Midwest IPO Day 2: Check Subscription Status, Key Takeaways, and Market Buzz

Midwest Ltd. launched its IPO on October 15, 2025. Investors have shown strong interest. By Day 2, October 16, 2025, the IPO was oversubscribed 11.73 times. People applied for 3.65 crore shares, while only 31.17 lakh shares were on offer. This shows high demand and confidence in the company.

The IPO price band is ₹1,014 to ₹1,065 per share. The company plans to raise ₹451 crore. The company will use the funds to expand quartz processing, buy electric dump trucks, and install solar power at its mines. Some money will also reduce debt and support growth in subsidiaries.

Midwest exports granite and is expanding into quartz and mineral sand mining. Analysts feel positive about the IPO. They say the company has strong fundamentals and a clear growth plan. The listing is expected on October 24, 2025. Investors are watching the final subscription and allotment closely.

This article explores Day 2 subscription, key takeaways, and market buzz around Midwest IPO. It gives clear insights for investors who want to make informed decisions.

Midwest IPO Overview

Company Background

Midwest Ltd. is a prominent player in India’s natural stone industry, specializing in the mining, processing, and export of Black Galaxy Granite. With over four decades of experience, the company has established a strong presence in both domestic and international markets. Midwest operates 16 mines across Telangana and Andhra Pradesh, along with 25 additional locations in Andhra Pradesh, Telangana, and Tamil Nadu. This extensive network supports its position as one of India’s largest producers and exporters of Black Galaxy Granite.

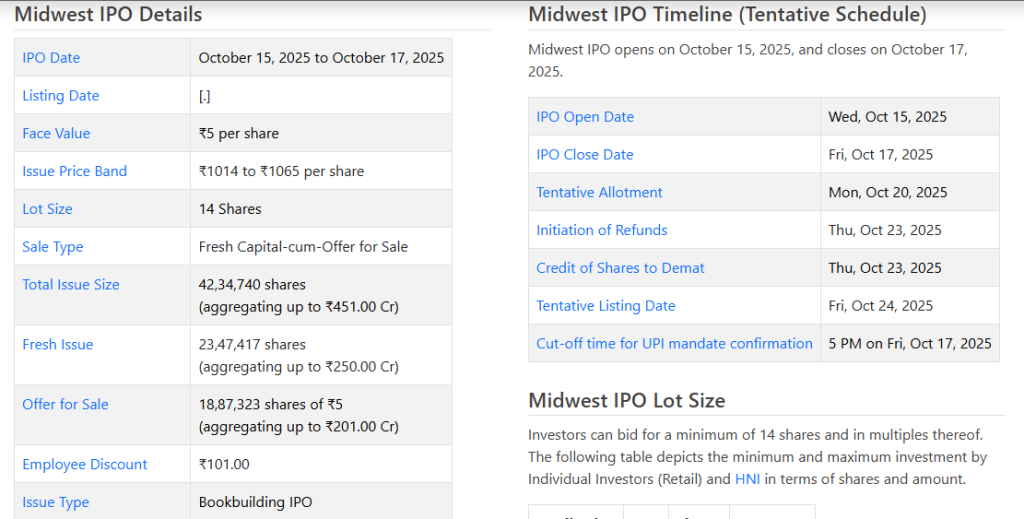

IPO Details

Midwest Ltd. launched its Initial Public Offering (IPO) on October 15, 2025, aiming to raise ₹451 crore. The price band for the IPO is set between ₹1,014 and ₹1,065 per share, with a minimum lot size of 14 shares. The subscription window is open until October 17, 2025, with the share allotment expected on October 20, 2025, and the listing scheduled for October 24, 2025, on both the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE).

Subscription Status on Day 2

As of October 16, 2025, the IPO has witnessed strong investor interest. By the end of Day 1, investors subscribed to the issue 1.84 times, bidding for 57.33 lakh shares while the company offered 31.17 lakh shares. On Day 2, the subscription continued to rise, indicating positive investor sentiment.

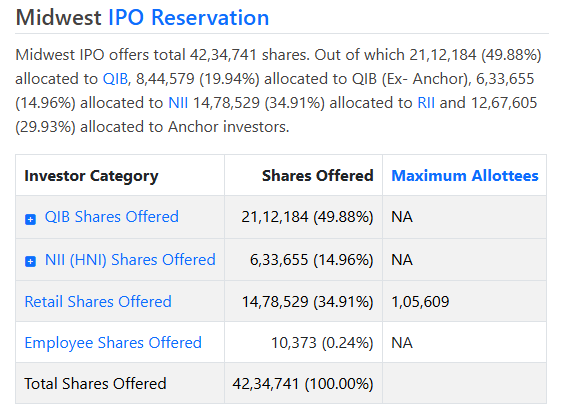

Category-wise Subscription

- Qualified Institutional Buyers (QIBs): The QIB portion has been subscribed 1.93 times, reflecting institutional confidence in the company’s prospects.

