MCX Gold Price Today: ₹13,000 Crash From Peak Sparks Investor Debate

On 28 October 2025, the price of gold futures on the Multi-Commodity Exchange of India (MCX) witnessed a sharp fall, plunging by around ₹13,000 per 10 grams from its recent highs. This steep decline has triggered a vigorous debate among investors and market watchers alike.

Many are scratching their heads: is this sudden drop a momentary blip or the beginning of a deeper correction? As global economic cues shift and domestic factors weigh in, gold’s shine appears to be dimming for now.

Let’s explore what caused the fall, how it compares with past gold corrections, how investor sentiment has responded, and most importantly, what this means for anyone holding or thinking about buying gold today.

MCX Gold Price Overview

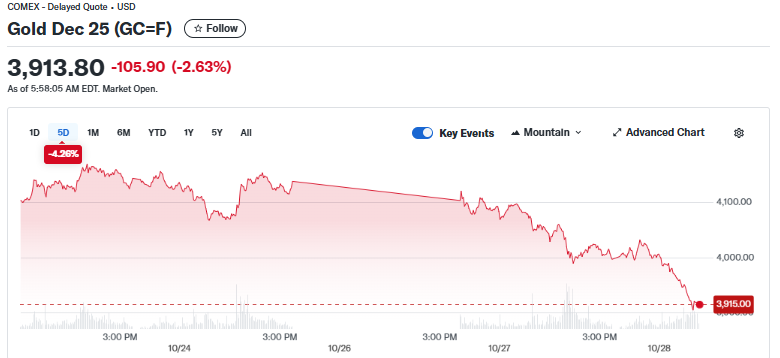

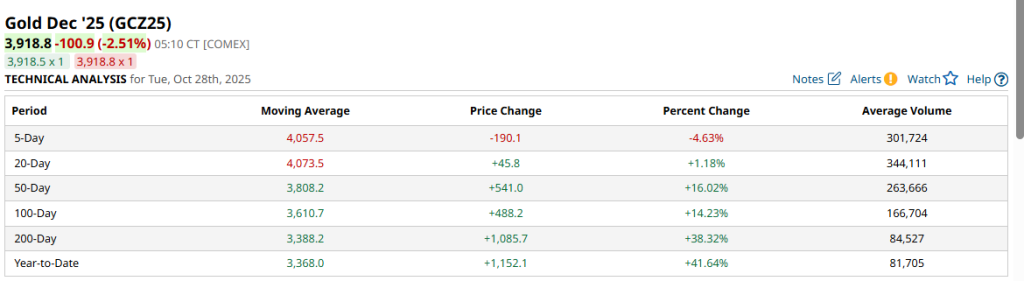

On October 28, 2025, MCX gold futures traded well below recent highs. The contract for December delivery fell to near ₹1.19 lakh per 10 grams after a steep slide from the peak. The drop from the record highs amounted to about ₹13,000 per 10 grams, a fall that has shaken short-term market sentiment. International bullion also eased, with COMEX gold slipping sharply on the same session.

What Triggered the ₹13,000 Price Fall?

Several factors combined to push gold lower on October 28, 2025. Profit booking followed a long rally that took gold to record levels in mid-October. Traders who bought the rally used the uptick to lock gains. At the same time, investors moved to cash and fixed income as US Treasury yields rose. Higher real yields reduce the appeal of non-yielding assets like gold.

The market also reacted to rising hopes of a clearer path on US interest-rate policy ahead of the Federal Reserve meeting. Improved risk appetite from easing trade-related headlines further reduced immediate safe-haven demand.

International Picture: COMEX and Global Cues

Global bullion followed a similar pattern. COMEX gold lost ground on October 28 as futures pulled back after a months-long rally. Dollar strength and higher long-term bond yields were key drivers. Geopolitical fears had supported gold earlier in the month, but those pressures softened. Spot prices in USD registered a notable intraday fall, which filtered into India after accounting for currency and local market dynamics.

