MEYKA AI Enhancing Client Support with Intelligent AI Financial Chatbot Services

As digital finance grows, the way companies handle client support is changing fast. In 2025, more financial firms are turning to AI financial chatbot services to meet rising customer expectations. People want quick, clear, and accurate help anytime and anywhere. That’s where Meyka AI comes with an innovative solution. Its intelligent chatbot system gives clients instant answers, financial insights, and guidance around the clock. No long waiting lines or confusing forms, just smart, simple conversations.

Unlike basic bots of the past, Meyka’s chatbots understand context, learn from interactions, and deliver personalized support. They don’t just reply; they analyze data to offer real financial value. These bots make finance more human and helpful. Financial AI-driven tools are redefining client engagement in banks, fintech firms, and investment platforms worldwide. It’s not just automation, it’s a smarter financial connection.

The Evolution of Client Support in Finance

Customer service in finance used to center on branch counters and long call queues. Digital channels changed that. Mobile apps and web portals made simple tasks faster. Still, complexity grew. Clients wanted instant answers about accounts, trades, and policy details. Firms turned to automation. Early chatbots handled scripted FAQs. Those bots often failed when questions went off script.

Modern systems now use natural language and context. They map conversations across sessions. That makes support faster and more accurate. This shift has pushed banks and fintechs to redesign support for a digital-first world.

What are AI Financial Chatbot Services?

AI financial chatbots are virtual assistants built on NLP, machine learning, and secure data links. They parse natural speech. They fetch account balances, transaction histories, and basic compliance checks. Advanced chatbots also run analytics on portfolios. They can surface fraud alerts and personalized advice.

Integration with core banking systems and APIs is central. This allows chatbots to pull live data and push secure actions, like transaction alerts or payment setup. These services reduce manual steps and speed up resolutions.

