Molina (MOH) Gains 9.2% Post-Earnings Despite Miss: A Value Case

Molina Healthcare (MOH) surprised the stock market on July 23, 2025, with an unusual reaction to its earnings. The company reported a quarterly earnings per share of $5.48, missing analyst estimates by a narrow margin of 14.1%. Despite this miss, Molina stock surged 9.2% after the report, leaving many investors curious about what drove this rally.

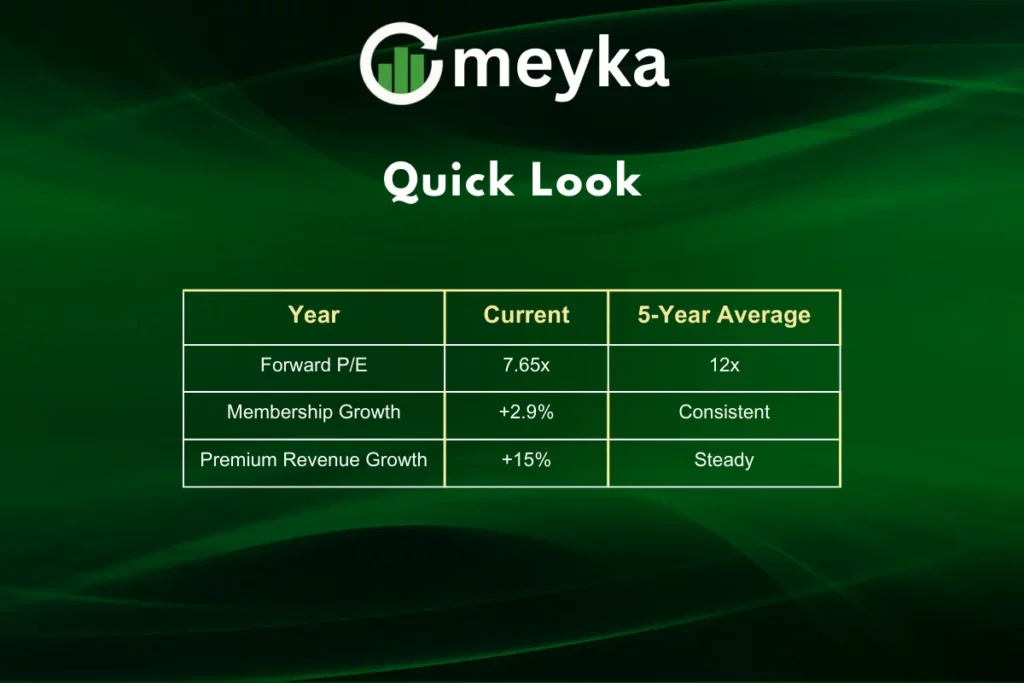

The strong move came even as full-year guidance was cut by 22.4% to a range of $19–$24.50 per share. Yet, premium revenue rose 15% to $10.9 billion, total revenue exceeded expectations at $11.43 billion, and membership climbed to 5.7 million. With a forward price-to-earnings ratio of 7.65x, far below its five-year average of 12x, the case for value investors is growing stronger.

This mix of earnings pressure and revenue growth signals an opportunity for investors looking at long-term fundamentals.

Earnings Results and Market Reaction

Molina’s Q2 2025 earnings highlighted both strengths and weaknesses:

- EPS: $5.48 vs. $5.50 expected

- Medical Care Ratio (MCR): 90.4%, up from 88.6% last year

- Revenue: $11.43 billion, beating estimates by 4.4%

- Premium revenue: $10.9 billion, up 15% year-over-year

While the earnings per share miss drew attention, revenue strength and rising membership drove optimism. The market often rewards growth and stability, and Molina delivered both.

Why the Stock Rose Despite the Miss

Several factors supported the 9.2% stock market gain:

- Revenue growth showed resilience in a competitive healthcare environment.

- Membership expansion to 5.7 million highlighted demand for Molina’s services.

- Valuation appeal, with the forward P/E ratio at 7.65x, offered a discount compared to peers.

- Embedded earnings of $8.65 per share from acquisitions in 2026–2027 gave investors a forward-looking reason for optimism.

The earnings miss was overshadowed by stronger signals of long-term growth and value.

Guidance Cuts and Investor Concerns

Despite the rally, Molina did revise guidance downward. The new range of $19–$24.50 per share marks a sharp 22.4% cut from earlier projections.

Key concerns for investors include:

- Rising medical costs are driving the MCR higher.

- Cash and investments at the parent company fell to $100 million from $445 million six months earlier.

- Operating cash flow shows an outflow of $112 million in the first half of 2025.

These factors could limit near-term flexibility, but the stock market still looked past them in favor of future earnings power.

Valuation and the Value Case

Molina stock is trading at a discount to its historical multiples.

Revenue Strength as a Key Driver

Revenue growth stood out as one of the strongest aspects of the earnings release. At $11.43 billion, revenue not only beat expectations but also showcased broad demand across Molina’s markets.

This strong revenue base supports the case that even with higher medical costs, the company’s scale and expansion can fuel long-term stability.

Looking Ahead

Future growth may come from acquisitions already in motion. Analysts estimate $8.65 per share in embedded earnings from deals planned for 2026–2027.

These acquisitions suggest that Molina is not only maintaining scale but also building future profitability. While short-term cash flow is tight, longer-term earnings growth could improve as integration takes hold.

Risks to Watch

Every investment comes with risks, and Molina is no exception. Investors should monitor:

- Rising medical costs are affecting the Medical Care Ratio.

- Lower cash reserves limit flexibility.

- Dependence on government programs, which can face regulatory shifts.

Balancing these risks with valuation and growth opportunities helps explain why the stock market sees Molina as undervalued.

Final Thoughts

Molina Healthcare (MOH) delivered a mixed quarter, with earnings missing estimates but revenue and membership showing strength. The stock’s 9.2% surge highlights investor confidence in future growth and the appeal of a low forward P/E.

With a strong revenue base, expanding membership, and future acquisition-driven earnings, Molina presents a potential value case for long-term investors. Despite risks from costs and cash flow, the fundamentals remain strong. For those watching the stock market, Molina stands as a healthcare stock with value appeal.

Disclaimer:

This is for informational purposes only and does not constitute financial advice. Always do your research.