Medicare 2026 Premiums: What’s Behind the Nearly 10% Increase

Medicare costs continue to rise each year, but the jump expected in 2026 is getting extra attention. Early projections from health policy experts in 2025 show that Medicare premiums may rise by nearly 10% in the coming year. This increase comes at a time when many older individuals are already struggling with higher prices for daily needs. It also raises questions about why healthcare is getting so expensive so quickly.

Many factors are pushing these premiums upward. New medical treatments cost more. Hospitals face higher operating expenses. More Americans are turning 65 each year, which means more people are using Medicare services. All these pressures add up and shape the premiums that millions of people must pay.

This coming change is not just a number. It will affect real households and real budgets. Understanding what is driving the increase can help older citizens plan. It also helps families support loved ones who depend on Medicare for care.

What are Medicare Premiums?

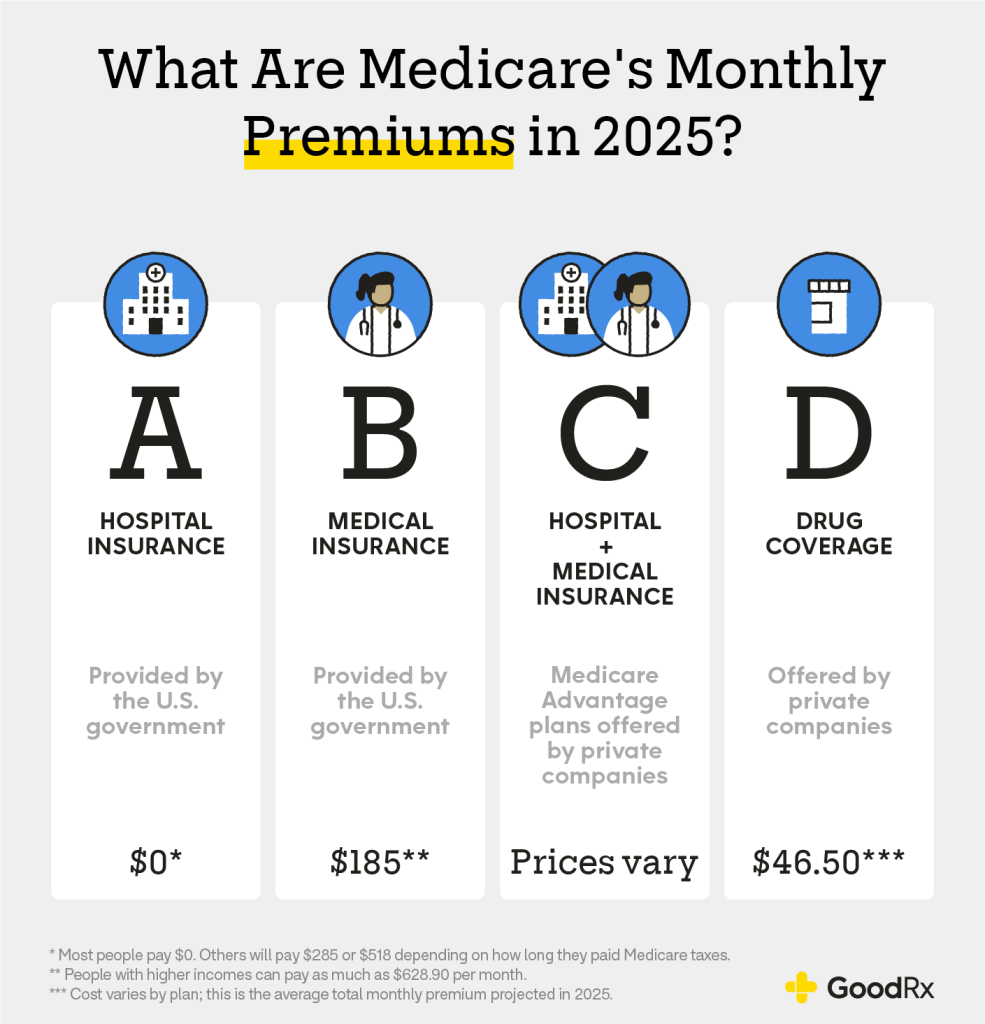

Medicare premiums are monthly fees for parts of the program. Part A is usually premium-free for most people who paid Medicare taxes while working. Part B covers doctor visits, outpatient care, and some medical equipment. Most people pay a monthly Part B premium. Part D covers prescription drugs and also uses monthly premiums. Premiums are separate from deductibles and copays. The Social Security Act and CMS rules determine the yearly Part B premium and deductible.

Summary of the Medicare 2026 Premiums Increase

CMS set the standard Part B premium at $202.90 per month for 2026. That is $17.90 more than the $185 charged in 2025. The Part B deductible will rise to $283 in 2026, up from $257 in 2025. These figures were announced by CMS on November 14, 2025. For many beneficiaries, the change represents just under a 10 percent jump in the Part B premium.

The national base Part D premium is also projected to rise. Insurers and analysts expect the full-year average Part D premium to reach about $615 in 2026, from roughly $590 in 2025. That figure reflects expected increases in drug spending and plan adjustments.