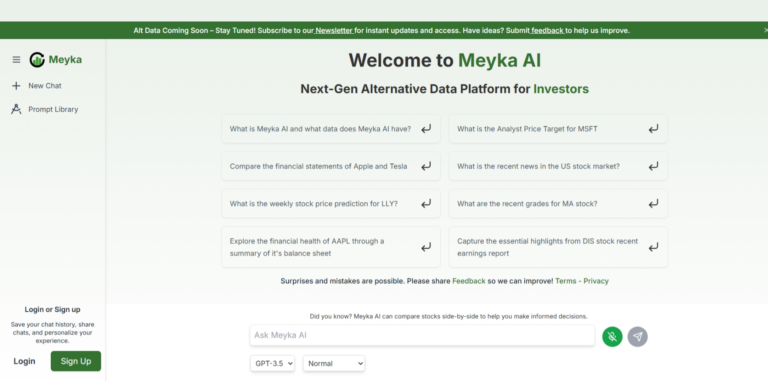

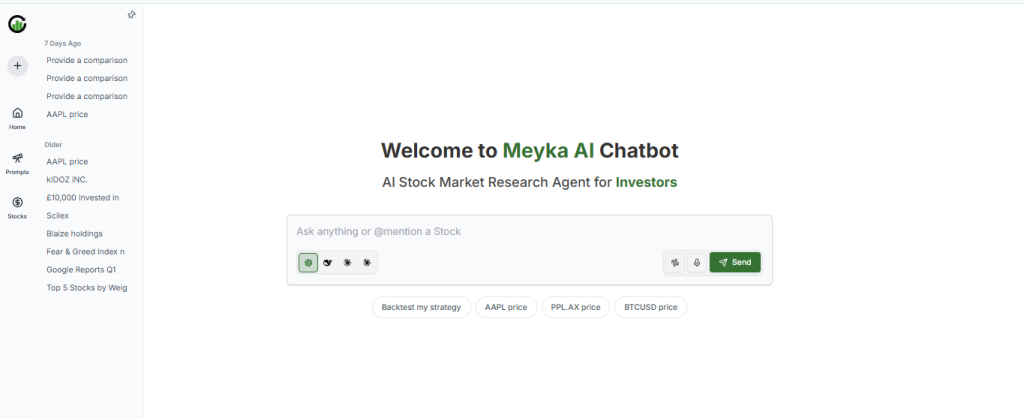

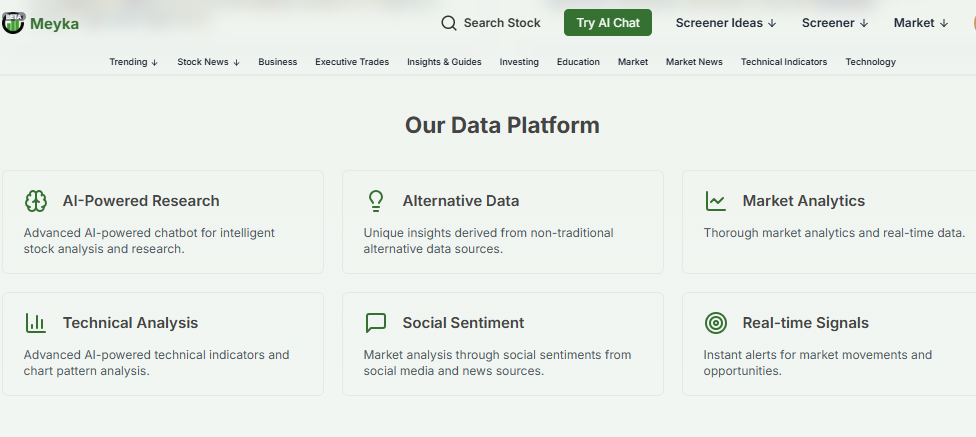

Meyka AI’s Financial Chatbot Capabilities

Meyka positions its chatbot as a finance-focused assistant. The platform claims real-time market access, context-aware follow-ups, and portfolio-grade analysis. Chat flows allow follow-up questions without repeating context. Meyka also offers enterprise integrations for CRMs and data warehouses.

On the security side, Meyka emphasizes encryption and access controls. The platform highlights use cases from retail investors to institutional research teams. For investors, the chatbot can summarize fundamentals and surface valuation metrics. For enterprises, it can connect to internal dashboards and compliance logs. The site frames Meyka as both a consumer-facing tool and an enterprise solution for smarter client engagement.

Benefits of AI Chatbots for Financial Institutions

Chatbots cut handle time for routine queries. This frees human agents for complex problems. Many banks report higher first-contact resolution and improved NPS after rollout. Chatbots also deliver personalized messages at scale. Machine learning profiles customers and tailors answers. That increases relevance and client trust when done right.

Cost savings arise from fewer tickets and lower agent headcount for repetitive work. Security and compliance can improve if chatbots enforce MFA and log sensitive flows. Yet, trust remains a challenge. Design must focus on transparency, explainability, and clear escalation paths to human agents.

Real-World Use Cases

In retail banking, chatbots answer balance checks, card blocks, and payment setup. Voice-enabled chatbots now handle a growing share of interactions, improving accessibility. Investment firms use chatbots to summarize market moves and run quick screening queries. Wealth managers deploy them to offer rebalancing suggestions and scenario snapshots.

Insurers use chatbots to check claim status and collect initial details. Internal teams use virtual assistants for IT and HR queries, cutting resolution time. In fraud detection, chatbots can push instant alerts and ask validating questions to stop suspicious activity. These real cases show the broad utility across finance functions.

Integration and Security Framework

Secure integration is non-negotiable. Chatbots must connect via API gateways and follow least-privilege principles. Strong encryption, tokenization, and multi-factor authentication protect data in transit and at rest. Logging and audit trails must capture every action for compliance audits. Regulators and central banks are stressing third-party risk and incident response.

The U.S. Federal Reserve and other authorities are already publishing guidance for cloud security and resilience in financial services. Firms should adopt secure cloud patterns and regular penetration testing. Finally, ethical AI controls are necessary. Models should be tested for bias and be able to explain recommendations.

Challenges and How to Address Them?

Trust and transparency remain key hurdles. Many chatbots still fail complex queries. Poor handoffs to human agents erode confidence. Data privacy concerns also limit adoption in stricter jurisdictions. To counter this, firms should adopt clear escalation rules and visible disclaimers.

Continuous training on domain-specific data improves accuracy. Governance structures for AI roles for model owners, auditors, and compliance teams help manage risk. Finally, small pilots with measurable KPIs allow teams to scale proven patterns rather than deploying broad systems at once.

