Mortgage Interest Rates in October 2025: Are More Hikes Ahead?

As of October 7, 2025, the average U.S. 30-year fixed mortgage rate is 6.26%. This is a small rise from last week’s 6.3%. Even after the Federal Reserve cut rates in September 2025, mortgage rates went up. Rising Treasury yields and investor behavior are pushing rates higher.

The Federal Reserve is cautious about cutting rates further. Inflation worries add more uncertainty to the housing market. Some experts say rates might drop in October, but it may not happen right away.

Higher mortgage rates make buying or refinancing a home harder. First-time buyers feel the pressure most. Affordability is a big concern for many families.

Let’s look at what affects mortgage rates, what experts predict, and tips for handling this tricky market.

Current Mortgage Rate Overview

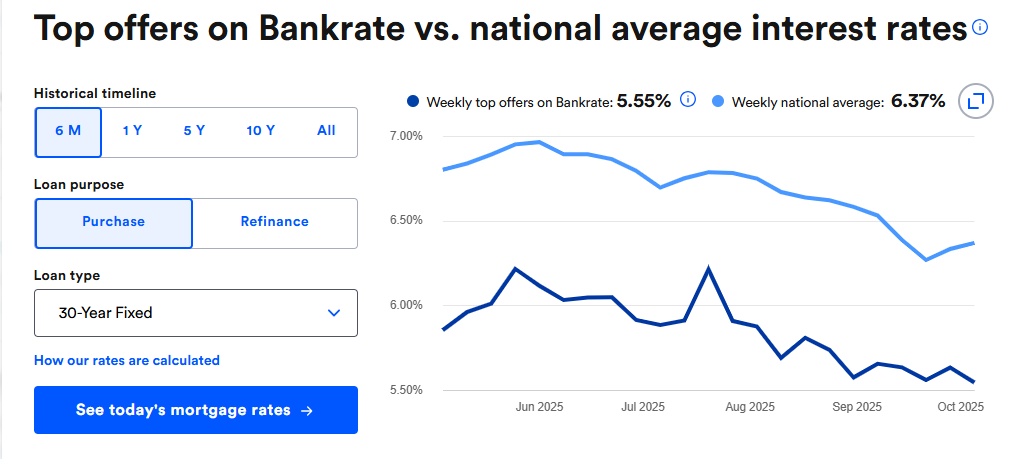

As of October 7, 2025, the average 30-year fixed mortgage rate in the United States is 6.26%, while the 15-year fixed rate stands at 5.6%. These rates reflect a slight increase from the previous week but remain below the 52-week average of 6.71%.

Recent data indicate that mortgage rates have been fluctuating due to various economic factors. For instance, on October 6, 2025, the average rate for a 30-year fixed mortgage fell to 6.37%, marking the lowest level seen in recent months. However, this drop was short-lived, as rates began to rise again, influenced by factors such as rising Treasury yields and investor sentiment.

It’s important to note that these rates are influenced by a complex interplay of factors, including inflation expectations, economic growth, and Federal Reserve policies. While recent rate cuts by the Federal Reserve have provided some relief, the overall trend in mortgage rates remains upward, driven by broader economic conditions.

Economic and Policy Drivers

Several economic factors and policies are affecting mortgage rates right now.