Domestic Factors that Amplified the Decline

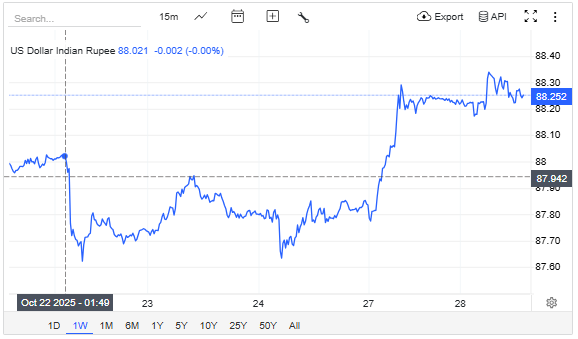

India’s gold market is sensitive to the rupee and local physical demand. On October 28, 2025, the rupee’s intraday moves added to volatility. A relatively firmer rupee in parts of the month had made imported bullion cheaper, reducing the local price cushion as global prices fell.

Seasonal demand patterns also played a role: buying ahead of festivals was strong earlier, but last-mile discretionary purchases slowed after the record highs. The import duty structure and inventory flows at bullion dealers influenced immediate supply and pricing in the domestic spot and futures market.

Investor Reaction and Market Sentiment

Retail traders showed mixed reactions. Some used the dip to add small positions. Others cut exposure to protect gains. Institutional flows were cautious ahead of the Fed decision. Exchange-traded funds and commodity funds trimmed positions in the short term, while longer-term holders maintained mandates tied to inflation hedging.

Social chatter and trading forums reflected two camps: those calling the dip a buying window and those warning of further corrections if global yields continued to climb.

Historical Context: Is this Unusual?

Large intraday or intra-month moves are not new for gold. The metal has seen sharp pullbacks during past Fed rate cycles and during rapid shifts in the dollar or bond market. Earlier corrections in recent years often ended with consolidation and then resumed the prior trend when macro drivers, like inflation or monetary easing, returned.

Comparing the current fall with earlier corrections suggests the move fits a short-term profit-taking pattern rather than a structural break, though that depends on upcoming central bank signals and macro data.

Expert Opinions and Technical Outlook

Analysts are split on the near term. Some emphasize that fundamentals remain intact for gold over the medium term. They point to persistent inflationary pressures globally and continued central-bank balance sheet uncertainties. Others warn that a sustained rise in real yields could push gold lower before any rebound.

Technical analysts highlight support levels around ₹1.12-1.15 lakh per 10 grams on MCX, with resistance near last month’s peaks. Traders should watch daily close levels and volume for clear trend confirmation.

Practical Advice for Different Investor Types

Short-term traders should wait for a clear trend signal. Trading on intraday volatility requires tight risk controls and predefined stop levels. Swing traders may use technical support zones to enter, but should size positions for the possibility of a deeper correction. Long-term investors who buy gold as an inflation hedge can average into positions rather than commit all funds at once.

Consider diversification: sovereign gold bonds, ETFs, and small physical allocations can reduce storage and liquidity friction. Digital gold platforms offer fractional access but come with counterparty considerations. Avoid emotional trading driven by headlines.

Wrap Up and What to Watch Next

The ₹13,000 fall from the peak on October 28, 2025, highlights gold’s short-term sensitivity to yields, the dollar, and profit taking. The medium-term outlook depends on two key items. First, the US Federal Reserve’s guidance after its meeting.

Second, the path of global real yields and any renewed geopolitical shocks. If yields stabilize and inflation remains elevated, gold could reclaim a portion of the recent losses. If yields keep rising, pressure may persist. Monitor Fed commentary, US Treasury yields, COMEX moves, and USD/INR for the clearest signals.

Frequently Asked Questions (FAQs)

On October 28, 2025, MCX gold prices fell because of profit booking, a strong US dollar, and rising bond yields that reduced investor demand for gold.

Experts say investors should wait for market stability. Buying in small amounts during dips is safer than investing all the money at once after a sharp fall.

On October 28, 2025, MCX gold futures traded near ₹1.19 lakh per 10 grams, showing a decline of around ₹13,000 from the recent record highs.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.