The Future of AI in Financial Client Support

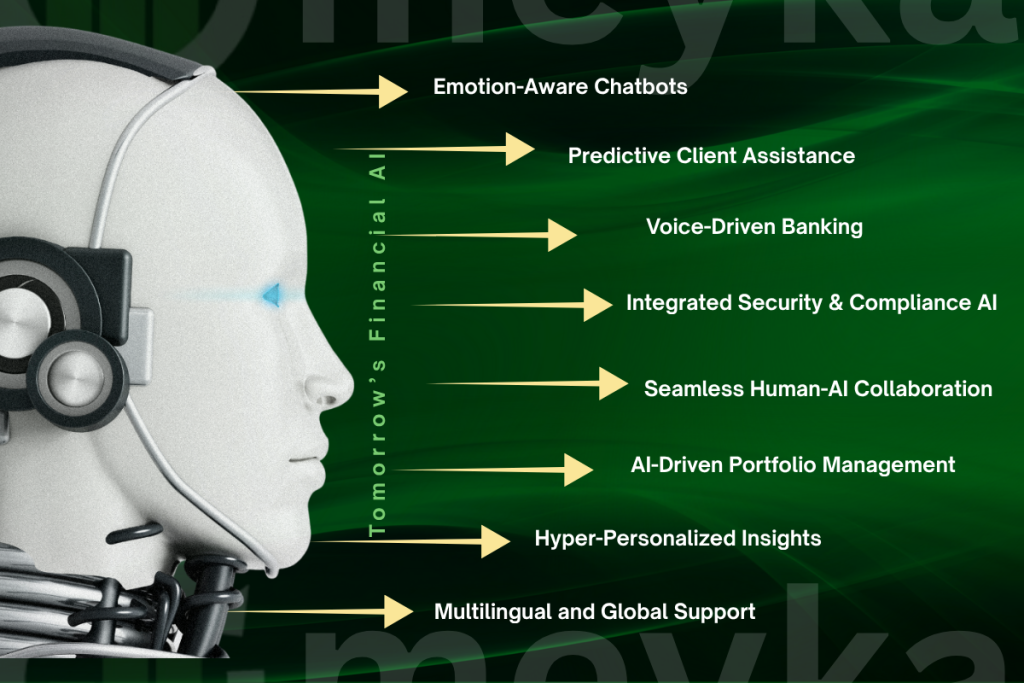

By late 2025, the expectation grows for chatbots that predict client needs before the question appears. Predictive nudges could warn of low balances or suggest debt consolidation. Deeper ties with robo-advisers and secure payment rails will let chatbots move from information to action. Blockchain may add immutable audit trails for critical transactions handled by bots. Emotion recognition could enable more sensitive customer handling for distressed clients.

Also, specialized tools like an AI stock research analysis tool will be embedded to provide quick fundamental checks inside chat flows. Market adoption will accelerate as organizations add AI governance and measure ROI in cost reduction and customer satisfaction.

Final Words

AI chatbots are now central to modern financial support. They reduce friction, speed up service. They can improve security and personalization when built with proper governance. The next wave will focus on trust, seamless human escalation, and actionable advice embedded in chat. Financial firms that adopt these practices will gain an edge in service and efficiency.

Ready to upgrade your client experience?

Explore how Meyka’s AI financial chatbot services can transform your customer support with smart automation and secure insights. Visit Meyka.com to learn more or request a free demo today.

Frequently Asked Questions (FAQs)

AI chatbots help by giving quick answers, tracking expenses, and sharing account details. They make banking easier and faster for customers in 2025.

Yes, most AI chatbots use strong encryption and security checks. In 2025, banks follow strict rules to protect user data and prevent online fraud.

Some chatbots give basic investment tips using market data. However, complex financial advice still needs human experts to ensure accuracy and personal guidance.

Meyka AI uses smart algorithms to understand customer questions. It gives real-time answers about accounts, markets, and investments through secure, simple chat.

Yes, banks save costs by using chatbots to handle common questions. This reduces staff workload and improves efficiency without affecting customer service quality.

By late 2025, AI chatbots will become smarter. They will predict client needs, support more languages, and link easily with banking apps and digital wallets.

Disclaimer: The content shared by Meyka AI PTY LTD is solely for research and informational purposes. Meyka is not a financial advisory service, and the information provided should not be considered investment or trading advice.