Key Factors Driving the Nearly 10% Increase

Rising prices across health care are the core reason. Hospitals and clinics face higher labor and supply costs. Those higher costs push up insurer payments. More advanced and costly treatments also drive spending. Specialty drugs and biologics have particularly steep price tags. When such drugs shift from private plans into Medicare coverage streams, premiums respond.

Use trends in durable medical products and wound-care therapies as a case in point. Spending on certain skin-substitute products has exploded over recent years. CMS said tightening payment rules for those products eased what could have been an even larger premium increase. Without the rule change, the Part B premium would have been higher. This single policy tweak lowered the final premium by several dollars per month.

Population aging also matters. The group of Americans turning 65 each year is growing. Older cohorts generally need more care. That raises utilization and per-beneficiary costs. Chronic diseases that require ongoing management add steady demand for services. The Congressional Budget Office and other analysts note that per-enrollee costs for drugs and services have been trending upward.

Finally, short-term fiscal shifts in Medicare’s accounting and trust fund projections can change premiums. Actuarial calculations use recent spending patterns to set the next year’s premium. When the expected total cost of Part B rises, the standard premium rises too. The Federal Register documents the actuarial basis for the 2026 rate.

Medicare 2026 Premiums: Impact on Medicare Beneficiaries

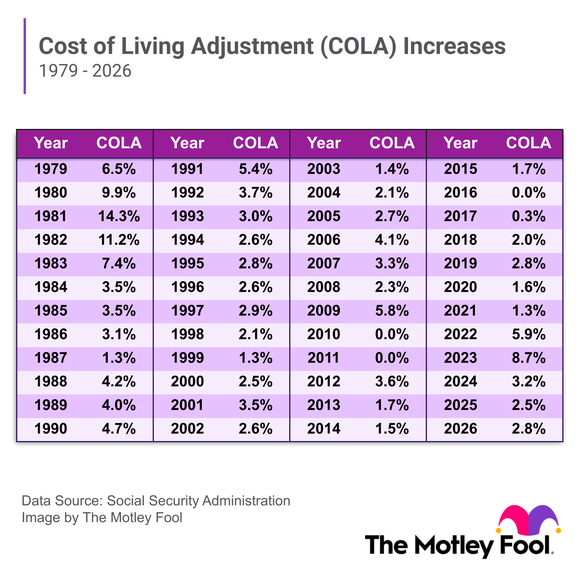

The bump will tighten budgets. For someone paying the standard premium, monthly costs will rise by $17.90. For households on a fixed income, that sum matters. Social Security’s 2026 cost-of-living adjustment (COLA) is smaller than the premium rise for many. Media analysis shows the Part B increase will consume a significant share of the average COLA for many beneficiaries. Those who rely on automatic Social Security deductions will see the premium taken out before payment arrives.

Higher-income beneficiaries still face income-related monthly adjustments (IRMAA). Those surcharges remain in place and may climb with income thresholds and bracket updates. About a small percentage of enrollees pay higher rates based on past tax returns. At the same time, programs that shield low-income people continue. The “hold harmless” rule limits premium effects for some Social Security recipients.

Part D cost increases affect drug affordability. Premiums, formularies, and cost-sharing often change year to year. Those who take expensive specialty medicines may face larger out-of-pocket exposure unless protected by low-income subsidies or supplemental coverage. Plan sponsors may shift benefit designs to manage cost pressures.

How Beneficiaries Can Prepare for 2026?

Review plan options during Open Enrollment. Compare not only premiums, but also deductibles and drug formularies. Check whether a preferred drug is in a plan’s tier. Also, survey provider networks for preferred doctors. Use official CMS tools and trusted counseling services. Consider eligibility for Medicare Savings Programs or the Low Income Subsidy for Part D. These programs can offset premium and cost-sharing burdens for eligible people.

Manage care proactively. Ask about lower-cost therapeutic alternatives. Discuss generic options with prescribers. Use preventive care visits to manage chronic conditions. For broader planning, financial advisors or a licensed counselor can show how the premium change affects retirement budgets. An AI tool can help spot patterns in spending and plan choice, though human guidance is essential for final decisions.

Medicare 2026 Premiums: Will it Keep Rising After 2026?

Longer-term trends point to continued upward pressure. Demographic shifts, drug pipeline costs, and medical technology advances are structural drivers. Policy changes could blunt some increases. For example, tighter payment rules or drug pricing reforms would affect future premiums. The Congressional Budget Office and Medicare trustees publish periodic forecasts that show moderate growth, but actual year-to-year swings can be large. Monitoring those reports is important for beneficiaries and policymakers.

Bottom Line

The 2026 Part B premium increase to $202.90 is a clear sign of the cost pressures facing Medicare. The rise stems from higher service costs, expensive therapies, and increased use. The change was announced on November 14, 2025, and will affect millions next year. Careful plan review and use of assistance programs can reduce the shock for many households. Policymakers and analysts will watch whether new rules or reforms can slow future premium growth.

Frequently Asked Questions (FAQs)

Medicare is rising in 2026 because healthcare costs increased in 2024 and 2025. New treatments, higher hospital expenses, and more older citizens using services pushed prices higher for the next year.

The Medicare Part B premium for 2026 is $202.90 per month, announced on November 14, 2025. This is higher than the 2025 premium due to increased medical spending.

The 2026 premium may lower your Social Security payment because it is taken from your monthly check. The final effect depends on your 2026 cost-of-living adjustment.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.