- Non-Institutional Investors (NIIs): The NII segment has seen a subscription of 34.89 times, indicating strong demand from high-net-worth individuals

- Retail Investors: The retail portion has been subscribed 8.61 times, demonstrating significant participation from individual investors.

Employee Portion

The employee reservation portion has been subscribed 9.12 times, highlighting the confidence of the company’s employees in its future growth.

Grey Market Premium (GMP) Insights

As of October 16, 2025, the Grey Market Premium (GMP) for Midwest Ltd.’s IPO stands at ₹175.5. This indicates that the shares are trading at a premium of approximately 16.5% over the upper price band of ₹1,065. The rising GMP reflects positive market sentiment and suggests that investors expect a favorable listing on the exchanges.

Financial Performance and Fundamentals

Recent Financials

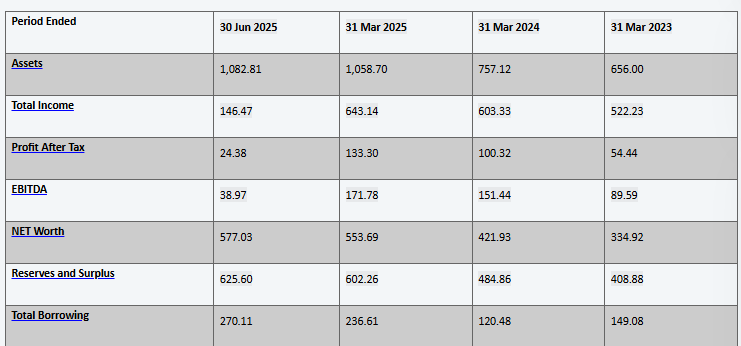

Midwest Ltd. has demonstrated robust financial performance in recent years. For the fiscal year 2024, the company reported a revenue of ₹603.33 crore and a profit after tax (PAT) of ₹54.4 crore. In FY2025, revenue increased to ₹643.14 crore, with a PAT of ₹213.3 crore, indicating strong growth.

The company has achieved a compound annual growth rate (CAGR) of 11.6% in revenue and 56.5% in PAT over the past two years, reflecting its expanding market presence and operational efficiency

Use of IPO Proceeds

The proceeds from the IPO are intended to fund several strategic initiatives:

- Phase II Expansion of Quartz Facility: The company will spend ₹130.3 crore to improve quartz processing through its subsidiary, Midwest Neostone.

- Acquisition of Electric Dump Trucks: It will invest ₹25.7 crore to buy electric dump trucks and boost mining operations.

- Solar Energy Integration: The company will use ₹3.2 crore to add solar energy at some mines and support sustainability.

Market Sentiment and Analyst Views

Several analysts have expressed positive views on the Midwest IPO:

- BP Equities: Recommends a “Subscribe” rating, citing the company’s established market position and growing global demand for natural and engineered stone products.

- Ventura Securities: Highlights Midwest’s strategic focus on expanding its production capacity and diversifying into heavy mineral mining in Sri Lanka, suggesting strong growth prospects.

The strong subscription numbers and rising GMP indicate that investors are optimistic about Midwest Ltd.’s future performance. The company’s financials, strategic expansion plans, and leadership in the granite industry contribute to this positive sentiment.

Risks and Considerations

Investors should be aware of the risks before investing in the Midwest IPO. Regulatory changes in mining or environmental laws could affect the company’s operations. The natural stone industry is highly competitive, which may lower profit margins. Midwest also depends heavily on mining, so any disruption or shortage of resources can impact its business.

The company is actively working to manage these risks. It is diversifying into quartz processing and heavy mineral mining to reduce dependence on granite. Midwest is also implementing sustainability measures, such as solar energy and electric vehicles, to support the environment. In addition, the company is expanding its processing capabilities and exploring new markets to drive growth and strengthen its position.

Wrap Up

The Midwest Ltd. IPO presents a compelling investment opportunity for those seeking exposure to India’s natural stone industry. The strong subscription numbers, rising GMP, and robust financial performance indicate a positive outlook for the company. However, potential investors should carefully consider the associated risks and conduct thorough due diligence before making investment decisions.

Frequently Asked Questions (FAQs)

By October 16, 2025, investors oversubscribed the Midwest IPO 11.73 times. Retail and institutional investors showed strong interest, with bids for 3.65 crore shares against 31.17 lakh shares offered.

Midwest will allot IPO shares after the subscription period ends on October 17, 2025. The company will list the shares on stock exchanges on October 24, 2025.

Midwest has strong financials and growth plans, but risks include competition and mining issues. Investors should consider these before investing. Past performance does not guarantee future profits.

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.