Markets Update: ASX Dips, DroneShield Momentum Continues

On October 1, 2025, the Australian share market opened weaker, extending the cautious mood we have seen in recent weeks. The ASX 200 slipped, with investors reacting to softer commodity prices and ongoing worries about global growth. Many sectors struggled to find direction. Banking and mining stocks were under pressure, while defensive sectors held steady.

Yet, in the middle of this market dip, DroneShield (ASX: DRO) continued to stand out. The defense technology company has been gaining momentum, supported by rising demand for counter-drone solutions. With global security risks on the rise, investors are showing strong interest in companies that can deliver next-generation defense tools.

What makes this story interesting is the contrast. While the broader ASX reflects caution and uncertainty, DroneShield shows resilience and growth. It highlights how niche sectors can move differently from the wider market. In today’s update, we look at the ASX performance, key sector moves, and why DroneShield continues to capture investor attention despite market headwinds.

ASX Market Overview

On October 1, 2025, the ASX was weaker. The ASX 200 slipped as traders reacted to mixed global cues and firmer local rates talk. Commodity prices softened, and that hit miners. Big banks also gave up ground on profit-taking and caution about margins. Market breadth narrowed. A few defensive names held up, but most cyclical stocks moved lower. Investors showed caution ahead of key economic data and corporate updates due next week.

Sectoral Performance

Financials dragged the index lower. Major banks dipped after interest-rate worries resurfaced. Mining saw mixed moves. Iron ore and oil traders pushed some miners down. Materials that supply green energy projects held firmer. Technology names were volatile, with profit-taking in high-flyers. Healthcare posted small gains as investors sought safe earnings. Overall, the market tone was cautious.

Spotlight on DroneShield

DroneShield has been a standout. The company makes counter-drone and electronic-warfare gear. On September 17, 2025, DroneShield announced two contracts worth AUD 7.9 million for handheld systems for a U.S. Department of Defense customer. The company also said it had passed 4,000 systems sold worldwide. Those updates pushed investor interest higher in late September.

DroneShield joined the S&P/ASX 200 in late September. That inclusion raised the stock’s profile. Index funds and ETFs that track the ASX 200 need to buy shares. That created upward price pressure. The move also made the stock more visible to global investors.

Drivers of DroneShield’s Momentum

Rising global threats drive demand for anti-drone tools. Governments and airports want systems that detect and stop rogue drones. Higher defense budgets in several countries help sales. DroneShield’s recent orders show practical demand for portable, field-ready systems. The company also reported stronger periodic revenue and improving margins in its mid-2025 results. That combination of orders, sales momentum, and index inclusion explains the recent rally.

Technology wins matter too. DroneShield bundles sensors, radio-frequency tools, and software. The product mix helps in both military and civilian markets. Winning US DoD contracts adds credibility. That opens doors to new partners and bigger deals. Analysts say the company still faces execution risk. But the pipeline looks healthier now than a year ago.

Broader Defense Sector Outlook

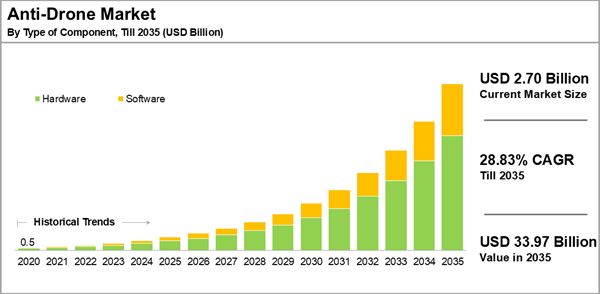

The near-term outlook for anti-drone tech is strong. Market research firms expect the anti-drone market to expand rapidly from 2025 to 2030. Growth is driven by more drone sightings near sensitive sites. Airports, stadiums, and military bases are investing in detection and disruption systems. This broader demand supports companies like DroneShield and helps justify higher valuations for niche defense tech names.

Competition is rising. Larger defense contractors and several specialists are boosting R&D. Market share gains will depend on delivery speed, technical performance, and after-sales support. Regulatory approvals and export controls can also shape which countries become customers. These factors matter for long-term growth and margins.

Market Analysts’ Views

Analysts have mixed takes. Some highlight the strong order flow and rising revenues. Others warn that small-cap defense stocks can be volatile. Price jumps after contract news often draw profit-taking. Inclusion in the ASX 200 helps with liquidity. But it also raises expectations for consistent performance. For traders, the stock looks attractive on momentum. For long-term investors, the valuation must be weighed against execution risk and geopolitical shifts.

What Investors Should Watch?

Watch earnings and guidance updates from DroneShield. New contract announcements will remain the key catalyst. Also, monitor deliveries and cash collection timelines for large orders. For the ASX, focus on upcoming economic data and any Reserve Bank commentary that could change rate expectations. Use an AI stock research analysis tool for quick screens, but always read the full company releases. Pay attention to trade volumes when the stock moves sharply, since momentum can reverse quickly.

Risks to Consider

Supply chain delays could slow deliveries. Export or regulatory rules may limit sales in some markets. Competition could push down gross margins over time. Political shifts can both create demand and add uncertainty. Lastly, small-cap stocks can move fast in either direction. That makes risk management and position sizing vital for any investor holding DroneShield.

Wrap Up

On October 1, 2025, the ASX showed caution. Many sectors paused amid global uncertainty. Yet DroneShield stood apart. Recent DoD orders, surpassing 4,000 systems sold, and ASX 200 inclusion helped the stock rally. The anti-drone sector’s long-term story is solid. But the path may be bumpy. Investors should watch company updates closely. Strong news will fuel gains. Execution and margins will decide how big those gains can be.

Frequently Asked Questions (FAQs)

The index slipped due to weaker commodity prices, global growth worries, and pressure on major banks and miners.

DroneShield gained momentum from new defense contracts, rising demand for anti-drone tech, and its inclusion in the ASX 200 index.

Analysts see growth potential in defense tech, but note risks like competition, regulation, and market volatility.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.