recovered after pandemic lows, and many platforms are chasing improved profitability, not just top-line growth. Interest-rate pressures and tighter capital markets have made creative financing tools more common. Convertibles are attractive in this environment because they let firms lock in financing now while offering investors equity upside later. Analysts often view such deals as signals that management expects stock appreciation over time, or at least wants to avoid immediate share dilution.

Planned Uses of the Proceeds

Lyft stated net proceeds will cover the cost of the capped call transactions tied to the offering. A portion will also be used to repurchase up to about $100 million of Class A common stock from institutional investors at the market price on the pricing date. The remaining funds will strengthen liquidity and provide flexibility for corporate needs. These steps aim to manage dilution risk and return some capital to the market in a controlled way.

Investor Reaction and Market Impact

Initial market reaction showed heightened interest from institutional buyers, since this was a Rule 144A private placement to qualified institutional investors. The conversion premium and the capped-call protections helped make the notes more appealing. Early media coverage noted that the conversion price sits well above the trading price at the time of pricing, which reduces immediate dilution and signals confidence in future share performance. Stocks in this sector often respond to such deals with mixed signals: investors like the balance-sheet boost, but some worry about eventual conversion.

Risks and Challenges

Convertible notes carry conversion risk for existing shareholders. If the stock rises above the conversion price, holders may convert, increasing share count. That causes dilution over time. If Lyft faces slower revenue growth or margin pressure, the company still has the debt obligation until maturity. Macroeconomic or regulatory shocks in the gig economy could also affect future cash flows and share price, which in turn affects whether conversions happen. Finally, redeemable features and capped-call costs are additional financial factors to watch.

Broader Implications for the Tech and Mobility Sectors

This offering fits a trend where tech and mobility firms opt for hybrid financings. Convertibles balance current financing needs with possible equity upside for investors. In some cases, these deals act as a middle ground when pure equity offerings would be too dilutive and straight debt would be too expensive. Other companies in the space have used similar structures, signaling that convertible instruments remain a viable tool for growth-focused firms navigating tighter capital markets.

Conclusion and What to Watch Next?

The $450 million convertible senior notes give Lyft cash and optionality. The structure aims to limit near-term dilution while offering investors upside. Key items to watch are the company’s use of funds, whether the $100 million buyback happens, and how the stock trades relative to the $23.52 conversion price. Also monitor quarter-to-quarter operating progress, regulatory updates, and any further capital moves. These factors will determine whether the notes help Lyft reach sustained profitability or simply delay tougher financing choices.

Frequently Asked Questions (FAQs)

Lyft’s $450 million convertible senior notes, announced on September 3, 2025, are loans that can later change into Lyft’s stock, giving investors possible future ownership benefits.

Lyft will use the money for capped call transactions, repurchase up to $100 million of Class A shares, and support general corporate needs, according to its September 2025 statement.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.