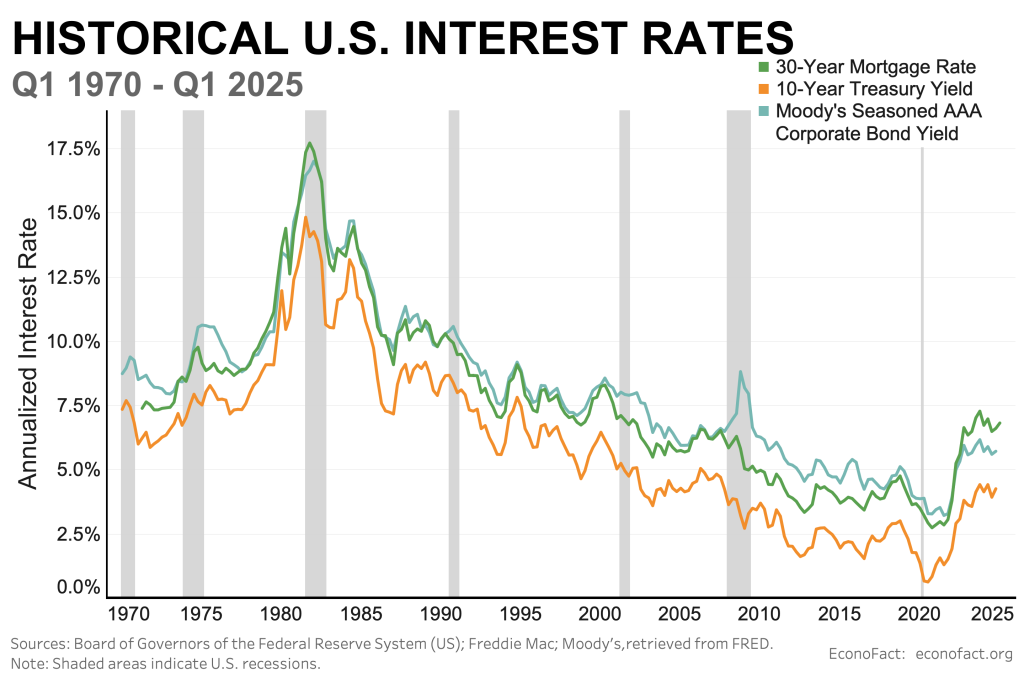

On September 17, 2025, the Federal Reserve cut the federal funds rate by 0.25 points to 4.00%-4.25%. This was meant to help the economy. But mortgage rates did not drop much because long-term rates depend more on inflation and Treasury yields.

Inflation is still a worry. On October 6, 2025, the 10-year Treasury yield rose to 4.161%, the highest since September 26, because of a government shutdown. When Treasury yields go up, mortgage rates usually rise too.

The job market is strong, with unemployment at 4.3%. Still, worries about slow economic growth or a recession make investors cautious. This can cause mortgage rates to go up and down.

Expert Opinions and Forecasts

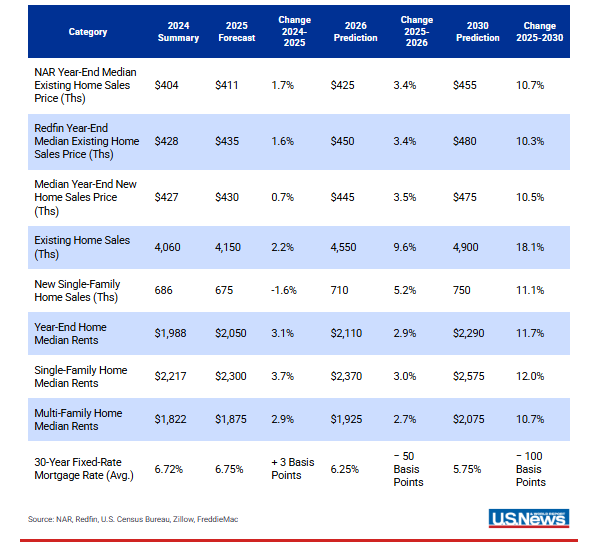

Experts have different views on where mortgage rates are headed. Some say rates will stay around 6% through 2025. They might slowly drop to the low 6% range by late 2026.

Experts also say many things affect mortgage rates. These include inflation, economic growth, and Federal Reserve actions. Recent rate cuts gave some relief, but overall, rates are still rising because of the bigger economy.

Regional and Market Differences

Mortgage rates can be very different in different places and for different buyers.

- Urban vs. Rural Areas: Cities often have more people looking for homes. This can make houses more expensive and rates higher. Rural areas usually have cheaper homes, but local economic conditions can still affect rates.

- First-Time Buyers vs. Investors: First-time buyers might get higher rates. Things like credit score and down payment matter. Investors can use other financing options, which can change the rates they pay.

Impact on Borrowers

The current mortgage rates bring both problems and chances for borrowers. Higher rates mean bigger monthly payments. A 1% rise can add hundreds of dollars each month. Homeowners with lower rates might not want to refinance now. Still, refinancing can help if they want a shorter loan or to use home equity.

Higher rates also make buying a first home harder. Some first-time buyers may wait longer before entering the housing market.

Housing Market Outlook

The housing market is slowing down because mortgage rates are higher. Higher rates make borrowing more expensive. This is causing home sales to drop. To attract buyers, builders are offering price cuts and incentives. In September 2025, 39% of builders lowered prices, and 65% gave extra offers. Higher rates make homes less affordable. First-time buyers and people in expensive areas feel this most.

Wrap Up

As of October 7, 2025, mortgage rates remain elevated, influenced by factors such as rising Treasury yields, inflation concerns, and Federal Reserve policies. While recent rate cuts by the Federal Reserve have provided some relief, the overall trend in these rates remains upward, driven by broader economic conditions. Borrowers should carefully consider their financial situation and consult with field professionals to navigate the current market environment effectively.

Frequently Asked Questions (FAQs)

As of October 6, 2025, the average U.S. 30-year fixed mortgage rate is approximately 6.34%, while the 15-year fixed rate stands at 5.55%.

Experts predict a slight decline in mortgage rates by the end of 2025, with forecasts suggesting rates could fall to around 6.25% to 6.5%.

These rates vary globally; for instance, in the UK, the best 2-year fixed mortgage rate is 3.64% as of October 6, 2025

Disclaimer: The above information is based on current market data, which is subject to change, and does not constitute financial advice. Always do your research.