Meta Partnership With Scale AI Shows Signs of Strain

Artificial intelligence is changing fast, and every big tech company is racing to stay ahead. Meta, the parent company of Facebook, Instagram, and WhatsApp, has placed huge bets on AI. From building smarter chatbots to developing large language models like Llama, Meta wants to be a global AI leader. To speed up this journey, it joined hands with Scale AI, a startup known for providing massive volumes of labeled data and infrastructure that trains machine learning systems.

At first, this partnership looked like a win-win. Meta got access to Scale AI’s resources, and Scale gained credibility by working with one of the largest tech giants. But as the AI race heats up, cracks are beginning to show. Rising costs, huge data demands, and Meta’s growing interest in building its own in-house tools are testing the limits of this collaboration.

Let’s explore how this relationship began, why it mattered, and what these recent signs of strain mean for both companies and the broader AI industry.

Background of the Partnership

Meta first began working with Scale AI to get high-quality labeled data. Labeled data helps teach AI models how to understand text, images, and actions. Scale AI grew fast by offering large volumes of annotated data and tools to clean and manage it. Meta saw Scale AI as a shortcut to train big models faster. This link grew stronger in 2025 when Meta moved to take a large stake in Scale AI. The move aimed to secure a reliable supply of data and the expertise to tune advanced models

Why the Partnership Mattered?

Data is the fuel for modern AI. Top models need lots of accurate labels. Scale AI had built a reputation for speed and scale. Meta needed both. The company also wanted to bring in talent. Hiring founders and engineers from Scale AI offered a dual benefit: access to people and to the company’s systems.

For Meta, the deal looked like a way to speed up its AI projects without building every part from scratch. The partnership also sent a signal to the market. It showed that Meta was serious about catching up in the race for next-generation AI.

Emerging Signs of Strain

Signs of trouble surfaced quickly. Internal teams at Meta began working with other data vendors. That suggested a lack of full confidence in Scale AI for certain tasks. Some employees told reporters the quality or fit of Scale’s output did not meet the needs for very advanced models. Meta also moved some Scale executives into new roles, but not all those executives stayed on core model teams.

Additionally, several large customers publicly cut or considered cutting ties with Scale after the Meta deal was announced. Those moves raised questions about Scale’s market reach and client trust.

Rising Costs and Business Pressure

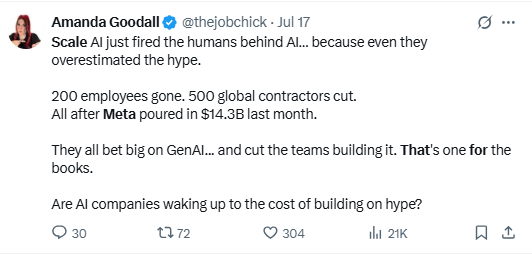

The cost of high-quality annotation keeps rising. As models grow more complex, simple crowdsourced labels are not enough. Experts are needed to produce domain-specific data. That raises labor costs. At the same time, some of Scale AI’s customers paused or left. That made revenue forecasts uncertain. Scale then announced staff cuts and contractor reductions.

Layoffs and churn added pressure on the startup’s ability to scale while keeping quality high. The timing of these cuts, right after Meta’s investment, deepened industry concern.

Meta’s Strategic Shift

Meta has also been changing its strategy. The company increased hiring in internal AI labs. It launched tied initiatives to build infrastructure and open models. New leadership moves inside Meta accelerated the shift toward centralizing AI work. Those changes suggested a move away from heavy dependence on any single external supplier.

In some cases, teams chose niche vendors or in-house labeling for sensitive or hard tasks. This shift reduces the need for Scale AI on some projects. It also shows Meta’s intent to own more of the stack.

Impact on Scale AI

Scale AI faces hard choices. A major client pullback can hurt short-term revenue. Losing other big customers after a competitor takes a stake raises trust issues. Layoffs also hurt morale and reduce capacity. On the other hand, the deal with Meta could keep Scale afloat and fund R&D.

The problem is perception. If other tech giants fear conflicts of interest or data leaks, Scale may lose more partners. That could force Scale to pivot to new markets or to focus on products that do not depend on a few large customers.

Industry-Wide Implications

This friction is not just a Meta-Scale story. It highlights a larger debate in tech. Big firms must choose between buying outside services and building in-house. Outsourcing can speed up work. But it can also create risk if the supplier becomes tied to a rival.

For startups, selling to a giant brings cash but also danger. Clients may worry about future independence. The situation may encourage more in-house builds, more vendor diversification, or new kinds of partnerships that protect client trust. The market for data labeling will likely see more competition and new models of collaboration.

Expert Views and Analyst Takeaways

Analysts say these tensions are normal in fast-moving tech deals. Large investments can upset existing client relationships. Experts note that quality and speed are hard to guarantee at a huge scale. Some analysts believe Meta will keep some external ties, but only for parts that do not affect core model secrets. Others say Scale can survive by diversifying clients and by improving product quality. Most agree that big tech will push harder to control sensitive parts of model training in the coming years.

Possible Future Scenarios

One path is a restructured partnership. Meta may narrow Scale’s role to specific, non-core tasks. Another path is Meta internalizing more functions. That would leave Scale to find new buyers and to compete on product features. A third path sees Scale aggressively diversifying and improving quality to win back trust. All options are possible. The outcome depends on how fast Meta builds internal capacity and how well Scale keeps other clients.

Bottom Line

The Meta-Scale relationship shows how fast the AI world is changing. Large deals bring both promise and risk. The early signs of strain highlight the limits of big, quick fixes. For big tech, the lesson is clear: owning the right tools matters. For startups, the lesson is to balance growth with independence. The next moves from both companies will matter for the whole AI data market.

Frequently Asked Questions (FAQs)

No. Meta did not acquire Scale AI outright. In June 2025, Meta bought a 49 percent non-voting stake in Scale AI, but the company remains independent.

“Meta Scale AI” is not a company. It refers to Meta’s investment in Scale AI, a data-labeling firm. Meta owns 49 percent of Scale AI and works closely with it.

Meta invested in Scale AI to boost its data labeling and AI model training. The deal also brought Scale’s CEO to Meta to lead its “superintelligence” lab.

Meta paid about $14.8 billion in June 2025 for a 49 percent stake in Scale AI. Some sources also report a finalized figure of $14.3 billion.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.